Answered step by step

Verified Expert Solution

Question

1 Approved Answer

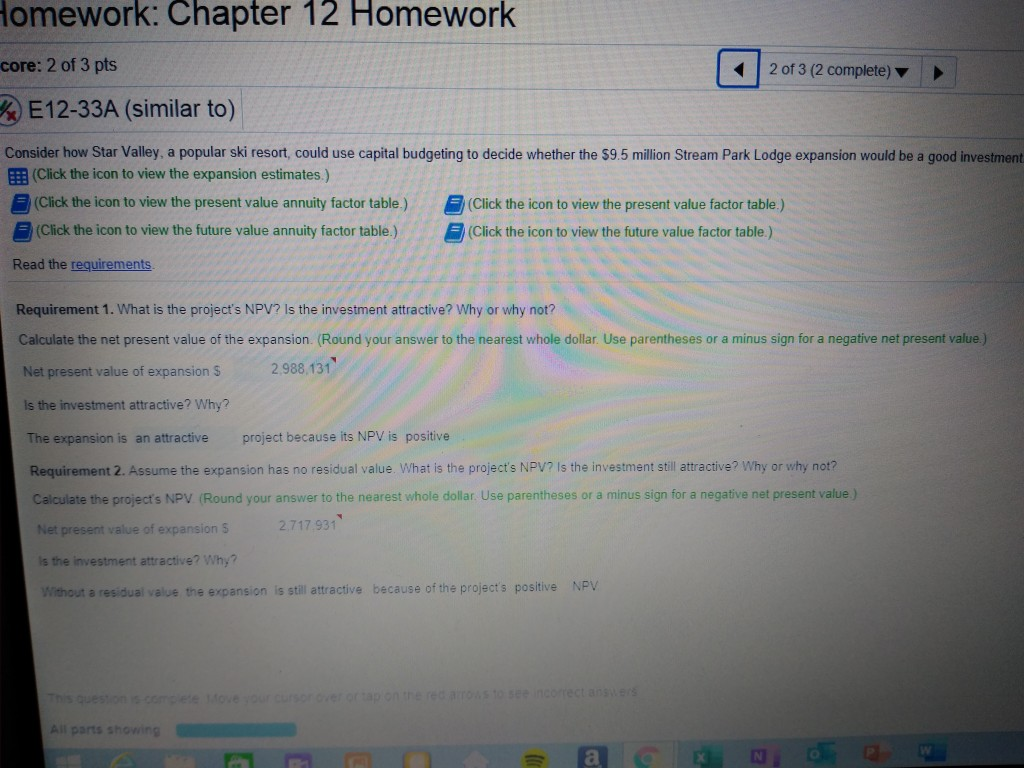

Will you please explain the calculations that came up with these answers. Thank you. Homework: Chapter 12 Homework core: 2 of 3 pts 2 of

Will you please explain the calculations that came up with these answers. Thank you.

