Answered step by step

Verified Expert Solution

Question

1 Approved Answer

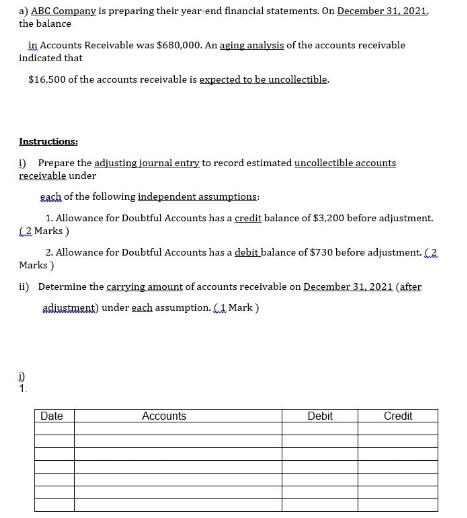

a) ABC Company is preparing their year end financial statements. On December 31, 2021, the balance in Accounts Receivable was $680,000. An aging analysis

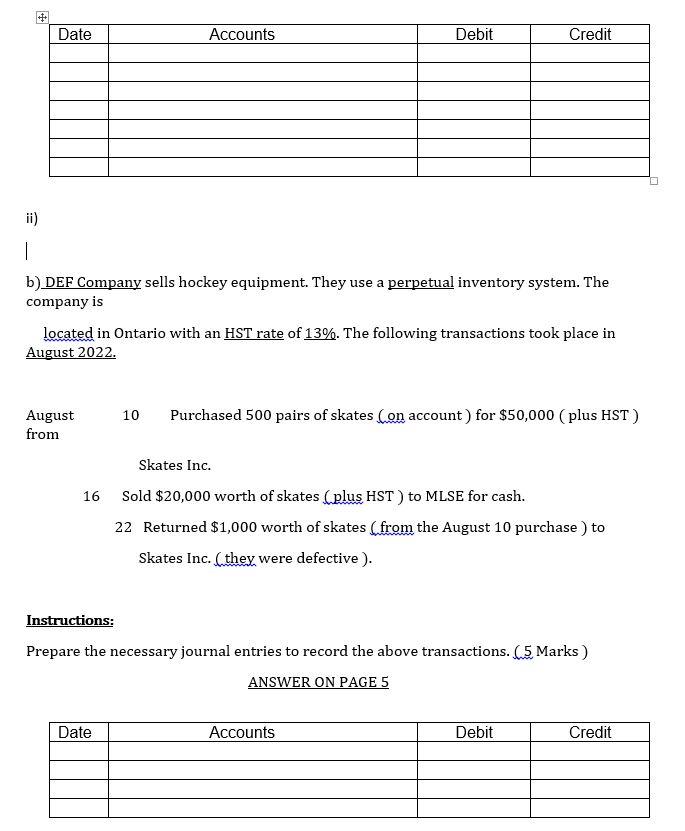

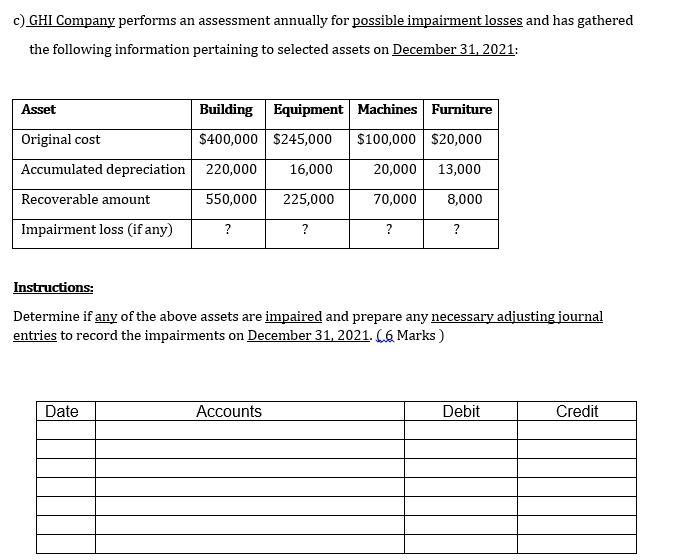

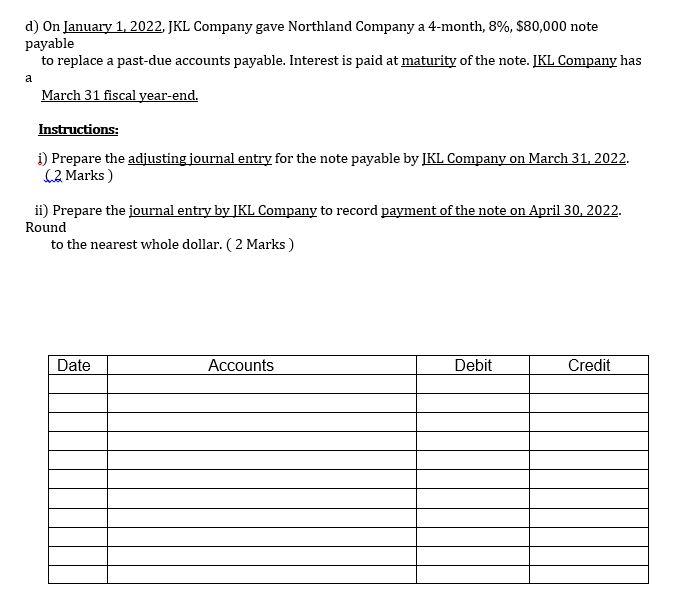

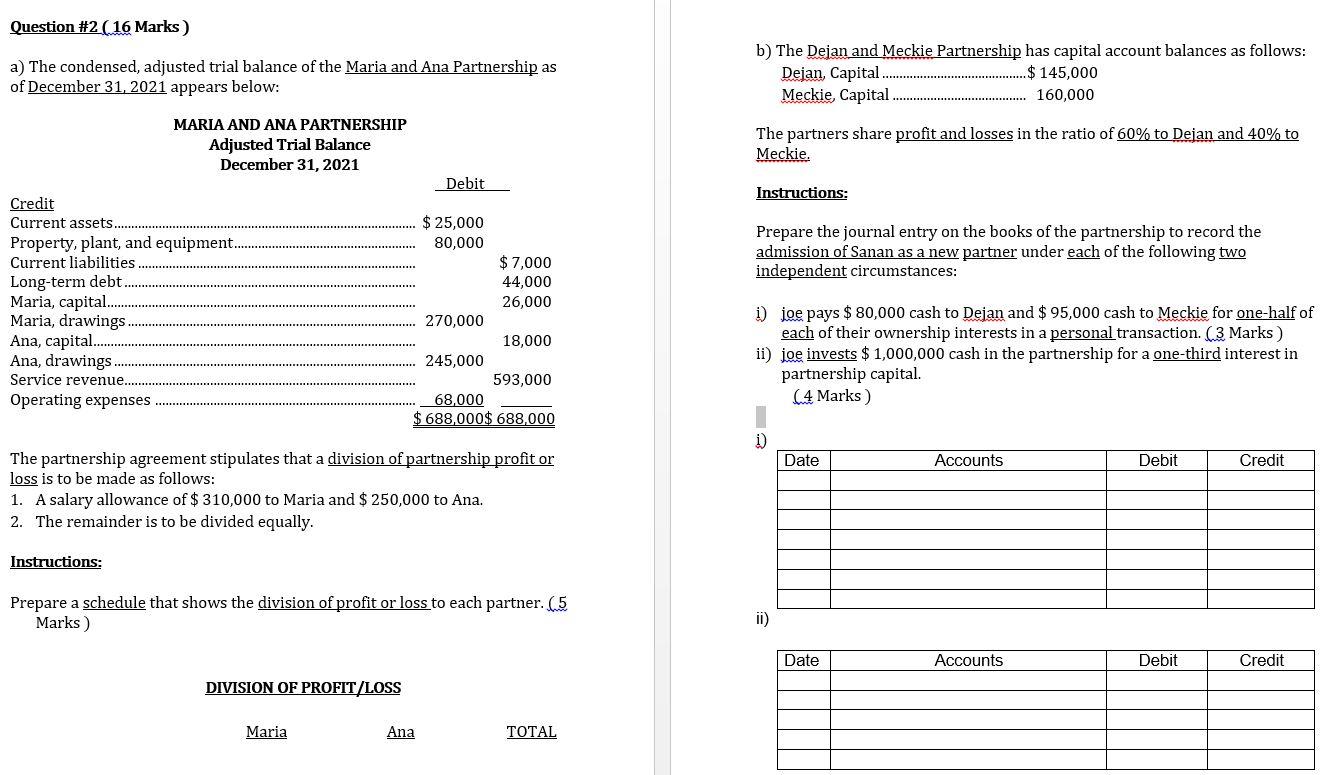

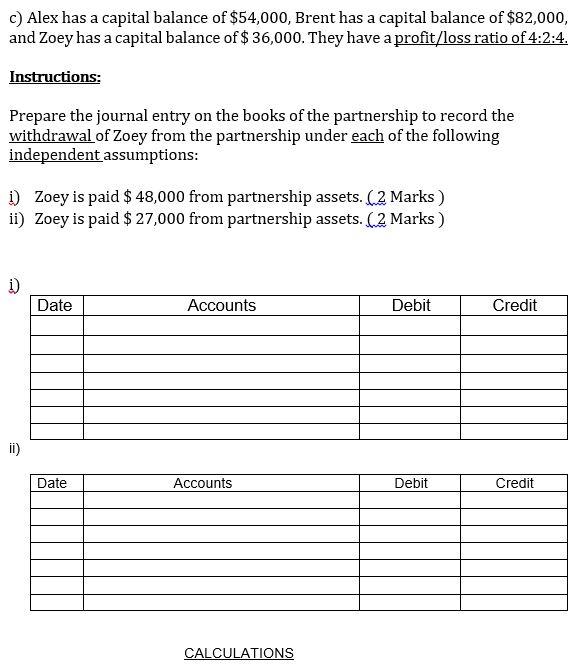

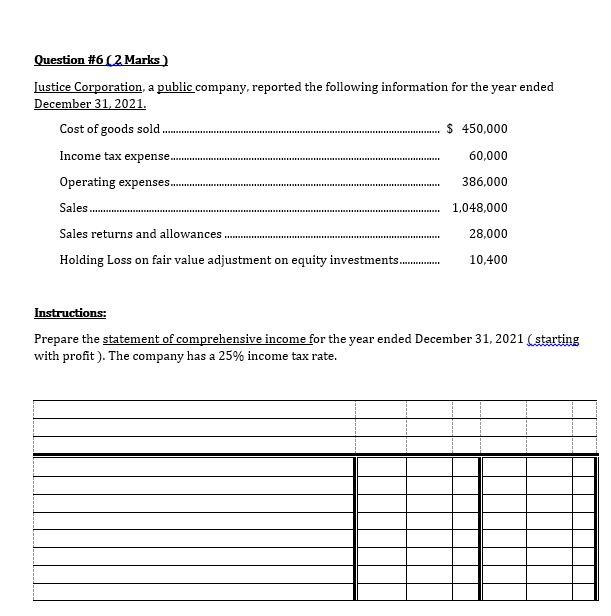

a) ABC Company is preparing their year end financial statements. On December 31, 2021, the balance in Accounts Receivable was $680,000. An aging analysis of the accounts receivable indicated that $16,500 of the accounts receivable is expected to be uncollectible. Instructions: 1) Prepare the adjusting journal entry to record estimated uncollectible accounts receivable under each of the following independent assumptions: 1. Allowance for Doubtful Accounts has a credit balance of $3,200 before adjustment. (2 Marks) 2. Allowance for Doubtful Accounts has a debit balance of $730 before adjustment. Marks) ii) Determine the carrying amount of accounts receivable on December 31, 2021 (after asliustment) under each assumption. (Mark) D 1. Date Accounts Debit Credit +++ Date August from Accounts | b) DEF Company sells hockey equipment. They use a perpetual inventory system. The company is 16 located in Ontario with an HST rate of 13%. The following transactions took place in August 