Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Will upvote answer 4. You are the CEO of an oil company and have the following project to consider. You can invest $2 million in

Will upvote answer

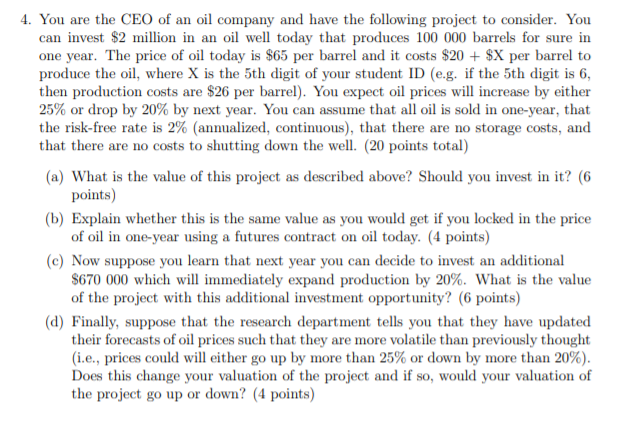

4. You are the CEO of an oil company and have the following project to consider. You can invest $2 million in an oil well today that produces 100 000 barrels for sure in one year. The price of oil today is $65 per barrel and it costs $20 + $X per barrel to produce the oil, where X is the 5th digit of your student ID (e.g. if the 5th digit is 6, then production costs are $26 per barrel). You expect oil prices will increase by either 25% or drop by 20% by next year. You can assume that all oil is sold in one-year, that the risk-free rate is 2% (annualized, continuous), that there are no storage costs, and that there are no costs to shutting down the well. (20 points total) (a) What is the value of this project as described above? Should you invest in it? (6 points) (b) Explain whether this is the same value as you would get if you locked in the price of oil in one-year using a futures contract on oil today. (4 points) (C) Now suppose you learn that next year you can decide to invest an additional $670 000 which will immediately expand production by 20%. What is the value of the project with this additional investment opportunity? (6 points) (a) Finally, suppose that the research department tells you that they have updated their forecasts of oil prices such that they are more volatile than previously thought (i.e., prices could will either go up by more than 25% or down by more than 20%). Does this change your valuation of the project and if so, would your valuation of the project go up or down? (4 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started