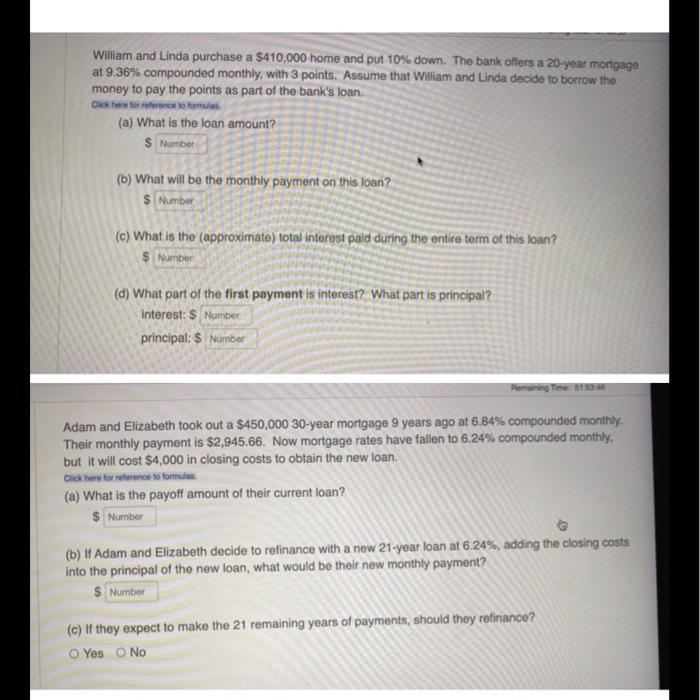

William and Linda purchase a $410,000 home and put 10% down. The bank offers a 20-year mortgage at 9.36% compounded monthly, with 3 points. Assume that William and Linda decide to borrow the money to pay the points as part of the bank's loan. Click here for reference to formulas (a) What is the loan amount? $ Number (b) What will be the monthly payment on this loan? $ Number (c) What is the (approximate) total interest paid during the entire term of this loan? $ Number (d) What part of the first payment is interest? What part is principal? interest: $ Number principal: $ Number Pemaining Time 5153 Adam and Elizabeth took out a $450,000 30-year mortgage 9 years ago at 6.84% compounded monthly. Their monthly payment is $2,945.66. Now mortgage rates have fallen to 6.24% compounded monthly but it will cost $4,000 in closing costs to obtain the new loan. Click here for reference to formulas (a) What is the payoff amount of their current loan? $ Number (b) If Adam and Elizabeth decide to refinance with a new 21-year loan at 6.24%, adding the closing costs into the principal of the new loan, what would be their new monthly payment? $ Number (c) If they expect to make the 21 remaining years of payments, should they refinance? o Yes No William and Linda purchase a $410,000 home and put 10% down. The bank offers a 20-year mortgage at 9.36% compounded monthly, with 3 points. Assume that William and Linda decide to borrow the money to pay the points as part of the bank's loan. Click here for reference to formulas (a) What is the loan amount? $ Number (b) What will be the monthly payment on this loan? $ Number (c) What is the (approximate) total interest paid during the entire term of this loan? $ Number (d) What part of the first payment is interest? What part is principal? interest: $ Number principal: $ Number Pemaining Time 5153 Adam and Elizabeth took out a $450,000 30-year mortgage 9 years ago at 6.84% compounded monthly. Their monthly payment is $2,945.66. Now mortgage rates have fallen to 6.24% compounded monthly but it will cost $4,000 in closing costs to obtain the new loan. Click here for reference to formulas (a) What is the payoff amount of their current loan? $ Number (b) If Adam and Elizabeth decide to refinance with a new 21-year loan at 6.24%, adding the closing costs into the principal of the new loan, what would be their new monthly payment? $ Number (c) If they expect to make the 21 remaining years of payments, should they refinance? o Yes No