Answered step by step

Verified Expert Solution

Question

1 Approved Answer

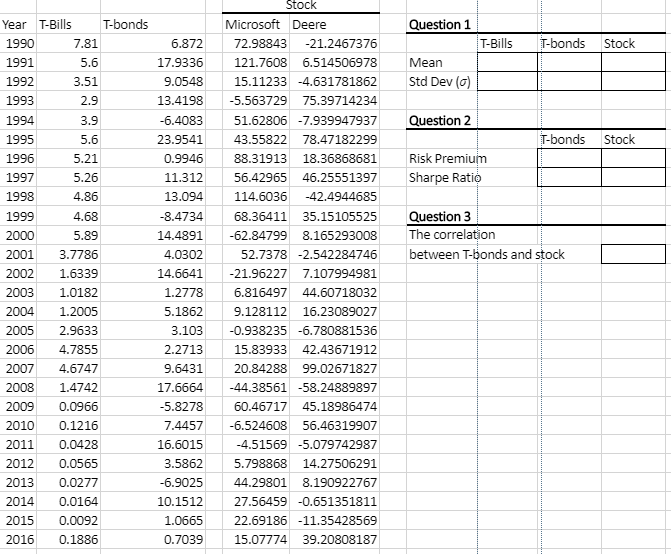

will thumbs up right away! The stock you use for 2 &3 is Microsoft Question 1 T-Bills T-bonds Stock Mean Std Dev (6) Question 2

will thumbs up right away! The stock you use for 2 &3 is Microsoft

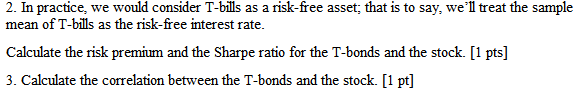

Question 1 T-Bills T-bonds Stock Mean Std Dev (6) Question 2 T-bonds Stock Risk Premium Sharpe Ratio Question 3 The correlation between T-bonds and stock Year T-Bills T-bonds 1990 7.81 1991 5.6 1992 3.51 1993 2.9 1994 3.9 1995 5.6 1996 5.21 1997 5.26 1998 4.86 1999 4.68 2000 5.89 2001 3.7786 2002 1.6339 2003 1.0182 2004 1.2005 2005 2.9633 2006 4.7855 2007 4.6747 2008 1.4742 2009 0.0966 2010 0.1216 2011 0.0428 2012 0.0565 2013 0.0277 2014 0.0164 2015 0.0092 2016 0.1886 6.872 17.9336 9.0548 13.4198 -6.4083 23.9541 0.9946 11.312 13.094 -8.4734 14.4891 4.0302 14.6641 1.2778 5.1862 3.103 2.2713 9.6431 17.6664 -5.8278 7.4457 16.6015 3.5862 -6.9025 10.1512 1.0665 0.7039 Stock Microsoft Deere 72.98843 -21.2467376 121.7608 6.514506978 15.11233 -4.631781862 -5.563729 75.39714234 51.62806 -7.939947937 43.55822 78.47182299 88.31913 18.36868681 56.42965 46.25551397 114.6036 -42.4944685 68.36411 35.15105525 -62.84799 8.165293008 52.7378 -2.542284746 -21.96227 7.107994981 6.816497 44.60718032 9.128112 16.23089027 -0.938235 -6.780881536 15.83933 42.43671912 20.84288 99.02671827 -44.38561 -58.24889897 60.46717 45.18986474 -6.524608 56.46319907 -4.51569 -5.079742987 5.798868 14.27506291 44.29801 8.190922767 27.56459 -0.651351811 22.69186 -11.35428569 15.07774 39.20808187 2. In practice, we would consider T-bills as a risk-free asset; that is to say, we'll treat the sample mean of T-bills as the risk-free interest rate. Calculate the risk premium and the Sharpe ratio for the T-bonds and the stock. [1 pts] 3. Calculate the correlation between the T-bonds and the stock. [1 pt]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started