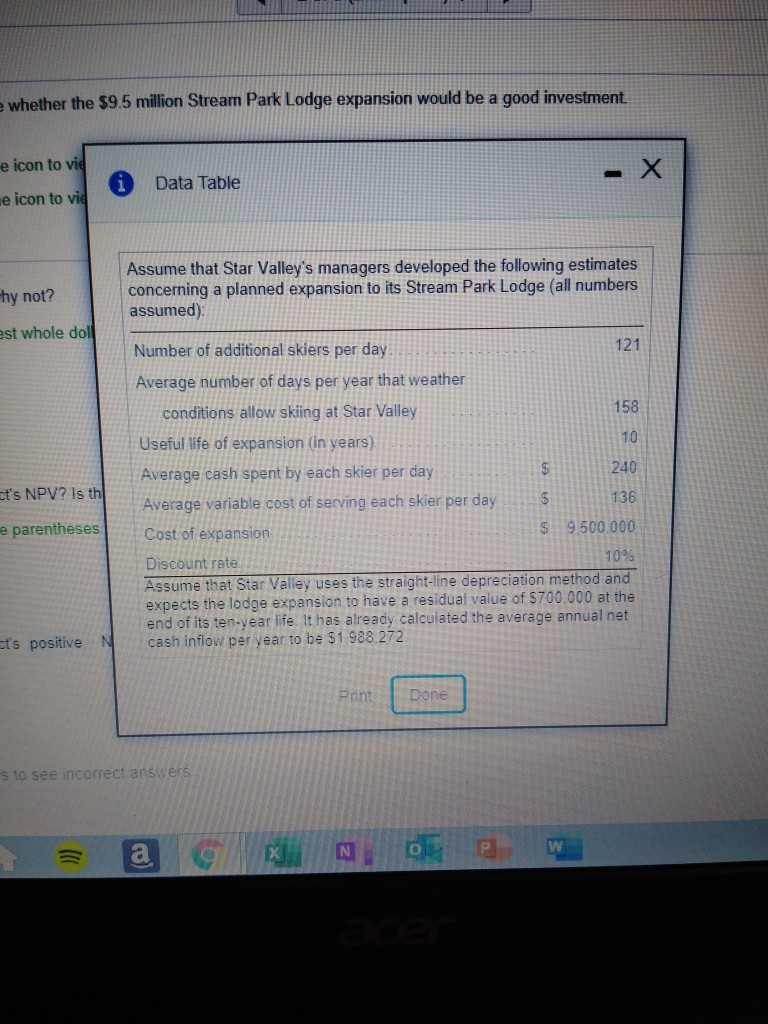

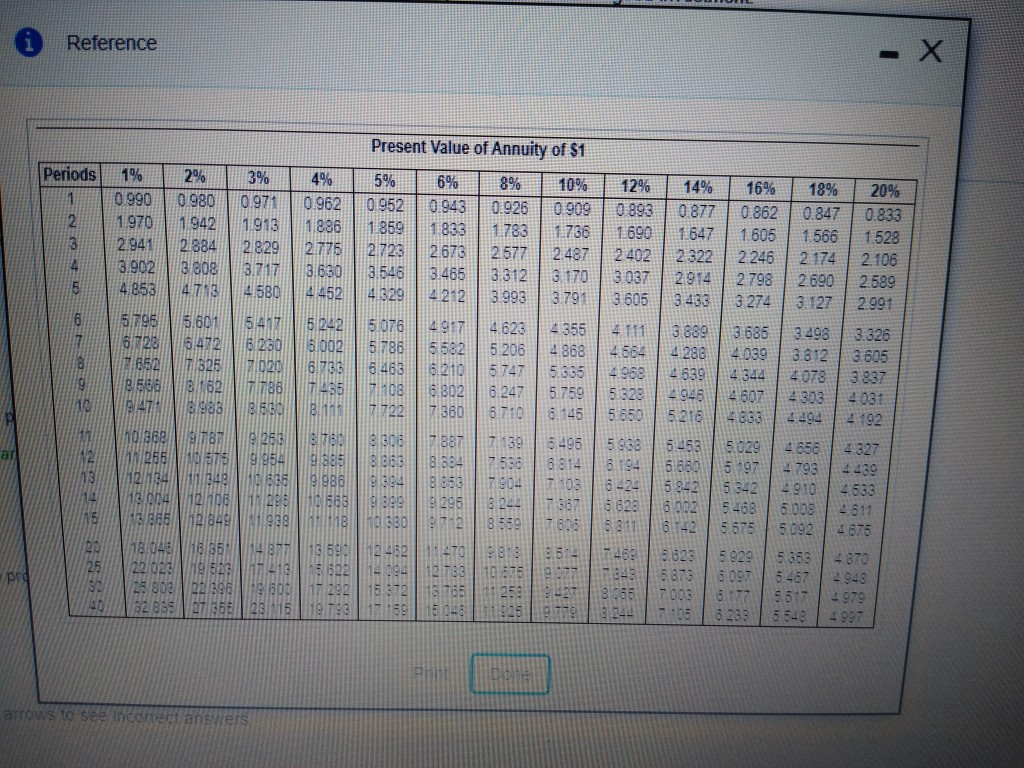

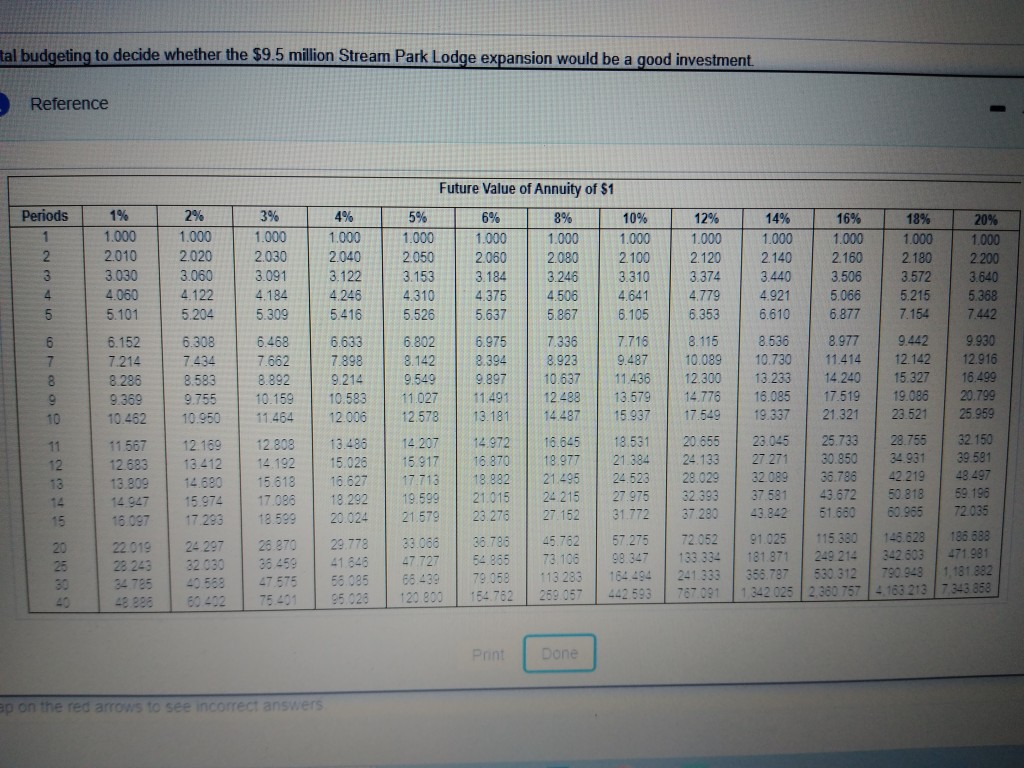

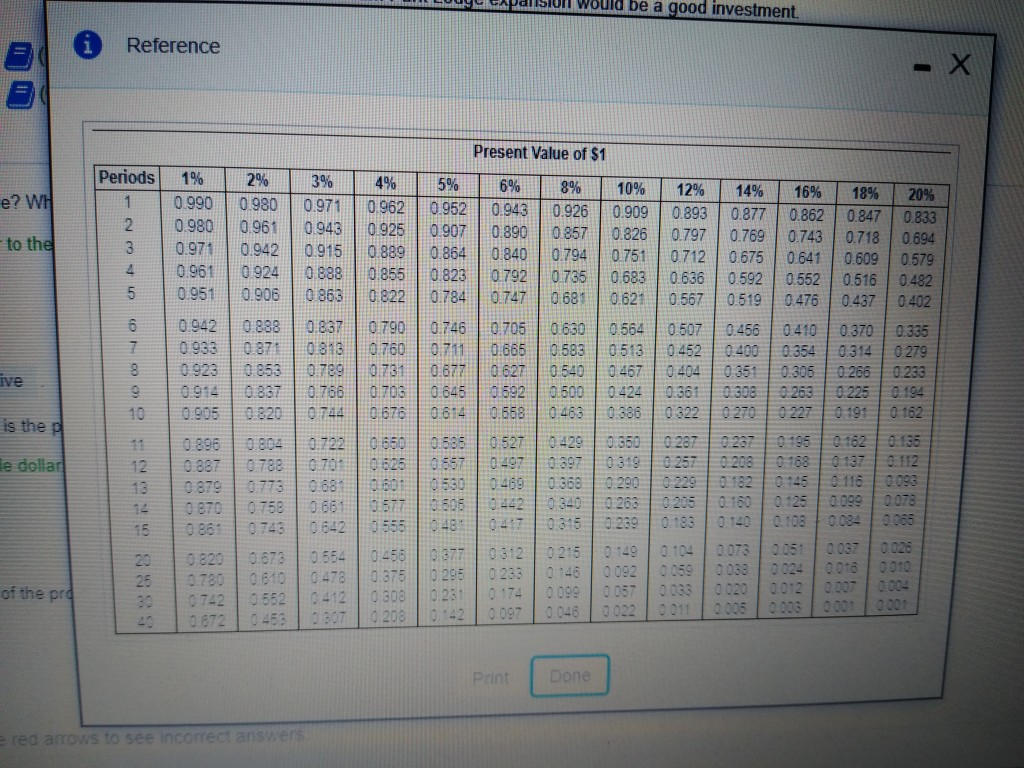

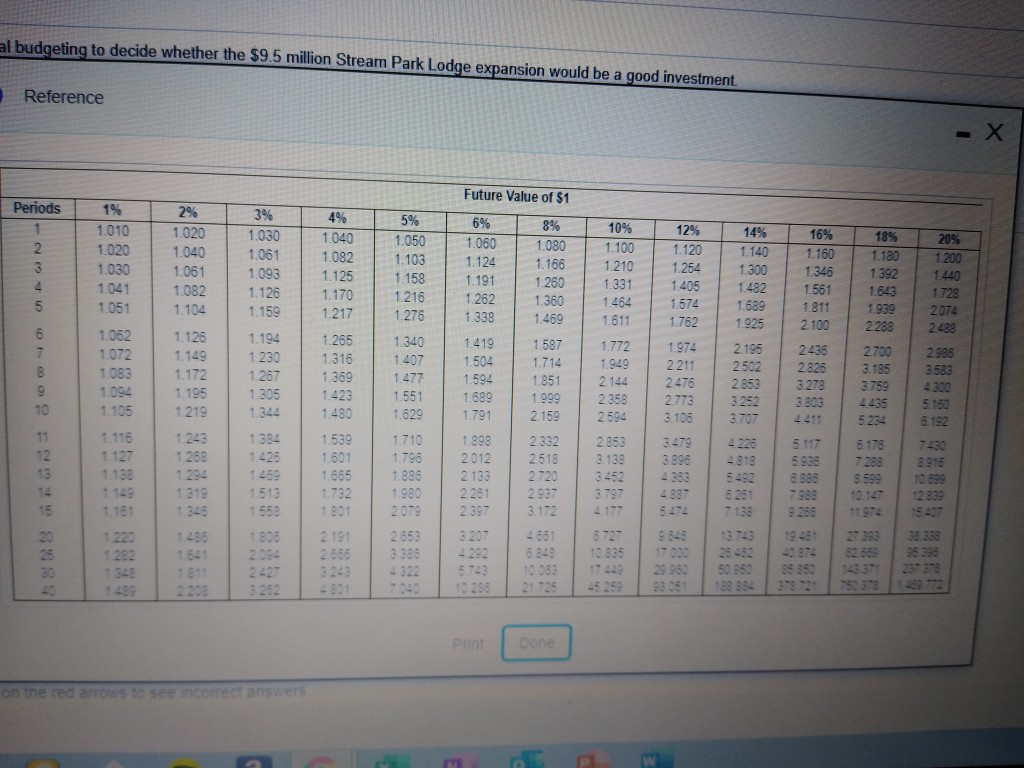

Homework: Chapter 12 Homework core: 2 of 3 pts 2 of 3 (2 complete) %E12-33A (similar to) Consider how Star Valley, a popular ski resort, could use capital budgeting to decide whether the $9.5 million Stream Park Lodge expansion would be a good investment (Click the icon to view the expansion estimates.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the present value factor table.) (Click the icon to view the future value annuity factor table.) (Click the icon to view the future value factor table.) Read the requirements Requirement 1. What is the project's NPV? Is the investment attractive? Why or why not? Calculate the net present value of the expansion. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) Net present value of expansion $ 2.988.131 Is the investment attractive? Why? The expansion is an attractive project because its NPV is positive Requirement 2. Assume the expansion has no residual value. What is the project's NPV? Is the investment still attractive? Why or why not? Calculate the project's NPV (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value) Net present value of expansion 5 2.717.931 is the investment attractive? Why? Without a residual value the expansion is still attractive because of the project's positive NPV a questions