Will you check my answers?

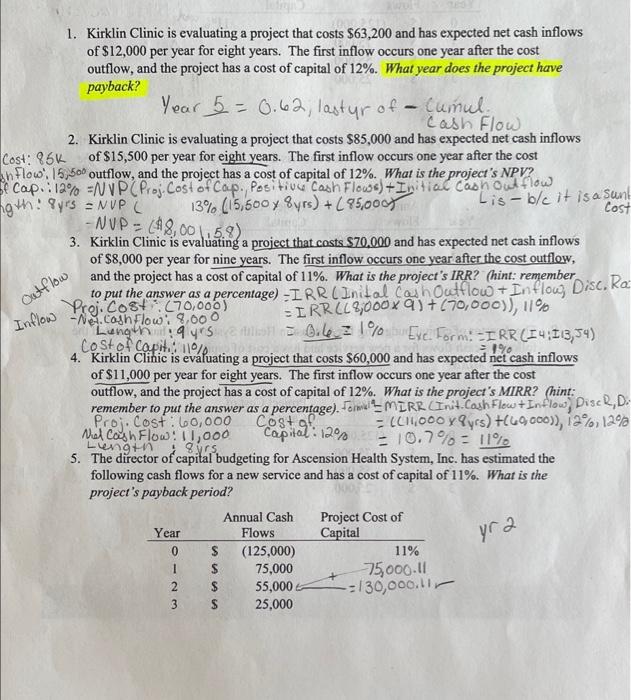

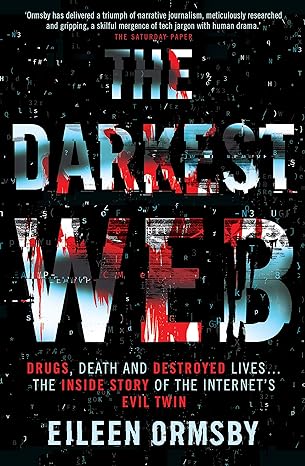

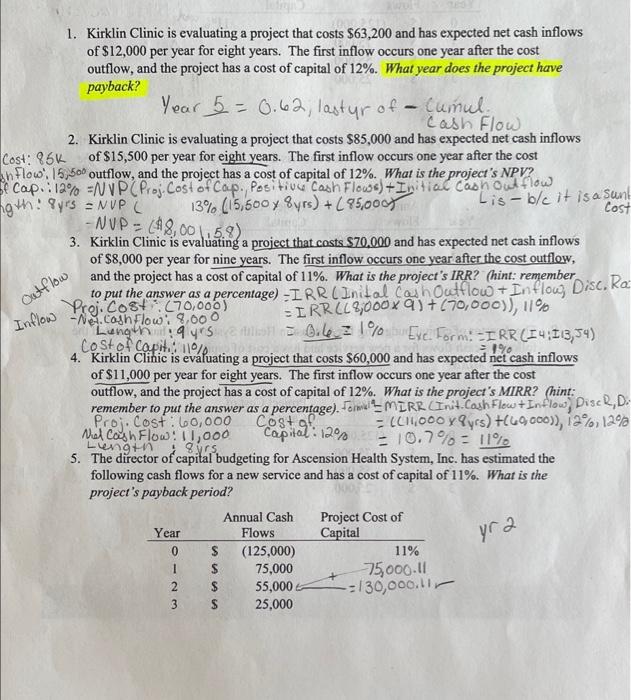

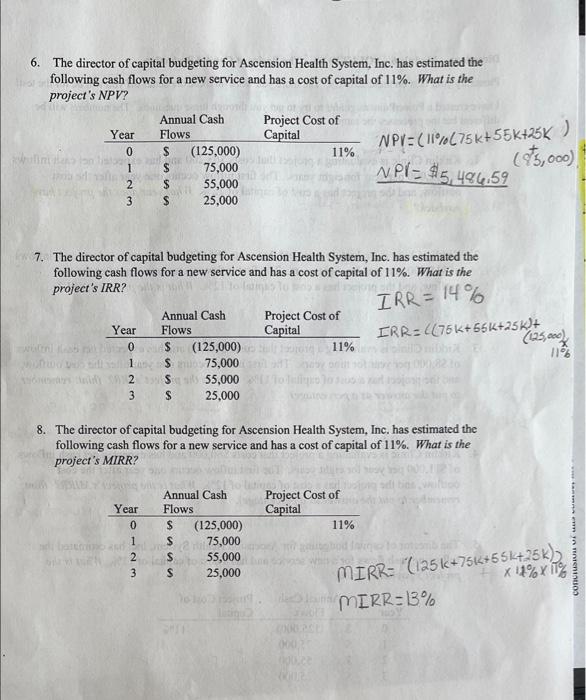

-NUP = ($8,00 1,5.9) Outflow 1. Kirklin Clinic is evaluating a project that costs $63,200 and has expected net cash inflows of $12,000 per year for eight years. The first inflow occurs one year after the cost outflow, and the project has a cost of capital of 12%. What year does the project have payback? Year 5 = 0.62, lastyr of - Cumul Cash Flow 2. Kirklin Clinic is evaluating a project that costs $85,000 and has expected net cash inflows Cost: 85k of $15,500 per year for eight years. The first inflow occurs one year after the cost in flow. 15,500 outflow, and the project has a cost of capital of 12%. What is the project's NPV? cap. 213% EN VPC Proj. Cost of Cap., Positrus Cash Flowe) + Intial casnow flow ngth: Pyes = NUP 13% (15,600 y 8yrs) +(85,00 Lis - b/c it is a sunt Cost 3. Kirklin Clinic is evaluating a project that costs $70,000 and has expected net cash inflows of $8,000 per year for nine years. The first inflow occurs one year after the cost outflow, and the project has a cost of capital of 11%. What is the project's IRR? (hint: remember to put the answer as a percentage) - IRR (Inital Cain outflow + In flous Disc, Ra Proj. Cost:270,000) IRR2L8,000x9)+(70,000)), 11% -Ne.cosh flow : 8,000 Lungh. yrs 0.21% Cost of capit10/ Eve. Form: IRR (14:113,54) 4. Kirklin Clinic is evaluating a project that costs $60,000 and has expected net cash inflows of $11,000 per year for eight years. The first inflow occurs one year