Will rate the answer!

Already solved Part 1 and 2, need someone to solve part 3.

-------

James Jones is the owner of a small retail business operated as a sole proprietorship. During 2019, his business recorded the following items of income and expense:

| | | |

| Revenue from inventory sales | $ | 147,000 |

| Cost of goods sold | | 33,500 |

| Business license tax | | 2,400 |

| Rent on retail space | | 42,000 |

| Supplies | | 15,000 |

| Wages paid to employees | | 22,000 |

| Payroll taxes | | 1,700 |

| Utilities | | 3,600 |

| |

Required:

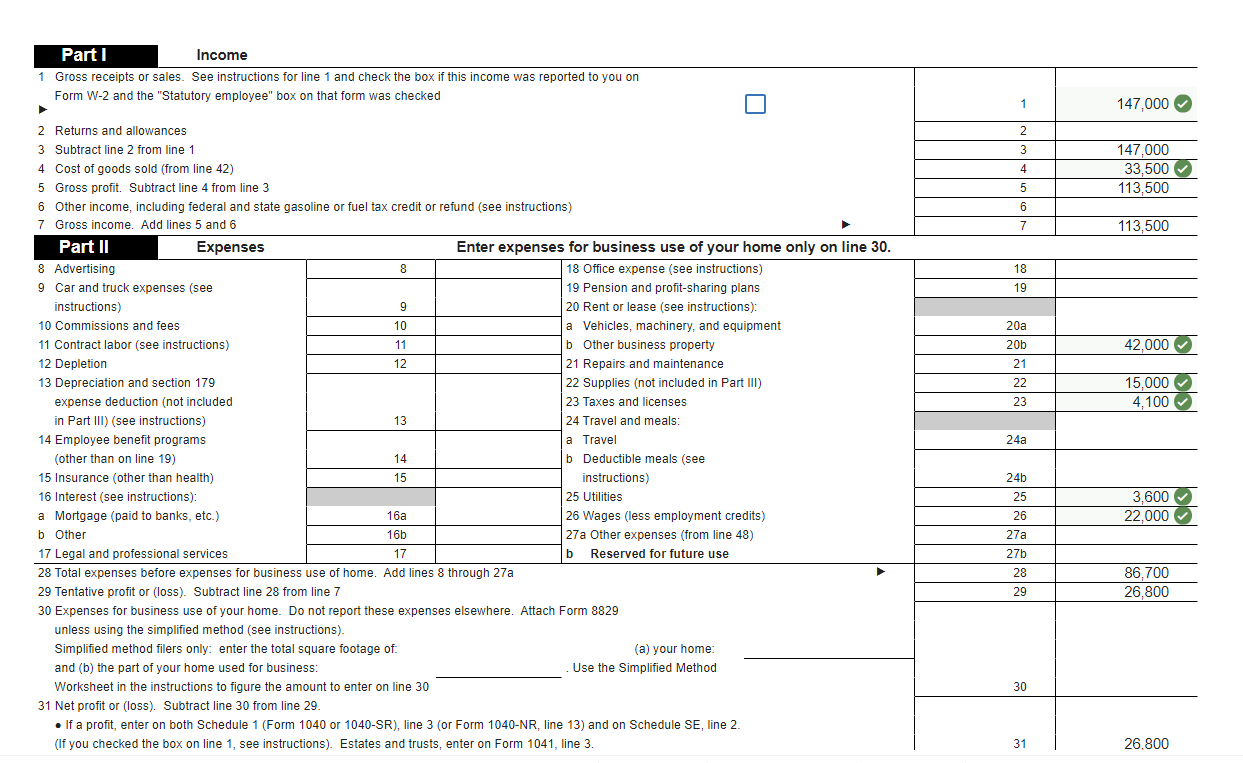

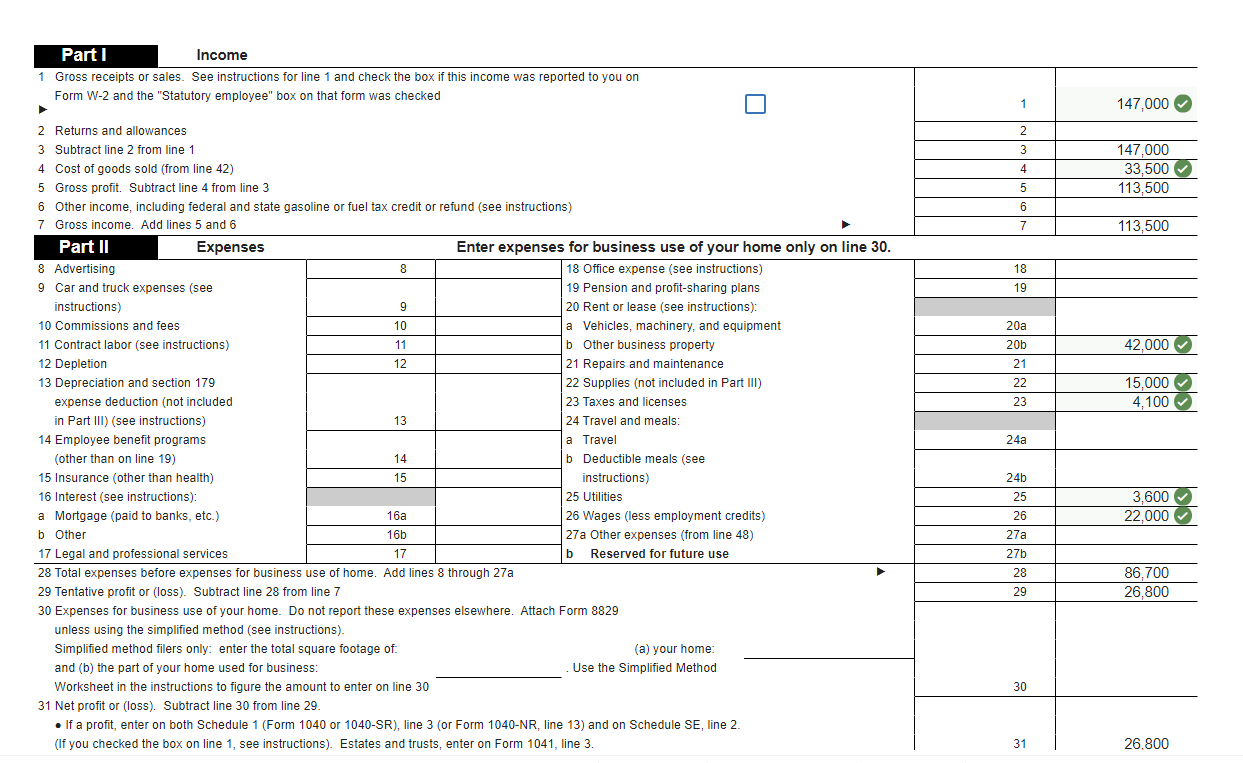

- Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in Jamess 2019 Form 1040.