com ele ove our cursorer or tap on the red rosto correct answers All parts showing W whether the $9.5 million Stream Park Lodge expansion would be a good investment. e icon to vie - X Data Table se icon to vie hy not? Assume that Star Valley's managers developed the following estimates concerning a planned expansion to its Stream Park Lodge (all numbers assumed): est whole doll It's NPV? Is th Number of additional skiers per day 121 Average number of days per year that weather conditions allow skiing at Star Valley 158 Useful life of expansion (in years) 10 Average cash spent by each skier per day $ 240 Average variable cost of serving each skier per day $ 136 Cost of expansion $ 9.500.000 Discount rate 10% Assume that Star Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $700.000 at the end of its ten-year life. It has already calculated the average annual net cash inflow per year to be $1.988.272 e parentheses et's positive N Print Done s to see incorrect answers X a o N Reference 1 1647 16 4 288 Present Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 0.990 20% 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0 893 0.877 0.862 0.847 0.833 1.970 1942 1913 1.886 1.859 1.833 1.783 1.736 1 690 1605 1.566 2.941 1.528 2.884 2.829 2.775 2.723 2.678 2 577 2.487 2 402 2 322 2.246 2 174 3.902 2.106 3.808 3.717 3,660 3.546 3.465 3.312 G 170 3 037 2914 2 798 2.690 2.589 5 4 853 4718 4580 4452 4.329 4212 3.993 3.791 3 605 3433 3274 3.127 2991 5.795 5.601 5.475 