Answered step by step

Verified Expert Solution

Question

1 Approved Answer

WILL THUMBS IF YOU ARE QUICK 5. 6. 7. 8. Complete the following table. Assume that today is March 31. Stock prices today: Seeger =

WILL THUMBS IF YOU ARE QUICK

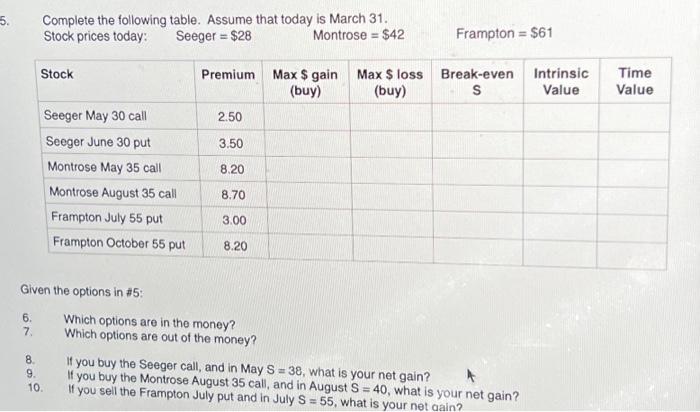

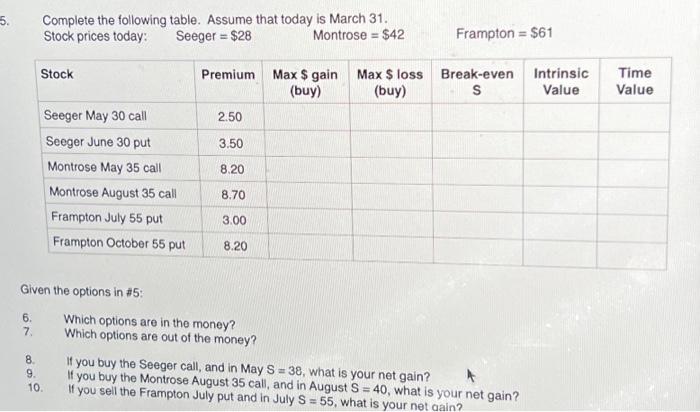

5. 6. 7. 8. Complete the following table. Assume that today is March 31. Stock prices today: Seeger = $28 Montrose= $42 Given the options in #5: 9. Stock Seeger May 30 call Seeger June 30 put Montrose May 35 call Montrose August 35 call Frampton July 55 put Frampton October 55 put 10. Premium 2.50 3.50 8.20 8.70 3.00 8.20 Which options are in the money? Which options are out of the money? Max $ gain (buy) Max $ loss (buy) Frampton = $61 Break-even Intrinsic S Value If you buy the Seeger call, and in May S = 38, what is your net gain? If you buy the Montrose August 35 call, and in August S = 40, what is your net gain? If you sell the Frampton July put and in July S = 55, what is your net gain? Time Value

WILL THUMBS IF YOU ARE QUICK

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started