Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Will upvote answer 1. Short Answer Questions: - Pick 3 questions of the following 5 and answer succinctly (6 points each, 18 points total). If

Will upvote answer

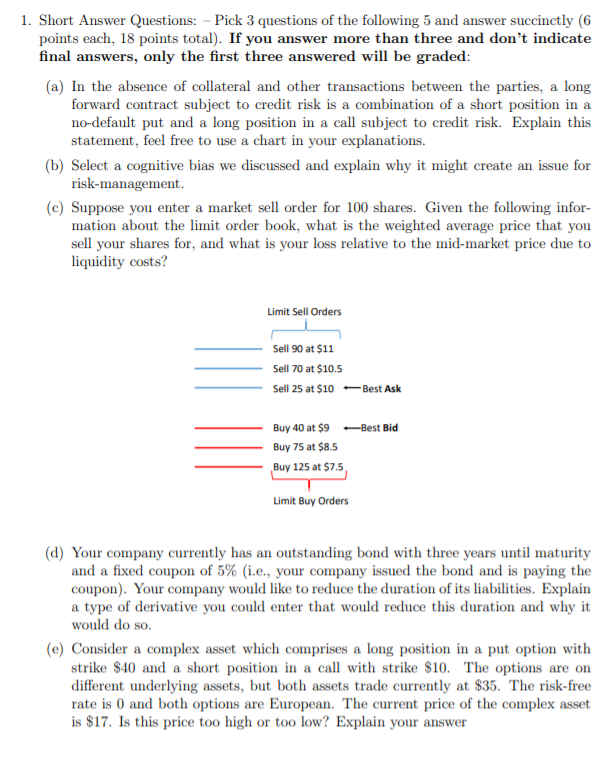

1. Short Answer Questions: - Pick 3 questions of the following 5 and answer succinctly (6 points each, 18 points total). If you answer more than three and don't indicate final answers, only the first three answered will be graded: (a) In the absence of collateral and other transactions between the parties, a long forward contract subject to credit risk is a combination of a short position in a no-default put and a long position in a call subject to credit risk. Explain this statement, feel free to use a chart in your explanations. (b) Select a cognitive bias we discussed and explain why it might create an issue for risk-management. (C) Suppose you enter a market sell order for 100 shares. Given the following infor- mation about the limit order book, what is the weighted average price that you sell your shares for, and what is your loss relative to the mid-market price due to liquidity costs? Limit Sell Orders Sell 90 at $11 Sell 70 at $10.5 Sell 25 at $10 Best Ask Buy 40 at $9 Best Bid Buy 75 at $8.5 Buy 125 at $7.5 Limit Buy Orders (d) Your company currently has an outstanding bond with three years until maturity and a fixed coupon of 5% (i.e., your company issued the bond and is paying the coupon). Your company would like to reduce the duration of its liabilities. Explain a type of derivative you could enter that would reduce this duration and why it would do so. (e) Consider a complex asset which comprises a long position in a put option with strike $40 and a short position in a call with strike $10. The options are on different underlying assets, but both assets trade currently at $35. The risk-free rate is 0 and both options are European. The current price of the complex asset is $17. Is this price too high or too low? Explain your answer 1. Short Answer Questions: - Pick 3 questions of the following 5 and answer succinctly (6 points each, 18 points total). If you answer more than three and don't indicate final answers, only the first three answered will be graded: (a) In the absence of collateral and other transactions between the parties, a long forward contract subject to credit risk is a combination of a short position in a no-default put and a long position in a call subject to credit risk. Explain this statement, feel free to use a chart in your explanations. (b) Select a cognitive bias we discussed and explain why it might create an issue for risk-management. (C) Suppose you enter a market sell order for 100 shares. Given the following infor- mation about the limit order book, what is the weighted average price that you sell your shares for, and what is your loss relative to the mid-market price due to liquidity costs? Limit Sell Orders Sell 90 at $11 Sell 70 at $10.5 Sell 25 at $10 Best Ask Buy 40 at $9 Best Bid Buy 75 at $8.5 Buy 125 at $7.5 Limit Buy Orders (d) Your company currently has an outstanding bond with three years until maturity and a fixed coupon of 5% (i.e., your company issued the bond and is paying the coupon). Your company would like to reduce the duration of its liabilities. Explain a type of derivative you could enter that would reduce this duration and why it would do so. (e) Consider a complex asset which comprises a long position in a put option with strike $40 and a short position in a call with strike $10. The options are on different underlying assets, but both assets trade currently at $35. The risk-free rate is 0 and both options are European. The current price of the complex asset is $17. Is this price too high or too low? Explain yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started