242 5.076 4917 4.623 4 355 4.1.11 3.889 3 685 3498 3.326 6728 5.472 8.280 61002 51786 5582 5.206 4.868 4564 4039 3.812 3.605 7 652 7.825 702061786 6.488 6.210 57475.666 4968 4 639 4344 4078 3.837 8.668 1862 77186 7.486 108 6.8026.2475759 5328 4946 4607 4303 10 9/47 4031 18.1988 8.530 B1 7722 7.360 6.710 6. 145 5 650 5.216 4833 4494 4192 BE 9789266 3780 81306887 7139 6495 5 908 6.458 5.029 4.656 4327 N2 AN 26605759954 9885 31866 8 884 6. 814 56805197 4793 4439 1034810 666 9986 9894 8.856 6.424 5842 5.342 4633 14 18.00 1200 129505689.8999 295 81244 71067 6628 6002 5468 6 008 4.611 15 NI 886 849908118 BB0972 8.569 8811 6142 5.675 5.092 4676 18.0488 131590 12.402 0.810 7469 5.628 5929 4.870 25 22 00 9523140 SRO TERE 5.876 6467 4948 25 808 00396 600 11 292 7003 6.177 4.979 40 32.885 LT1068 2015 19793 10 05 6203 5540 4997 1596 71904 7606 14. BAB 11 140 10 5517 --- -- De arrows to see incorrect answers tal budgeting to decide whether the $9.5 million Stream Park Lodge expansion would be a good investment Reference Periods 3% 1.000 1% 1.000 2.010 3.030 4060 5.101 1 2 3 4 5 2% 1.000 2.020 3.060 4122 5.204 2.030 4% 1.000 2.040 3.122 4.246 5.416 14% 1.000 2.140 3.440 4.921 6.610 16% 1.000 2.160 3.506 5.066 6.877 12% 1.000 2.120 3.374 4.779 6.353 8.115 10.089 12.300 14.776 17.549 18% 1.000 2.180 3.572 5.215 7.154 20% 1.000 2.200 3.640 5.368 7.442 3.091 4.184 5.309 4.506 6 7 8 9 10 6.152 7.214 8.286 9.369 10.462 6.468 7.662 8.892 10.159 11.464 6.633 7.898 9.214 10.583 12.006 Future