WILL UPVOTE IF ALL ARE DONE! Questions in second picture

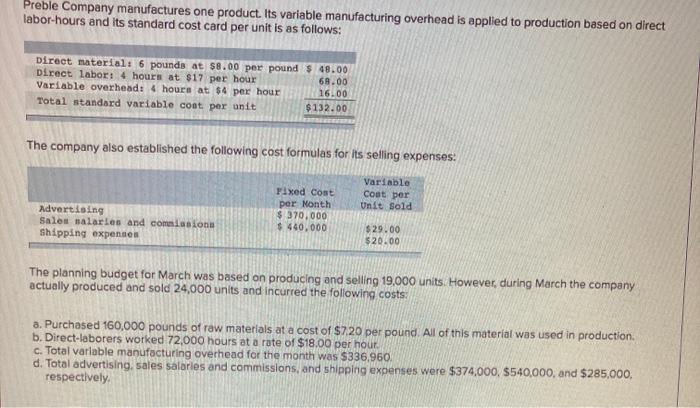

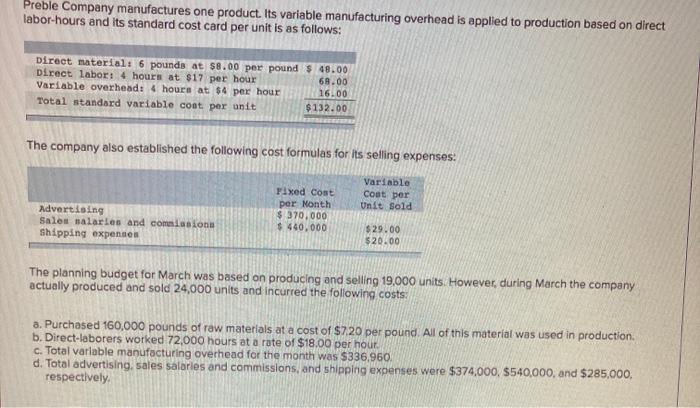

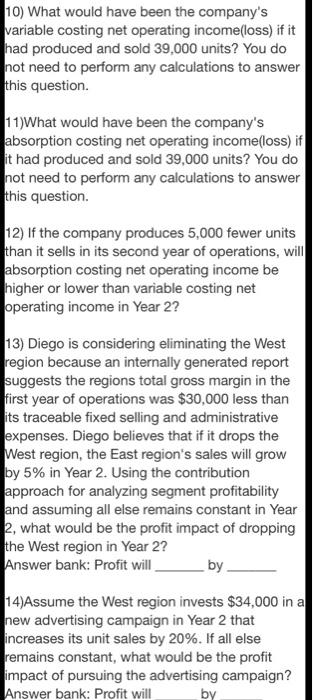

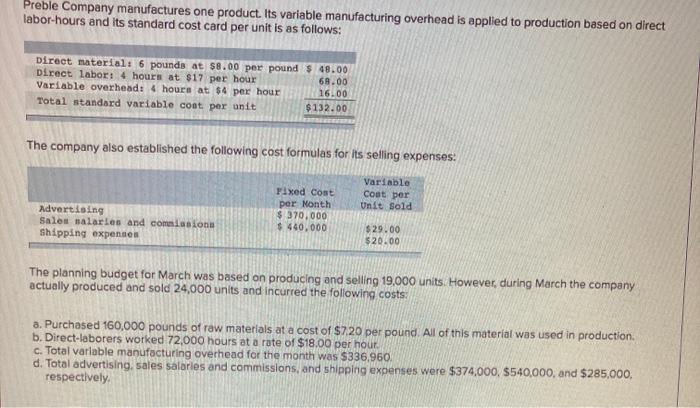

Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 6 pounds at $8.00 per pound $ 48.00 Direct labor: 4 hours at $17 per hour 68.00 Variable overhead: 4 hours at $4 per hour 16.00 Total standard variable coat per unit $132.00 The company also established the following cost formulas for its selling expenses. Variable Cost per Unit Sold Fixed Cost per Month $ 370,000 $ 440,000 Advertising Sales malaries and commissione Shipping expenses $29.00 $20.00 The planning budget for March was based on producing and selling 19,000 units. However, during March the company actually produced and sold 24,000 units and incurred the following costs: a. Purchased 160,000 pounds of raw materials at a cost of $720 per pound. All of this material was used in production b. Direct-laborers worked 72,000 hours at a rate of $18.00 per hour. c. Total variable manufacturing overhead for the month was $336,960, d. Total advertising, sales salaries and commissions, and shipping expenses were $374,000, $540,000, and $285,000, respectively 10) What would have been the company's variable costing net operating income(loss) if it had produced and sold 39.000 units? You do not need to perform any calculations to answer this question. 11) What would have been the company's absorption costing net operating incomelloss) if it had produced and sold 39,000 units? You do not need to perform any calculations to answer this question. 12) If the company produces 5,000 fewer units than it sells in its second year of operations, will absorption costing net operating income be higher or lower than variable costing net operating income in Year 2? 13) Diego is considering eliminating the West region because an internally generated report suggests the regions total gross margin in the first year of operations was $30,000 less than its traceable fixed selling and administrative expenses. Diego believes that if it drops the West region, the East region's sales will grow by 5% in Year 2. Using the contribution approach for analyzing segment profitability and assuming all else remains constant in Year 2, what would be the profit impact of dropping the West region in Year 2? Answer bank: Profit will by 14)Assume the West region invests $34,000 in a new advertising campaign in Year 2 that increases its unit sales by 20%. If all else remains constant, what would be the profit impact of pursuing the advertising campaign? Answer bank: Profit will by Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 6 pounds at $8.00 per pound $ 48.00 Direct labor: 4 hours at $17 per hour 68.00 Variable overhead: 4 hours at $4 per hour 16.00 Total standard variable coat per unit $132.00 The company also established the following cost formulas for its selling expenses. Variable Cost per Unit Sold Fixed Cost per Month $ 370,000 $ 440,000 Advertising Sales malaries and commissione Shipping expenses $29.00 $20.00 The planning budget for March was based on producing and selling 19,000 units. However, during March the company actually produced and sold 24,000 units and incurred the following costs: a. Purchased 160,000 pounds of raw materials at a cost of $720 per pound. All of this material was used in production b. Direct-laborers worked 72,000 hours at a rate of $18.00 per hour. c. Total variable manufacturing overhead for the month was $336,960, d. Total advertising, sales salaries and commissions, and shipping expenses were $374,000, $540,000, and $285,000, respectively 10) What would have been the company's variable costing net operating income(loss) if it had produced and sold 39.000 units? You do not need to perform any calculations to answer this question. 11) What would have been the company's absorption costing net operating incomelloss) if it had produced and sold 39,000 units? You do not need to perform any calculations to answer this question. 12) If the company produces 5,000 fewer units than it sells in its second year of operations, will absorption costing net operating income be higher or lower than variable costing net operating income in Year 2? 13) Diego is considering eliminating the West region because an internally generated report suggests the regions total gross margin in the first year of operations was $30,000 less than its traceable fixed selling and administrative expenses. Diego believes that if it drops the West region, the East region's sales will grow by 5% in Year 2. Using the contribution approach for analyzing segment profitability and assuming all else remains constant in Year 2, what would be the profit impact of dropping the West region in Year 2? Answer bank: Profit will by 14)Assume the West region invests $34,000 in a new advertising campaign in Year 2 that increases its unit sales by 20%. If all else remains constant, what would be the profit impact of pursuing the advertising campaign? Answer bank: Profit will by