Answered step by step

Verified Expert Solution

Question

1 Approved Answer

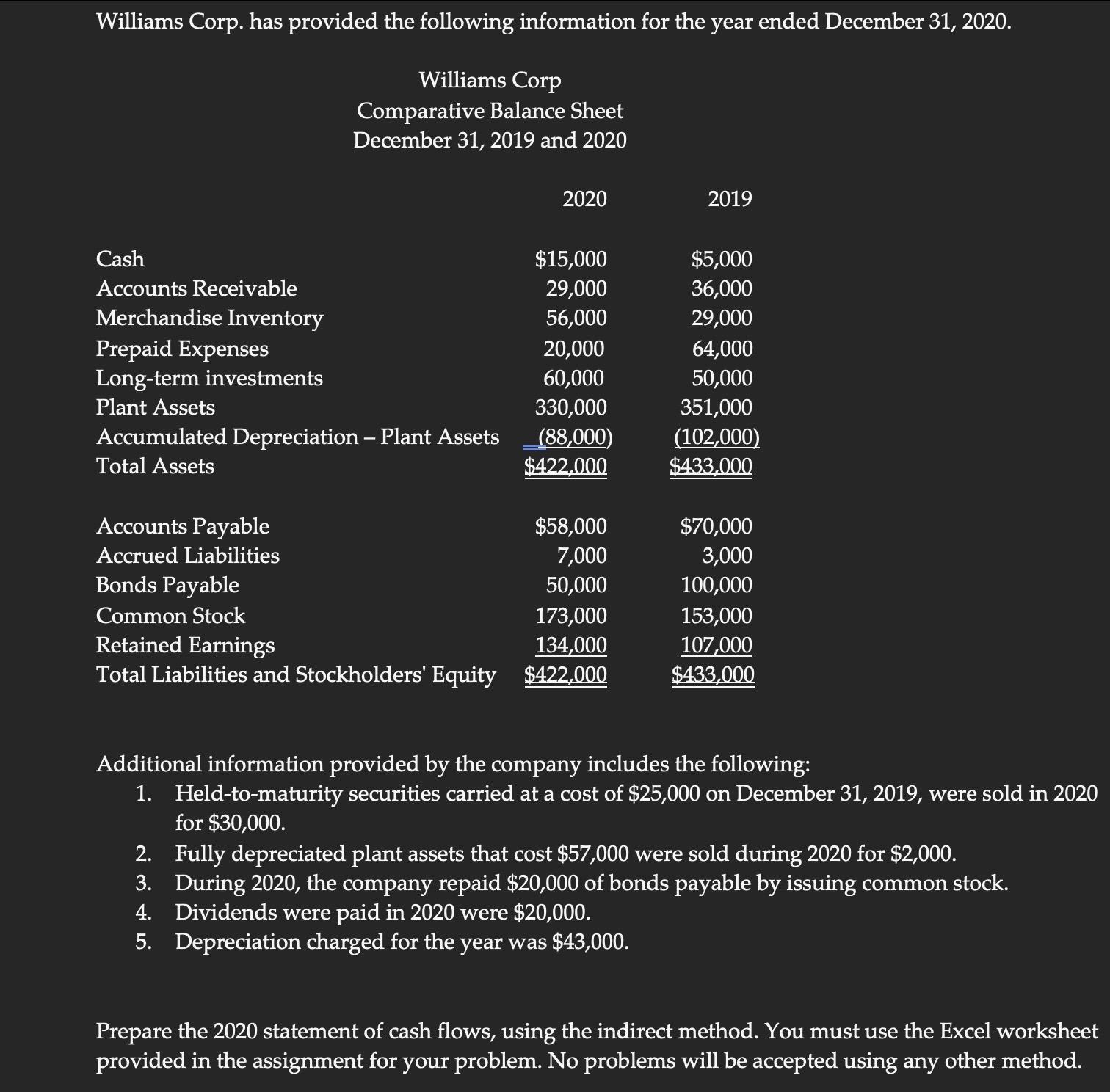

Williams Corp. has provided the following information for the year ended December 31, 2020. Williams Corp Comparative Balance Sheet December 31, 2019 and 2020