Value of Annuity of $1 5% 6% 8% 10% 1.000 1.000 1.000 1.000 2.050 2.060 2.080 2100 3.153 3.184 3.246 3.310 4.310 4.375 4.641 5.526 5.637 5.867 6.105 6.802 6.975 7.336 7.716 8.142 8.394 8.923 9.487 9.549 9.897 10.637 11.436 11.027 11.491 12.488 13.579 12.578 13.181 14487 15.937 14.207 14.972 16.645 18.531 15 917 16.870 18.977 21.384 17.713 18.882 21 405 24528 19.599 21.015 24 215 27.975 21.579 27.152 31.772 33.066 36.788 45.762 57.275 47727 54 865 73.106 98.347 66.439 79 058 113 283 164 494 120.800 269.057 442 593 20.655 11 12 6.308 7.434 8.583 9.755 10.950 12.169 13.412 14.680 15.974 17.293 24 297 32030 40.568 60402 11 567 12.683 13.809 14947 16.097 22.019 28 243 34 785 12.808 14 15.618 17.086 18.599 26.870 36459 47 575 75401 14 15 13.486 15.026 16.627 18.292 20.024 29.778 41 646 56.085 95026 8.536 10.730 13.233 16.085 19.337 23.045 27.271 32089 37581 43.842 91.025 181.871 356.787 1 342 028 8.977 9.442 9.930 11.414 12.142 12.916 14.240 15.327 16.499 17.519 19.086 20.799 21.321 23.521 25.959 25.733 28.755 32.150 30.850 34 931 39 581 36.786 42.219 48.497 43.672 50.818 69. 196 51.660 60.965 72035 115380 146.628 186 688 249 214 342 603 471.981 530 312 790 948 1.181.882 2.360 757 4 163 213 7343 868 24 133 28.029 32.393 37.280 72052 133 334 241 333 767 091 23276 20 30 154.762 Print Done ep on the red arrows to see incorrect answers Polision would be a good investment Reference Present Value of $1 e? WH 16% Periods 1 2 3 4 5 1% 0.990 0.980 0.971 0.961 0.951 2% 0.980 0.961 