Answered step by step

Verified Expert Solution

Question

1 Approved Answer

will upvote when completed. thank you! Your new job offers a savings plan that pays 0.75 percent in interest each month. You can't participate in

will upvote when completed. thank you!

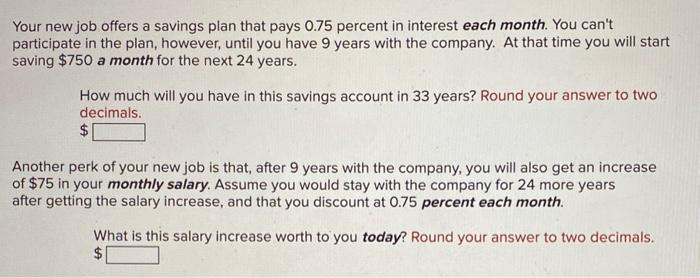

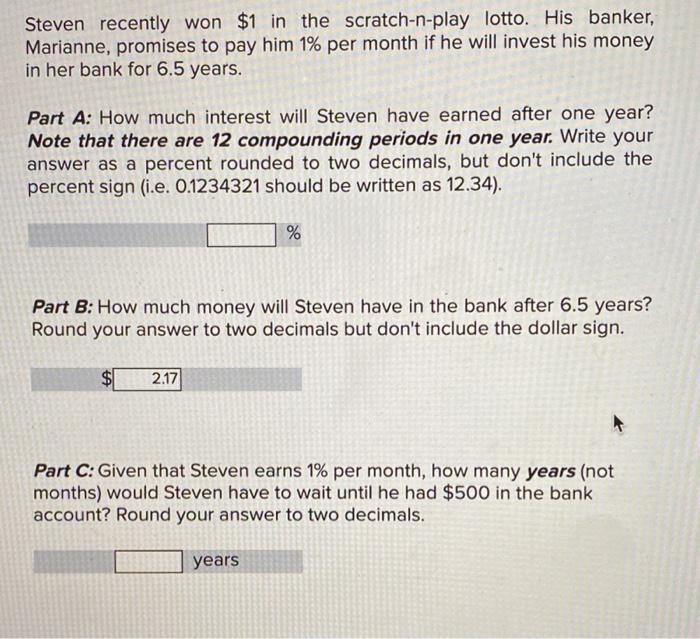

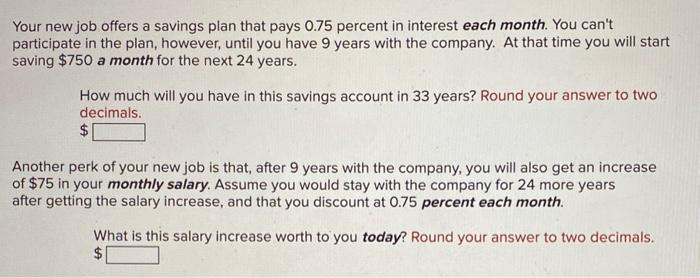

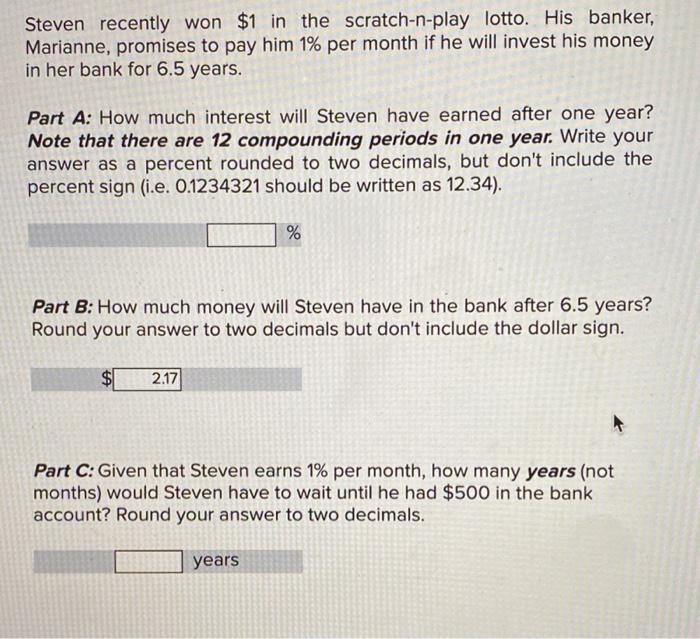

Your new job offers a savings plan that pays 0.75 percent in interest each month. You can't participate in the plan, however, until you have 9 years with the company. At that time you will start saving $750 a month for the next 24 years. How much will you have in this savings account in 33 years? Round your answer to two decimals. $ Another perk of your new job is that, after 9 years with the company, you will also get an increase of $75 in your monthly salary. Assume you would stay with the company for 24 more years after getting the salary increase, and that you discount at 0.75 percent each month. What is this salary increase worth to you today? Round your answer to two decimals. $ Steven recently won $1 in the scratch-n-play lotto. His banker, Marianne, promises to pay him 1% per month if he will invest his money in her bank for 6.5 years. Part A: How much interest will Steven have earned after one year? Note that there are 12 compounding periods in one year. Write your answer as a percent rounded to two decimals, but don't include the percent sign (i.e. 0.1234321 should be written as 12.34). % Part B: How much money will Steven have in the bank after 6.5 years? Round your answer to two decimals but don't include the dollar sign. $ 2.17 Part C: Given that Steven earns 1% per month, how many years (not months) would Steven have to wait until he had $500 in the bank account? Round your answer to two decimals. years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started