Answered step by step

Verified Expert Solution

Question

1 Approved Answer

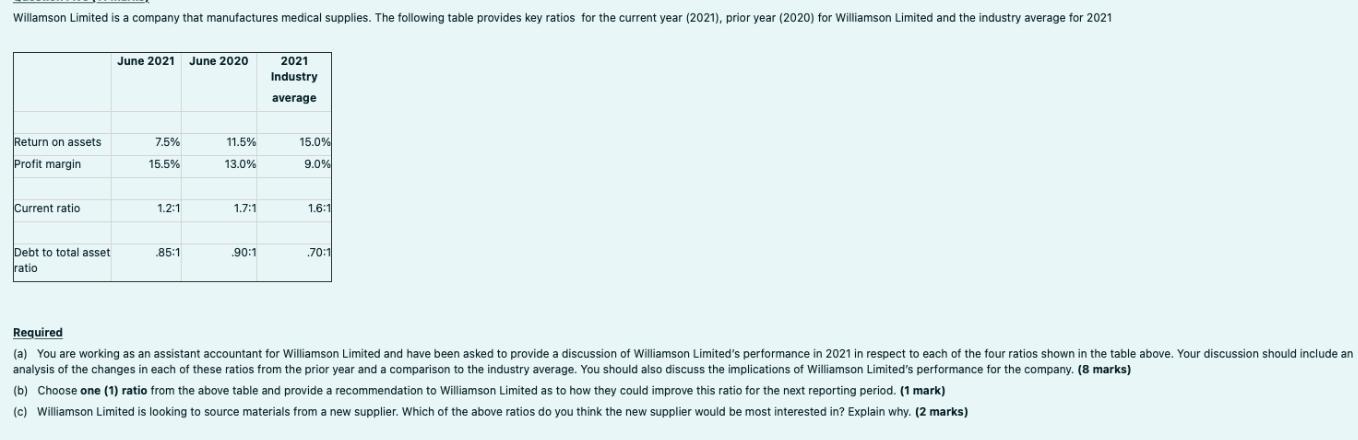

Willamson Limited is a company that manufactures medical supplies. The following table provides key ratios for the current year (2021), prior year (2020) for

Willamson Limited is a company that manufactures medical supplies. The following table provides key ratios for the current year (2021), prior year (2020) for Williamson Limited and the industry average for 2021 Return on assets Profit margin Current ratio Debt to total asset ratio June 2021 June 2020 7.5% 15.5% 1.2:1 .85:1 11.5% 13.0% 1.7:1 .90:1 2021 Industry average 15.0% 9.0% 1.6:1 .70:1 Required (a) You are working as an assistant accountant for Williamson Limited and have been asked to provide a discussion of Williamson Limited's performance in 2021 in respect to each of the four ratios shown in the table above. Your discussion should include an analysis of the changes in each of these ratios from the prior year and a comparison to the industry average. You should also discuss the implications of Williamson Limited's performance for the company. (8 marks) (b) Choose one (1) ratio from the above table and provide a recommendation to Williamson Limited as to how they could improve this ratio for the next reporting period. (1 mark) (c) Williamson Limited is looking to source materials from a new supplier. Which of the above ratios do you think the new supplier would be most interested in? Explain why. (2 marks)

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Discussion on the ratios of Williamson Limited Return on assets ratio o It is measured as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started