Answered step by step

Verified Expert Solution

Question

1 Approved Answer

William wants to retire at the end of this year (2020). His life expectancy is 20 years from his retirement. William has come to you,

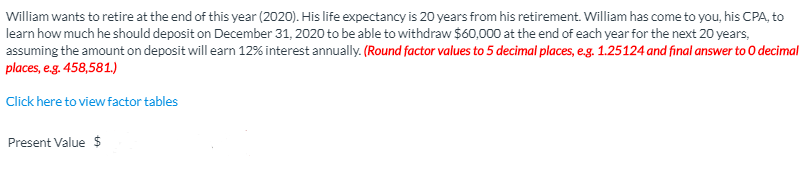

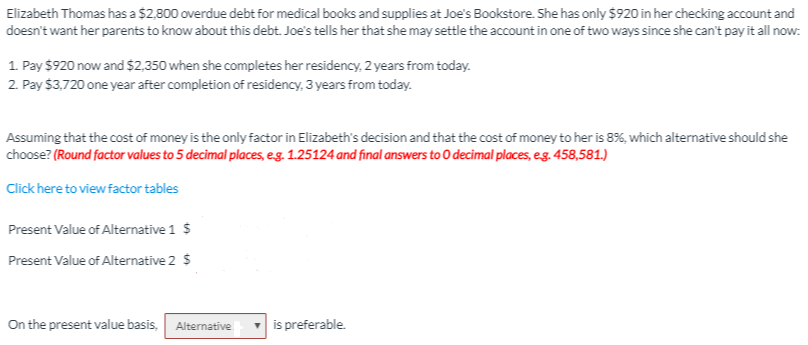

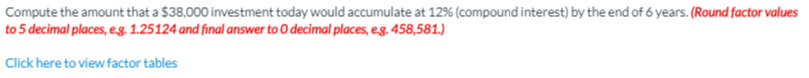

William wants to retire at the end of this year (2020). His life expectancy is 20 years from his retirement. William has come to you, his CPA, to learn how much he should deposit on December 31, 2020 to be able to withdraw $60,000 at the end of each year for the next 20 years, assuming the amount on deposit will earn 12% interest annually. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) Click here to view factor tables Present Value $ Elizabeth Thomas has a $2,800 overdue debt for medical books and supplies at Joe's Bookstore. She has only $920 in her checking account and doesn't want her parents to know about this debt. Joe's tells her that she may settle the account in one of two ways since she can't pay it all now: 1. Pay $920 now and $2,350 when she completes her residency 2 years from today. 2. Pay $3,720 one year after completion of residency, 3 years from today. Assuming that the cost of money is the only factor in Elizabeth's decision and that the cost of money to her is 8%, which alternative should she choose? (Round factor values to 5 decimal places, eg. 1.25124 and final answers to decimal places, eg. 458,581.) Click here to view factor tables Present Value of Alternative 1 $ Present Value of Alternative 2 5 On the present value basis. Alternative is preferable. Compute the amount that a $38,000 investment today would accumulate at 12% (compound interest) by the end of 6 years.(Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Click here to view factor tables

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started