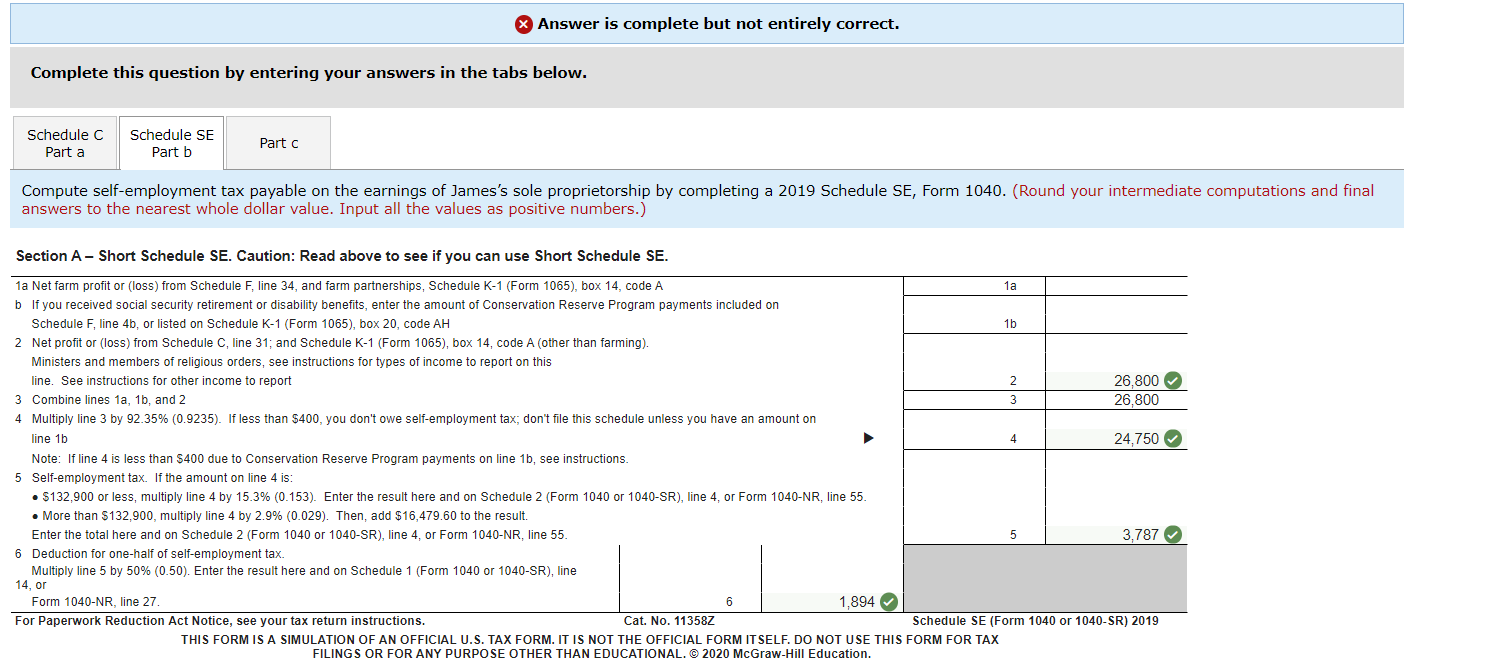

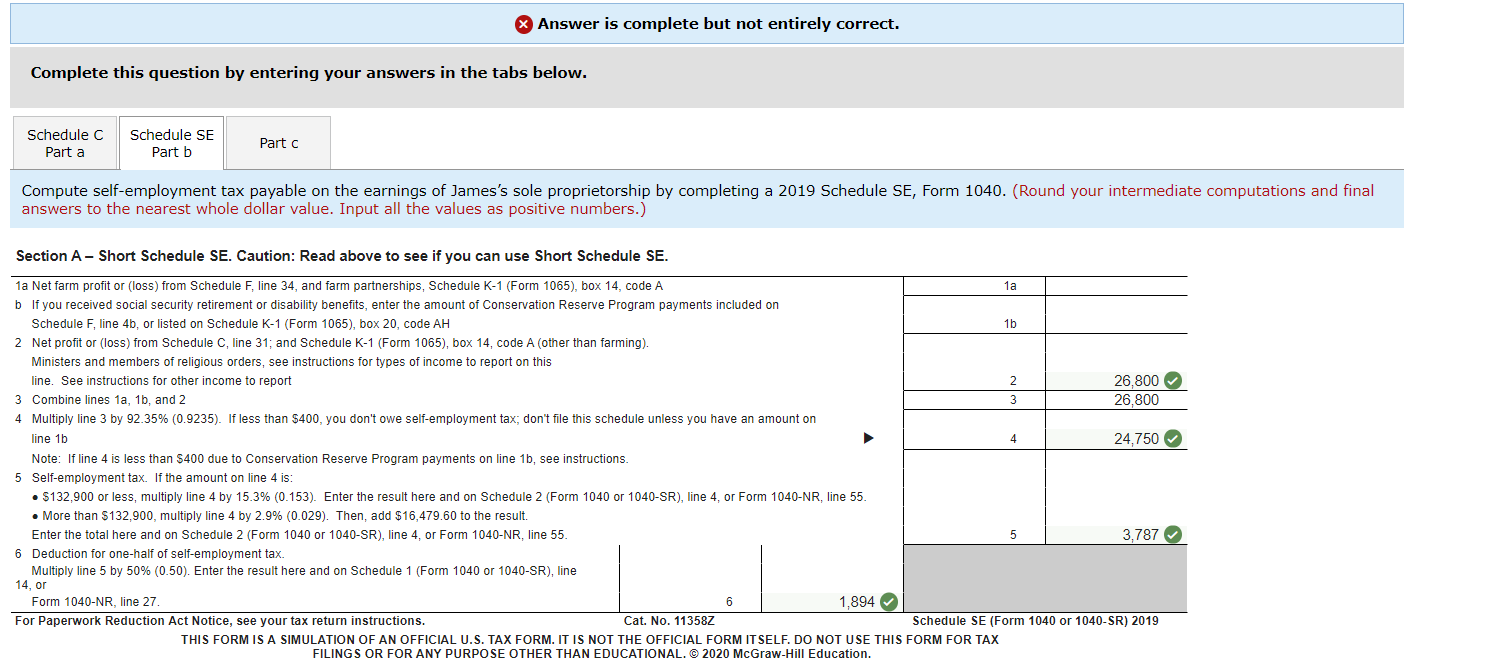

- Compute self-employment tax payable on the earnings of Jamess sole proprietorship by completing a 2019 Schedule SE, Form 1040.

