Answered step by step

Verified Expert Solution

Question

1 Approved Answer

will upvote for fast correct answer yes it is. Well before the accounts payable were due. Russ visited a local bank and inquired about obtaining

will upvote for fast correct answer

yes it is.

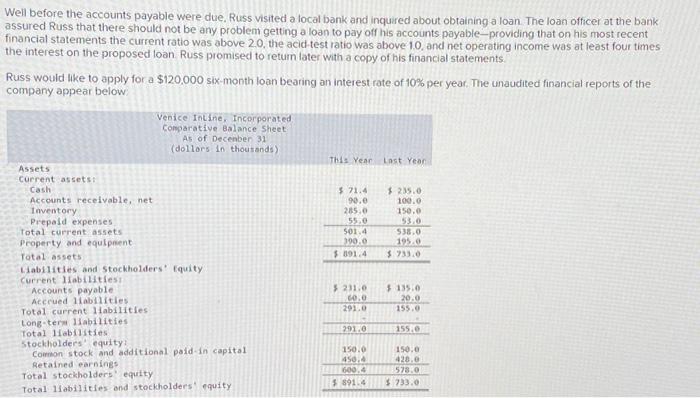

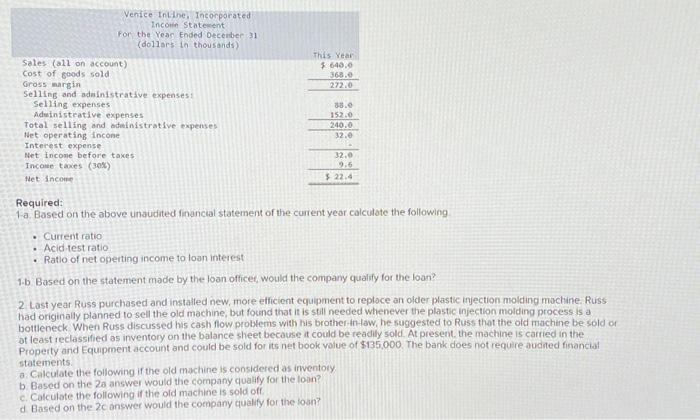

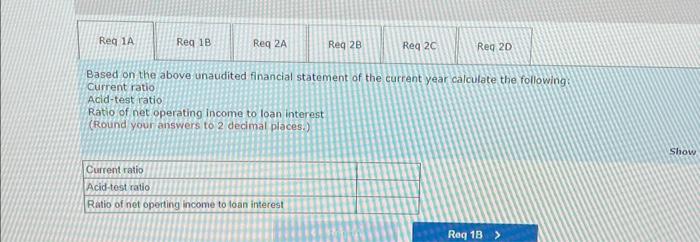

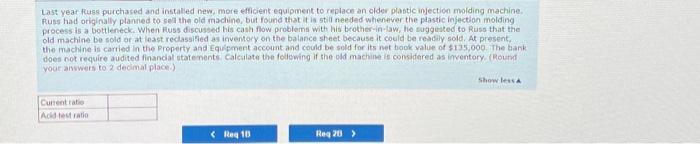

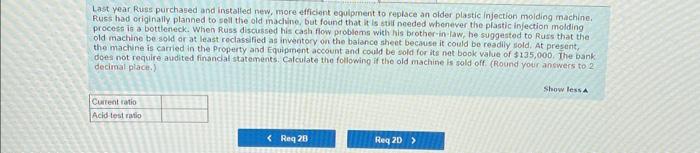

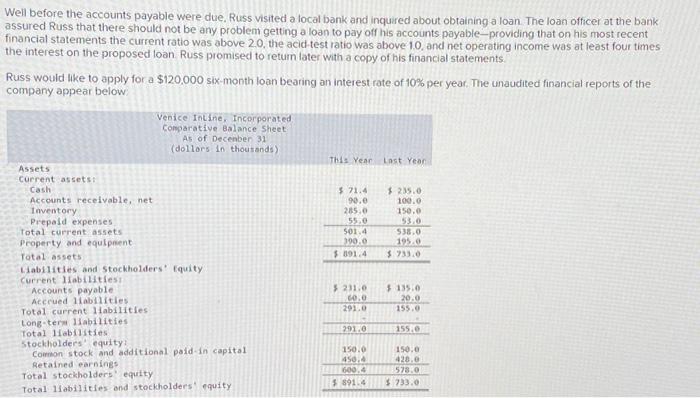

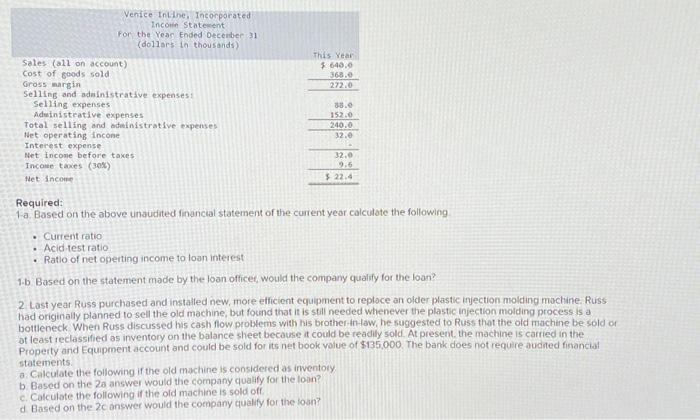

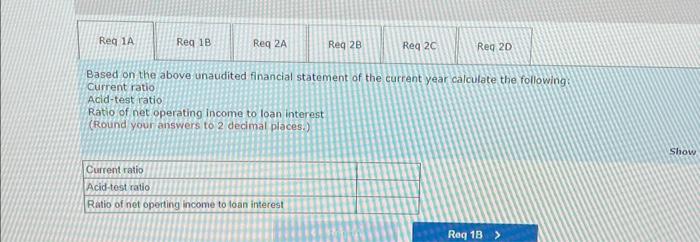

Well before the accounts payable were due. Russ visited a local bank and inquired about obtaining a loan The loan officer at the bank assured Russ that there should not be any problem getting a loan to pay off his accounts payable-providing that on his most recent financial statements the current ratio was above 20, the acid test ratio was above 1.0 , and net operating income was at least four times the interest on the proposed loan. Russ promised to return fater with a copy of his financial statements. Russ would like to apply for a $120,000 six-month loan bearing an interest rate of 10% per year. The unaudited financial reports of the company appear below: Required: 1a. Based on the above unaudited financial statement of the carrent year calculate the following - Current ratio - Acid test ratio - Ratio of net operting income to loan interest 1.b Based on the statement made by the loan office, would the company qualify for the loan? 2. Last year Russ purchased and installed new, more efficient equipment to reploce an older plastic injection molding machine. Russ had originally planned to sell the old machine, but found that it is still needed whenever the plastic injection molding process is a botteneck. When Russ discussed his cash flow problems with his brother-in-law, he suggested to Russ that the old machine be sold of ot least reclassified as inventory on the balance sheet because it could be readily sold. At present, the machine is carried in the Property and Equipment account and could be sold for its net book