2022. Date Debit Skates Inc. Credit 10 Purchased 500 pairs of skates (on account) for $50,000 (plus HST) Sold $20,000 worth of skates (plus HST) to MLSE for cash. 22 Returned $1,000 worth of skates (from the August 10 purchase) to Skates Inc. (they were defective). Instructions: Prepare the necessary journal entries to record the above transactions. (5 Marks) ANSWER ON PAGE 5 Accounts Debit Credit c) GHI Company performs an assessment annually for possible impairment losses and has gathered the following information pertaining to selected assets on December 31, 2021: Asset Building Equipment Machines Furniture Original cost $400,000 $245,000 $100,000 $20,000 Accumulated depreciation 220,000 16,000 20,000 13,000 Recoverable amount 550,000 225,000 70,000 8,000 Impairment loss (if any) ? ? Date ? Instructions: Determine if any of the above assets are impaired and prepare any necessary adjusting journal entries to record the impairments on December 31, 2021. (6 Marks) Accounts ? Debit Credit d) On January 1, 2022, JKL Company gave Northland Company a 4-month, 8%, $80,000 note payable to replace a past-due accounts payable. Interest is paid at maturity of the note. IKL Company has March 31 fiscal year-end. a Instructions: i) Prepare the adjusting journal entry for the note payable by JKL Company on March 31, 2022. (2 Marks) ii) Prepare the journal entry by JKL Company to record payment of the note on April 30, 2022. Round to the nearest whole dollar. (2 Marks) Date Accounts Debit Credit Question #2 (16 