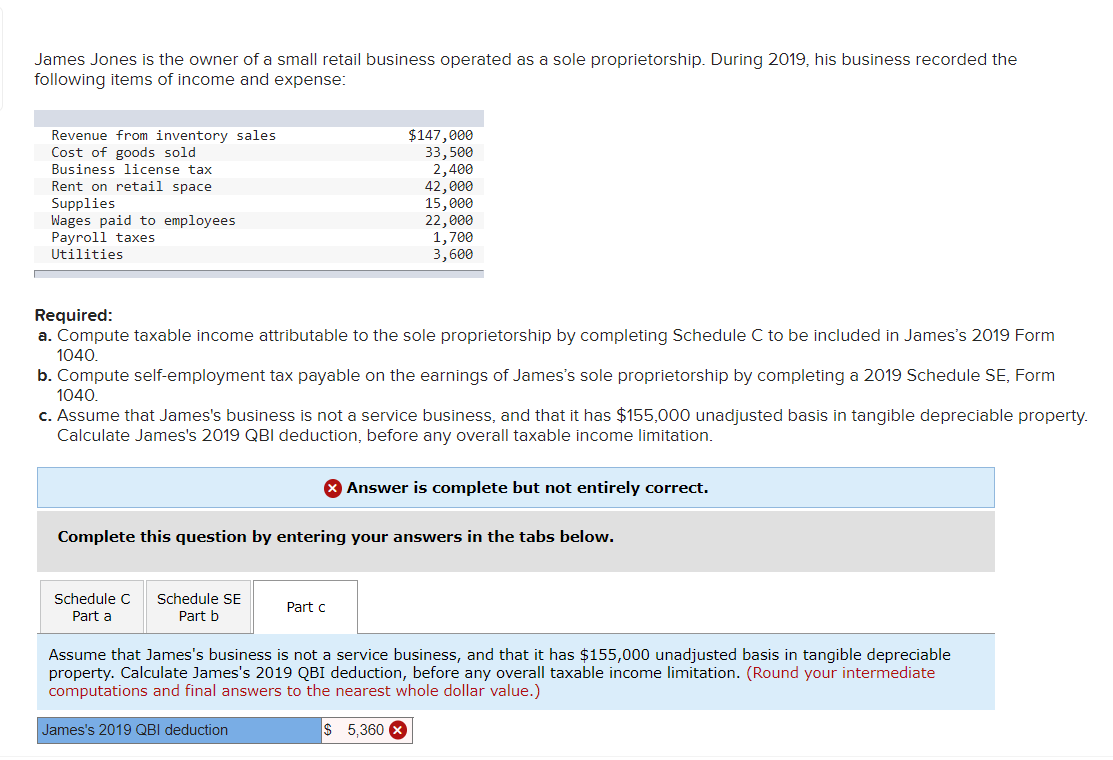

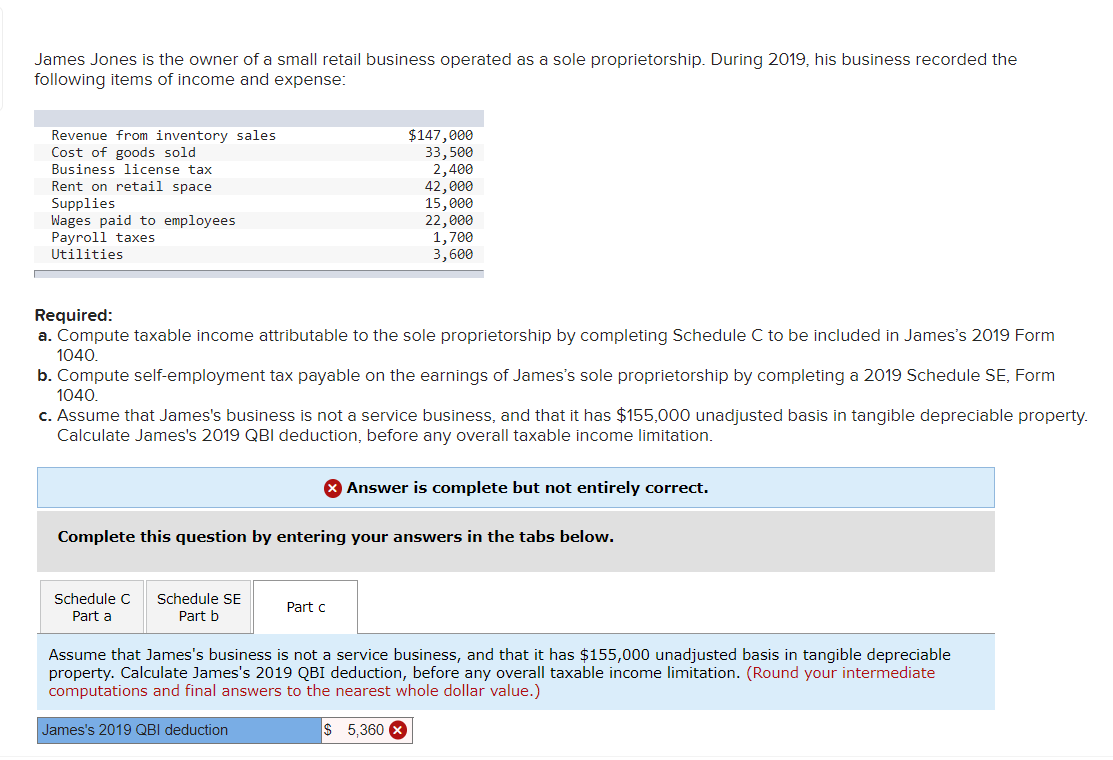

- Assume that James's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. Calculate James's 2019 QBI deduction, before any overall taxable income limitation.

