WILL THUMBS UP FOR CORRECT ANSWER! :)

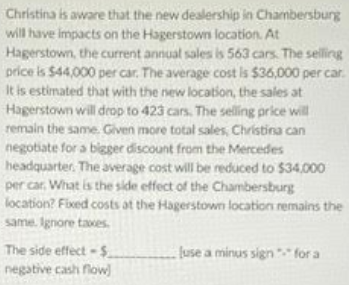

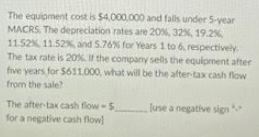

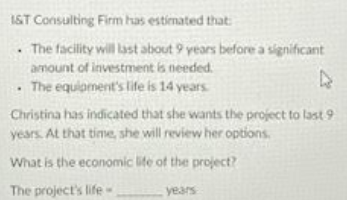

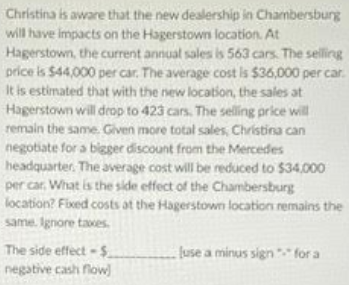

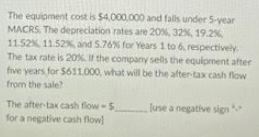

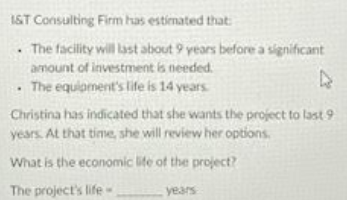

Christina is aware that the new dealership in Chambersburg will have impacts on the Hagerstown location. At Hagerstown, the current annual sales is 563 cars. The seller price is $44.000 per car. The average cost is $36,000 per car It is estimated that with the new location, the sales at Hagerstown will drop to 423 cars. The selling price will remain the same. Given more total sales, Christina can negotiate for a bigger discount from the Mercedes headquarter. The average cost will be reduced to $34,000 per car. What is the side effect of the Chambersburg location? Fixed costs at the Hagerstown location remains the same. Ignore taves The side effect - fuse a minus sign for a negative cash flow) The equiment cost is 54.000.000 and falls under 5-year MACRS. The depreciation rates are 20%,32% 19.2% 1152 1152 and 5.76% for Years 1 to 6. respectively The tax rates 20%. If the company sells the equipment after five years for 5611.000, what will be the after tax cash now from the sale? The after-tax cash flow - 5 Juse a negative sin for a negative cash flow) IST Consulting Firm has estimated that The facility will last about years before a significant amount of investment 6 needed The equipment's life is 14 years Christina has indicated that she wants the project to last 9 years. At that time she will review her options What is the economic life of the project? The project life years Christina is aware that the new dealership in Chambersburg will have impacts on the Hagerstown location. At Hagerstown, the current annual sales is 563 cars. The seller price is $44.000 per car. The average cost is $36,000 per car It is estimated that with the new location, the sales at Hagerstown will drop to 423 cars. The selling price will remain the same. Given more total sales, Christina can negotiate for a bigger discount from the Mercedes headquarter. The average cost will be reduced to $34,000 per car. What is the side effect of the Chambersburg location? Fixed costs at the Hagerstown location remains the same. Ignore taves The side effect - fuse a minus sign for a negative cash flow) The equiment cost is 54.000.000 and falls under 5-year MACRS. The depreciation rates are 20%,32% 19.2% 1152 1152 and 5.76% for Years 1 to 6. respectively The tax rates 20%. If the company sells the equipment after five years for 5611.000, what will be the after tax cash now from the sale? The after-tax cash flow - 5 Juse a negative sin for a negative cash flow) IST Consulting Firm has estimated that The facility will last about years before a significant amount of investment 6 needed The equipment's life is 14 years Christina has indicated that she wants the project to last 9 years. At that time she will review her options What is the economic life of the project? The project life years