0.942 to the 3% 0.971 0.943 0.915 0.888 0 863 5% 0.952 0.907 0.864 0.823 0.784 10% 0.909 0.826 0.751 0.683 0.621 0924 0.906 6% 8% 0.943 0.926 0.890 0857 0.840 0.794 0.792 0.735 0.747 0.681 0.705 0630 0.665 0.583 0.627 0.640 0 5920.500 0.668 0.463 6 7 8 9 0.942 0.963 0.923 0.888 0871 0853 0.837 0.820 4% 0.962 10.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0 650 0526 0.837 0 818 0.789 0.768 0744 0.746 0.711 0.677 0.645 0.614 0.564 0513 0.467 0424 0386 ive 12% 14% 18% 20% 0.893 0.877 0.862 0.847 0.833 0.797 0.769 0.743 0.718 0.694 0.712 0.675 0.641 0.609 0.579 0.636 0.592 0.552 0.516 0.482 0.567 0519 0.476 0.437 0.402 0 507 | 0.456 0.410 0.370 0.335 0 452 0.400 0.354 0.314 0.279 0.404 0351 0.306 0.266 0.233 0.361 0.308 0.263 0.225 0322 0270 0 227 0 191 | 0 162 0.287 0.237 0196 0.162 0 257 0 208 0.768 0.137 0.112 0.229 0182 0 116 0125 0.099 0078 0183 0.108 0.0840065 0051 0.037 0.020 0 059 0038 0024 0020 000 0.004 0003 0.003 0.905 is the o 0.135 0.722 0.700 0.527 0.497 e dollar 12 13 0.896 0.887 0.879 0 870 0.804 0788 0.773 0758 0743 0.686 0 557 0 530 0429 0.397 0.368 0.360 0319 0.290 15 0239 0572 0555 0.458 0.375 20 26 30 0554 0.478 0673 0610 0552 0820 0780 0742 0672 0 3770312 0 295 0233 0 281 0215 0146 0 099 0046 0 149 0 092 0 057 of the pro 0 308 0 200 0.097 Print Done ered arrows to see incorrect answers al budgeting to decide whether the $9.5 million Stream Park Lodge expansion would be a good investment Reference - X Future Value of $1 5% 1.050 Periods 1 