Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Will someone create an excel sheet to show me how to complete this assignment? Part I - Mortgage Amortization and the Covid-19 Pandemic The Covid-19

Will someone create an excel sheet to show me how to complete this assignment?

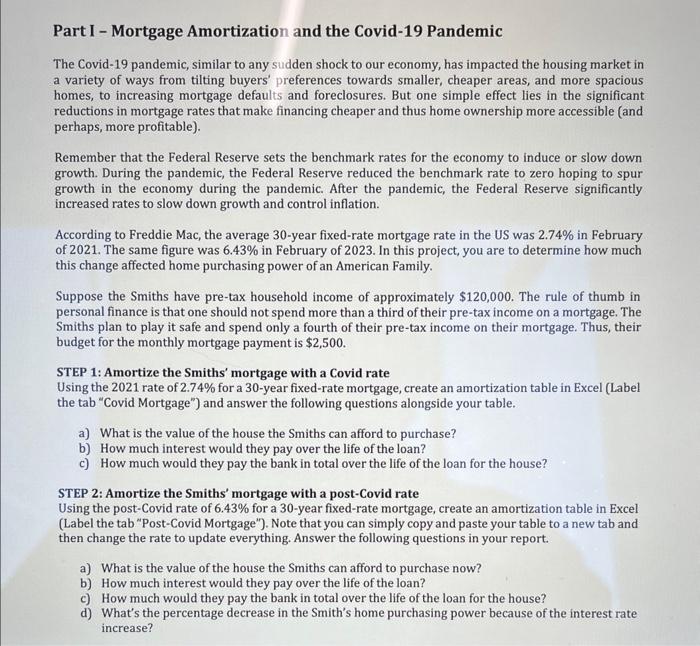

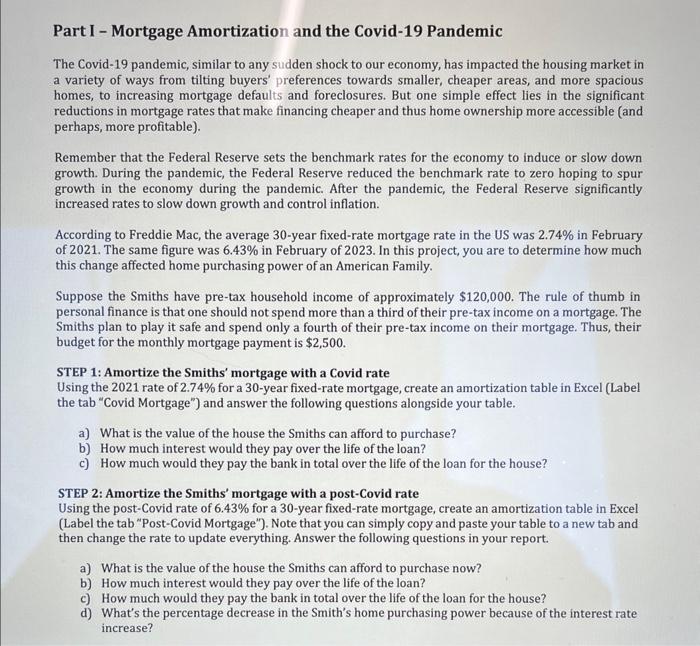

Part I - Mortgage Amortization and the Covid-19 Pandemic The Covid-19 pandemic, similar to any sudden shock to our economy, has impacted the housing market in a variety of ways from tilting buyers' preferences towards smaller, cheaper areas, and more spacious homes, to increasing mortgage defaults and foreclosures. But one simple effect lies in the significant reductions in mortgage rates that make financing cheaper and thus home ownership more accessible (and perhaps, more profitable). Remember that the Federal Reserve sets the benchmark rates for the economy to induce or slow down growth. During the pandemic, the Federal Reserve reduced the benchmark rate to zero hoping to spur growth in the economy during the pandemic. After the pandemic, the Federal Reserve significantly increased rates to slow down growth and control inflation. According to Freddie Mac, the average 30-year fixed-rate mortgage rate in the US was 2.74% in February of 2021. The same figure was 6.43% in February of 2023. In this project, you are to determine how much this change affected home purchasing power of an American Family. Suppose the Smiths have pre-tax household income of approximately $120,000. The rule of thumb in personal finance is that one should not spend more than a third of their pre-tax income on a mortgage. The Smiths plan to play it safe and spend only a fourth of their pre-tax income on their mortgage. Thus, their budget for the monthly mortgage payment is $2,500. STEP 1: Amortize the Smiths' mortgage with a Covid rate Using the 2021 rate of 2.74% for a 30-year fixed-rate mortgage, create an amortization table in Excel (Label the tab "Covid Mortgage") and answer the following questions alongside your table. a) What is the value of the house the Smiths can afford to purchase? b) How much interest would they pay over the life of the loan? c) How much would they pay the bank in total over the life of the loan for the house? STEP 2: Amortize the Smiths' mortgage with a post-Covid rate Using the post-Covid rate of 6.43% for a 30 -year fixed-rate mortgage, create an amortization table in Excel (Label the tab "Post-Covid Mortgage"). Note that you can simply copy and paste your table to a new tab and then change the rate to update everything. Answer the following questions in your report. a) What is the value of the house the Smiths can afford to purchase now? b) How much interest would they pay over the life of the loan? c) How much would they pay the bank in total over the life of the loan for the house? d) What's the percentage decrease in the Smith's home purchasing power because of the interest rate increase? Part I - Mortgage Amortization and the Covid-19 Pandemic The Covid-19 pandemic, similar to any sudden shock to our economy, has impacted the housing market in a variety of ways from tilting buyers' preferences towards smaller, cheaper areas, and more spacious homes, to increasing mortgage defaults and foreclosures. But one simple effect lies in the significant reductions in mortgage rates that make financing cheaper and thus home ownership more accessible (and perhaps, more profitable). Remember that the Federal Reserve sets the benchmark rates for the economy to induce or slow down growth. During the pandemic, the Federal Reserve reduced the benchmark rate to zero hoping to spur growth in the economy during the pandemic. After the pandemic, the Federal Reserve significantly increased rates to slow down growth and control inflation. According to Freddie Mac, the average 30-year fixed-rate mortgage rate in the US was 2.74% in February of 2021. The same figure was 6.43% in February of 2023. In this project, you are to determine how much this change affected home purchasing power of an American Family. Suppose the Smiths have pre-tax household income of approximately $120,000. The rule of thumb in personal finance is that one should not spend more than a third of their pre-tax income on a mortgage. The Smiths plan to play it safe and spend only a fourth of their pre-tax income on their mortgage. Thus, their budget for the monthly mortgage payment is $2,500. STEP 1: Amortize the Smiths' mortgage with a Covid rate Using the 2021 rate of 2.74% for a 30-year fixed-rate mortgage, create an amortization table in Excel (Label the tab "Covid Mortgage") and answer the following questions alongside your table. a) What is the value of the house the Smiths can afford to purchase? b) How much interest would they pay over the life of the loan? c) How much would they pay the bank in total over the life of the loan for the house? STEP 2: Amortize the Smiths' mortgage with a post-Covid rate Using the post-Covid rate of 6.43% for a 30 -year fixed-rate mortgage, create an amortization table in Excel (Label the tab "Post-Covid Mortgage"). Note that you can simply copy and paste your table to a new tab and then change the rate to update everything. Answer the following questions in your report. a) What is the value of the house the Smiths can afford to purchase now? b) How much interest would they pay over the life of the loan? c) How much would they pay the bank in total over the life of the loan for the house? d) What's the percentage decrease in the Smith's home purchasing power because of the interest rate increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started