Part 1

Part 2

Part 3

Parti Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked 1 147,000 2 3 4 147.000 33,500 113,500 5 6 6 7 113,500 18 19 20a 20b 42,000 21 22 23 15,000 4,100 2 Returns and allowances 3 Subtract line 2 from line 1 4 Cost of goods sold (from line 42) 5 Gross profit. Subtract line 4 from line 3 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) 7 Gross income. Add lines 5 and 6 Part II Expenses Enter expenses for business use of your home only on line 30. 8 Advertising 8 18 Office expense (see instructions) 9 Car and truck expenses (see 19 Pension and profit-sharing plans instructions) 9 20 Rent or lease (see instructions): 10 Commissions and fees 10 a Vehicles, machinery, and equipment 11 Contract labor (see instructions) 11 b Other business property 12 Depletion 12 21 Repairs and maintenance 13 Depreciation and section 179 22 Supplies (not included in Part III) expense deduction (not included 23 Taxes and licenses in Part 111) (see instructions) 13 24 Travel and meals: 14 Employee benefit programs a Travel (other than on line 19) 14 b Deductible meals (see 15 Insurance (other than health) 15 instructions) 16 Interest (see instructions): 25 Utilities a Mortgage (paid to banks, etc.) 16a 26 Wages (less employment credits) b Other 16b 27a Other expenses (from line 48) 17 Legal and professional services 17 b Reserved for future use 28 Total expenses before expenses for business use of home. Add lines 8 through 27a 29 Tentative profit or loss). Subtract line 28 from line 7 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only enter the total square footage of (a) your home and (b) the part of your home used for business: Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 31 Net profit or loss). Subtract line 30 from line 29. If a profit, enter on both Schedule 1 (Form 1040 or 1040-SR), line 3 (or Form 1040-NR, line 13) and on Schedule SE, line 2 (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. 24a 24b 25 26 27a 27b 3,600 22,000 28 29 86.700 26,800 30 31 26.800 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Schedule C Part a Schedule SE Part b Part c Compute self-employment tax payable on the earnings of James's sole proprietorship by completing a 2019 Schedule SE, Form 1040. (Round your intermediate computations and final answers to the nearest whole dollar value. Input all the values as positive numbers.) 4 Section A - Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE. 1a Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A 1a b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b 2 Net profit or loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report 2 26,800 3 Combine lines 1a, 1b, and 2 3 26,800 4 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax, don't file this schedule unless you have an amount on line 15 24,750 Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 5 Self-employment tax. If the amount on line 4 is: $132,900 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 2 (Form 1040 or 1040-SR), line 4, or Form 1040-NR, line 55. . More than $132,900, multiply line 4 by 2.9% (0.029). Then, add $16,479.60 to the result. Enter the total here and on Schedule 2 (Form 1040 or 1040-SR), line 4, or Form 1040-NR, line 55. 3,787 6 Deduction for one-half of self-employment tax. Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040 or 1040-SR), line 14, or Form 1040-NR, line 27. 6 1.894 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11358Z Schedule SE (Form 1040 or 1040-SR) 2019 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2020 McGraw-Hill Education. James Jones is the owner of a small retail business operated as a sole proprietorship. During 2019, his business recorded the following items of income and expense: Revenue from inventory sales Cost of goods sold Business license tax Rent on retail space Supplies Wages paid to employees Payroll taxes Utilities $147,000 33,500 2,400 42,000 15,000 22,000 1,700 3,600 Required: a. Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in James's 2019 Form 1040 b. Compute self-employment tax payable on the earnings of James's sole proprietorship by completing a 2019 Schedule SE, Form 1040 c. Assume that James's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. Calculate James's 2019 QBI deduction, before any overall taxable income limitation. * Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Schedule C Part a Schedule SE Part b Part c Assume that James's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. Calculate James's 2019 QBI deduction, before any overall taxable income limitation. (Round your intermediate computations and final answers to the nearest whole dollar value.) James's 2019 QBI deduction $ 5,360 X Parti Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked 1 147,000 2 3 4 147.000 33,500 113,500 5 6 6 7 113,500 18 19 20a 20b 42,000 21 22 23 15,000 4,100 2 Returns and allowances 3 Subtract line 2 from line 1 4 Cost of goods sold (from line 42) 5 Gross profit. Subtract line 4 from line 3 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) 7 Gross income. Add lines 5 and 6 Part II Expenses Enter expenses for business use of your home only on line 30. 