2 3 4 5 1.010 1.020 1.030 1.041 1.051 2% 1.020 1.040 1.061 1.082 1.104 3% 1.030 1.061 1.093 1.126 4% 1.040 1.082 1.125 1.170 1.103 1.158 8% 1.080 1.166 1.260 1.360 1.469 14% 1.140 1.300 1 482 1.689 1.925 16% 1.160 1.346 1.561 1.811 2100 1.216 1.159 1.217 1.276 6 1.194 1.230 1.265 1.316 1.062 1.072 1.083 1 094 1.105 1.126 1.149 1.172 1.195 1.219 2. 195 2502 1267 1.369 12% 1.120 1.254 1405 1.574 1.762 1.974 2211 2476 2773 3.106 3.479 3.896 4 363 4.887 1.587 1.714 1.851 1.999 2.159 10% 1.100 1.210 1.331 1.464 1.611 1.772 1.949 2.144 2.358 2.594 2853 3.138 3.452 3.797 4 177 2853 6% 1.060 1.124 1.191 1.262 1.338 1.419 1.504 1.594 1.689 1.791 1.898 2012 2.133 2.261 2.397 3207 4292 6743 10 286 2436 2826 3.278 3.803 1.305 1.344 11 1.116 18% 20% 1.180 1 200 1.392 1.440 1.643 1.728 1.939 2074 2.288 2488 2700 2986 3.185 3583 3.759 4300 4.435 5160 5.234 6.192 6176 7430 7288 8916 8599 10.699 10 147 12339 11 974 27393 38.358 82.689 95 398 1.340 1407 1.477 1.551 1.629 1.710 1.796 1.886 1980 2.079 2653 3388 4322 1.384 1426 2332 1.127 1.423 1.480 1.539 1.601 1 666 1.732 1 801 2191 2650 3243 1.243 1.268 1 294 1.319 1 346 1 138 2518 2.720 2.937 3.172 3.252 3.707 4226 4818 5492 6.261 7138 13743 25462 50 950 183 334 1.513 1558 6 117 5.936 6.885 7988 9268 19451 1.161 1220 1282 1480 1806 2094 2427 3252 4661 6848 10.053 21725 6.727 10 835 1220 9846 1000 29 980 93051 35 352 378721 2208 Done on the red arrows to see incorrect answersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started