volue of $135,000. The bank does not require audited financial statements. a. Calculate the following if the old machine is considered as inwentory. b. Based on the 20 answer would the company qualify for the loin? c. Calculate the following if the oid machine is sold off d. Based on the 2c onswer would the company qualify for the soan? Based on the above unaudited financial statement of the current year calculate the following: Current ratio Acid-test ratio Ratio of net operating income to loan interest (Round your ahswers to 2 decimal places.) Last yeat fuss purchased and installed new, more efficient equipment to replace an older plastic injection molding machine. Russ had originally plamed to seli the old machine, but found that it ia stil needed whenever the plastic fnjection molding process is a bottleneck. When fuss discussed his cash fow problems with his brother-in-law, ho saggested to Russ that the old machine bo sold or at least reclassilied as inventory on the balance sheet because it could be reacily sold. At present. the machine in carried in the Preperty and Equipment accomnt and could be sold for its net book yalue of 1135,000 . The bank does not require audited finandal statements Calculate the follewing if the old machine is considered as inventory (Rournd yoot answers to 2 decimal place.) Last year Russ purchased and instalfed new, more efficiont equlpment to replace an older plastic injection molding machine. Fuss had originally planned to sell the old machine, but found that it is stif needed whenever the plastic injection molding procese is a bottleneck. When Russ discussed his cash flow problems with his brother-in-law, he suggestod to Russ that the old machine be sold ar at least reclassified as inventory on the balance sheet because it could bo readlly sold, At present, the machine is carried in the Property and Equipment account and could be sold for its net book value of $135,000. The bank does not require audited finandal statements. Calculate tho following if the old machine is sold off (Round your answers to 2 decirnal plact.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started