8 Advertising 8 18 Office expense (see instructions) 9 Car and truck expenses (see 19 Pension and profit-sharing plans instructions) 9 20 Rent or lease (see instructions): 10 Commissions and fees 10 a Vehicles, machinery, and equipment 11 Contract labor (see instructions) 11 b Other business property 12 Depletion 12 21 Repairs and maintenance 13 Depreciation and section 179 22 Supplies (not included in Part III) expense deduction (not included 23 Taxes and licenses in Part 111) (see instructions) 13 24 Travel and meals: 14 Employee benefit programs a Travel (other than on line 19) 14 b Deductible meals (see 15 Insurance (other than health) 15 instructions) 16 Interest (see instructions): 25 Utilities a Mortgage (paid to banks, etc.) 16a 26 Wages (less employment credits) b Other 16b 27a Other expenses (from line 48) 17 Legal and professional services 17 b Reserved for future use 28 Total expenses before expenses for business use of home. Add lines 8 through 27a 29 Tentative profit or loss). Subtract line 28 from line 7 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only enter the total square footage of (a) your home and (b) the part of your home used for business: Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 31 Net profit or loss). Subtract line 30 from line 29. If a profit, enter on both Schedule 1 (Form 1040 or 1040-SR), line 3 (or Form 1040-NR, line 13) and on Schedule SE, line 2 (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. 24a 24b 25 26 27a 27b 3,600 22,000 28 29 86.700 26,800 30 31 26.800 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Schedule C Part a Schedule SE Part b Part c Compute self-employment tax payable on the earnings of James's sole proprietorship by completing a 2019 Schedule SE, Form 1040. (Round your intermediate computations and final answers to the nearest whole dollar value. Input all the values as positive numbers.) 4 Section A - Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE. 1a Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A 1a b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b 2 Net profit or loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report 2 26,800 3 Combine lines 1a, 1b, and 2 3 26,800 4 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax, don't file this schedule unless you have an amount on line 15 24,750 Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 5 Self-employment tax. If the amount on line 4 is: $132,900 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 2 (Form 1040 or 1040-SR), line 4, or Form 1040-NR, line 55. . More than $132,900, multiply line 4 by 2.9% (0.029). Then, add $16,479.60 to the result. Enter the total here and on Schedule 2 (Form 1040 or 1040-SR), line 4, or Form 1040-NR, line 55. 3,787 6 Deduction for one-half of self-employment tax. Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040 or 1040-SR), line 14, or Form 1040-NR, line 27. 6 1.894 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11358Z Schedule SE (Form 1040 or 1040-SR) 2019 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2020 McGraw-Hill Education. James Jones is the owner of a small retail business operated as a sole proprietorship. During 2019, his business recorded the following items of income and expense: Revenue from inventory sales Cost of goods sold Business license tax Rent on retail space Supplies Wages paid to employees Payroll taxes Utilities $147,000 33,500 2,400 42,000 15,000 22,000 1,700 3,600 Required: a. Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in James's 2019 Form 1040 b. Compute self-employment tax payable on the earnings of James's sole proprietorship by completing a 2019 Schedule SE, Form 1040 c. Assume that James's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. Calculate James's 2019 QBI deduction, before any overall taxable income limitation. * Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Schedule C Part a Schedule SE Part b Part c Assume that James's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. Calculate James's 2019 QBI deduction, before any overall taxable income limitation. (Round your intermediate computations and final answers to the nearest whole dollar value.) James's 2019 QBI deduction $ 5,360 X