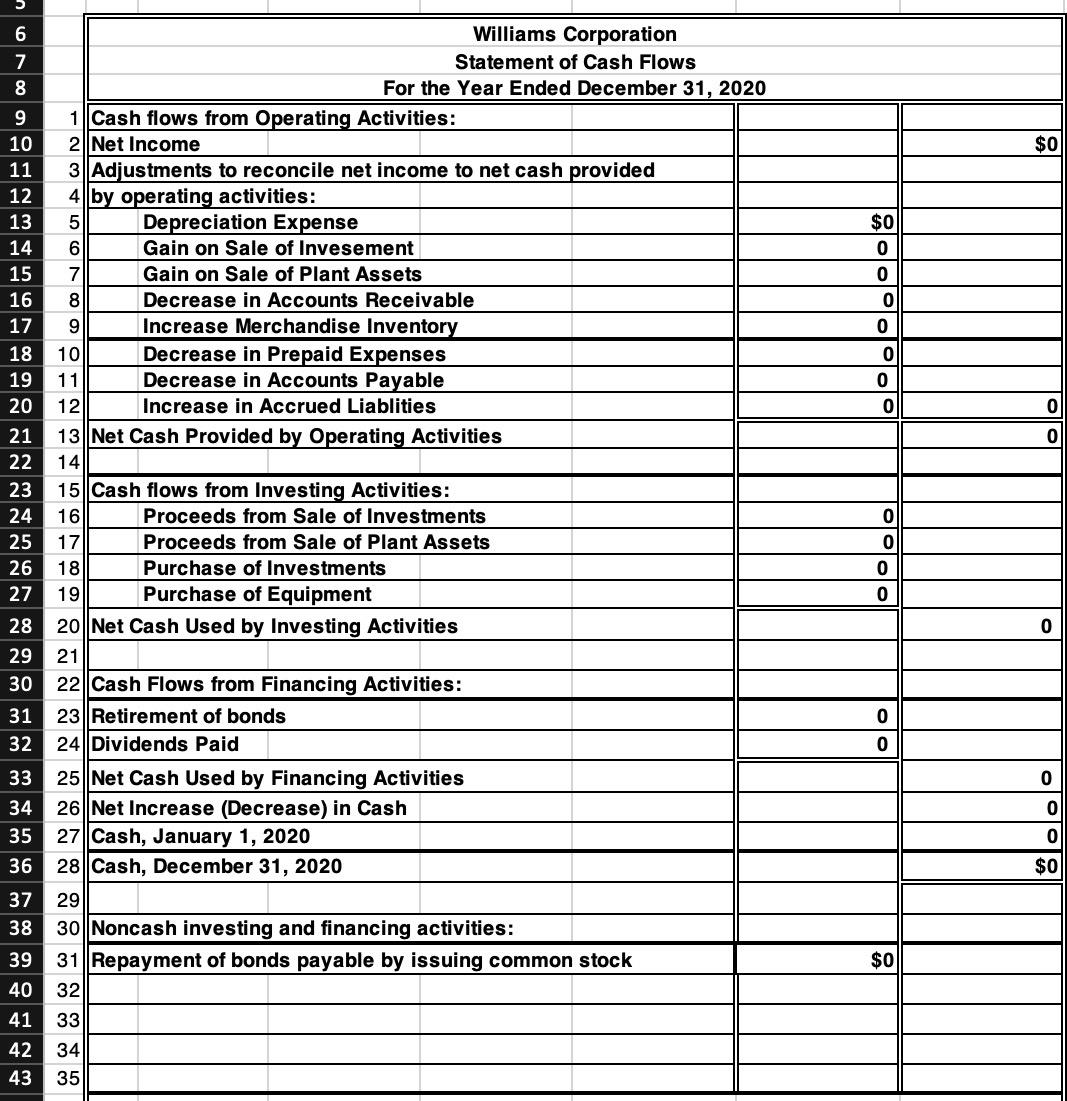

Williams Corp. has provided the following information for the year ended December 31, 2020. Williams Corp Comparative Balance Sheet December 31, 2019 and 2020 Cash Accounts Receivable Merchandise Inventory Prepaid Expenses Long-term investments Plant Assets Accumulated Depreciation - Plant Assets Total Assets Accounts Payable Accrued Liabilities Bonds Payable 2020 Common Stock Retained Earnings $15,000 29,000 56,000 $58,000 7,000 50,000 173,000 134,000 Total Liabilities and Stockholders' Equity $422,000 20,000 60,000 330,000 (88,000) $422,000 2019 $5,000 36,000 29,000 64,000 50,000 351,000 (102,000) $433,000 $70,000 3,000 100,000 153,000 107,000 $433,000 Additional information provided by the company includes the following: 1. Held-to-maturity securities carried at a cost of $25,000 on December 31, 2019, were sold in 2020 for $30,000. 2. Fully depreciated plant assets that cost $57,000 were sold during 2020 for $2,000. 3. During 2020, the company repaid $20,000 of bonds payable by issuing common stock. 4. Dividends were paid in 2020 were $20,000. 5. Depreciation charged for the year was $43,000. Prepare the 2020 statement of cash flows, using the indirect method. You must use the Excel worksheet provided in the assignment for your problem. No problems will be accepted using any other method. 56789 10 11 12 13 14 15 7 16 8 17 9 18 10 19 11 20 12 1 Cash flows from Operating Activities: 2 Net Income 456 Williams Corporation Statement of Cash Flows For the Year Ended December 31, 2020 3 Adjustments to reconcile net income to net cash provided 4 by operating activities: Depreciation Expense Gain on Sale of Invesement Gain on Sale of Plant Assets Decrease in Accounts Receivable Increase Merchandise Inventory Decrease in Prepaid Expenses Decrease in Accounts Payable Increase in Accrued Liablities 21 13 Net Cash Provided by Operating Activities 22 14 23 15 Cash flows from Investing Activities: 24 16 25 17 26 18 27 19 Proceeds from Sale of Investments Proceeds from Sale of Plant Assets Purchase of Investments Purchase of Equipment 20 |Net Cash Used by Investing Activities 31 23 Retirement of bonds 32 24 Dividends Paid 28 29 21 30 22 Cash Flows from Financing Activities: 33 25 Net Cash Used by Financing Activities 34 26 Net Increase (Decrease) in Cash 35 27 Cash, January 1, 2020 36 28 Cash, December 31, 2020 37 29 38 30 Noncash investing and financing activities: 39 31 Repayment of bonds payable by issuing common stock 40 32 41 33 42 34 43 35 $0 0 0 0 0 0 0 0 0 0 0 0 0 0 $0 $0 0 0 0 OOOO 0 0 0 $0

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Prepare the operating activities section Start with net income 134000 Retained Earnings 2020 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started