Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Will upvote answer 3. You have a portfolio that is long several complex derivatives. The portfolio has a current value of 15 million. The expected

Will upvote answer

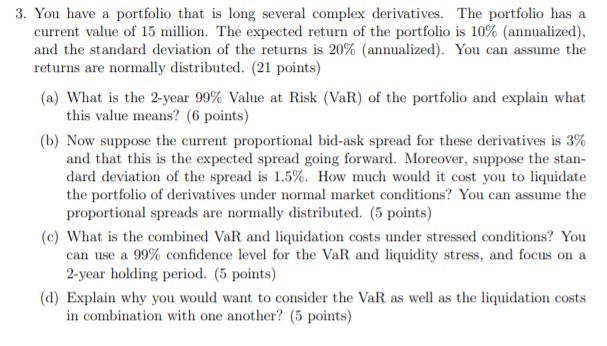

3. You have a portfolio that is long several complex derivatives. The portfolio has a current value of 15 million. The expected return of the portfolio is 10% (annualized), and the standard deviation of the returns is 20% (annualized). You can assume the returns are normally distributed. (21 points) (a) What is the 2-year 99% Value at Risk (VaR) of the portfolio and explain what this value means? (6 points) (b) Now suppose the current proportional bid-ask spread for these derivatives is 3% and that this is the expected spread going forward. Moreover, suppose the stan- dard deviation of the spread is 1.5%. How much would it cost you to liquidate the portfolio of derivatives under normal market conditions? You can assume the proportional spreads are normally distributed. (5 points) (c) What is the combined VaR and liquidation costs under stressed conditions? You can use a 99% confidence level for the VaR and liquidity stress, and focus on a 2-year holding period. (5 points) (d) Explain why you would want to consider the VaR as well as the liquidation costs in combination with one another? (5 points) 3. You have a portfolio that is long several complex derivatives. The portfolio has a current value of 15 million. The expected return of the portfolio is 10% (annualized), and the standard deviation of the returns is 20% (annualized). You can assume the returns are normally distributed. (21 points) (a) What is the 2-year 99% Value at Risk (VaR) of the portfolio and explain what this value means? (6 points) (b) Now suppose the current proportional bid-ask spread for these derivatives is 3% and that this is the expected spread going forward. Moreover, suppose the stan- dard deviation of the spread is 1.5%. How much would it cost you to liquidate the portfolio of derivatives under normal market conditions? You can assume the proportional spreads are normally distributed. (5 points) (c) What is the combined VaR and liquidation costs under stressed conditions? You can use a 99% confidence level for the VaR and liquidity stress, and focus on a 2-year holding period. (5 points) (d) Explain why you would want to consider the VaR as well as the liquidation costs in combination with one another? (5 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started