after the cost outflow, and the project has a cost of capital of 12%. What is the project's MIRR? (hint: remember to put the answer as a percentage). Forma MIRR (Init. Cash Flow +Inflow) DiscR,D. Proj. Cost: 60,000 Costa - 01000 Pyss) +(69000)), 12%, 12% Nel Cash Flow : 11,000 Capital: 1207 - 10.7% 11% s. The director of capital budgeting for Ascension Health System, Inc. has estimated the following cash flows for a new service and has a cost of capital of 11%. What is the project's payback period? Annual Cash Project Cost of Year Flows Capital $ (125,000) 11% $ 75,000 75000.11 2 $ 55,000 -130,000.11 3 $ 25,000 Inflow yra 0 1 6. The director of capital budgeting for Ascension Health System, Inc. has estimated the following cash flows for a new service and has a cost of capital of 11%. What is the project's NPV? Annual Cash Project Cost of Year Flows Capital NPV=(11%75k+55 +256) (125,000) 11% ( 75,000 1 (5,000) 2 55,000 3 25,000 0 S $ NPI- $5.496.59 S 7. The director of capital budgeting for Ascension Health System, Inc. has estimated the following cash flows for a new service and has a cost of capital of 11%. What is the project's IRR? Project Cost of Capital 11% Annual Cash Year Flows 0 $ (125,000) 1$ 75,000 Les 255,000 3 S 25,000 IRR = 14% IRR:((75K+56K+255+ (135.000 11% 8. The director of capital budgeting for Ascension Health System, Inc. has estimated the following cash flows for a new service and has a cost of capital of 11%. What is the project's MIRR? a Annual Cash Flows S (125,000) s 75,000 Project Cost of Capital 11% Year 0 1 2 3 at to 55,000 S 25,000 CONVIVE MIRR= (125k+751*55k+25k)) x 11% 11% MIRR=13%