Marks) a) The condensed, adjusted trial balance of the Maria and Ana Partnership as of December 31, 2021 appears below: Credit Current assets. Property, plant, and equipment... Current liabilities Long-term debt. Maria, capital.. Maria, drawings Ana, capital... Ana, drawings.. Service revenue.. Operating expenses MARIA AND ANA PARTNERSHIP Adjusted Trial Balance December 31, 2021 Instructions: Debit DIVISION OF PROFIT/LOSS $ 25,000 80,000 Maria 270,000 1. A salary allowance of $ 310,000 to Maria and $ 250,000 to Ana. 2. The remainder is to be divided equally. 245,000 Ana The partnership agreement stipulates that a division of partnership profit or loss is to be made as follows: $ 7,000 44,000 26,000 18,000 68,000 $688,000$ 688,000 593,000 Prepare a schedule that shows the division of profit or loss to each partner. (5 Marks) TOTAL b) The Dejan and Meckie Partnership has capital account balances as follows: Dejan, Capital. $145,000 Meckie, Capital................... 160,000 The partners share profit and losses in the ratio of 60% to Dejan and 40% to Meckie. Instructions: Prepare the journal entry on the books of the partnership to record the admission of Sanan as a new partner under each of the following two independent circumstances: i) joe pays $ 80,000 cash to Dejan and $ 95,000 cash to Meckie for one-half of each of their ownership interests in a personal transaction. (3 Marks) ii) joe invests $1,000,000 cash in the partnership for a one-third interest in partnership capital. (4 Marks) i) ii) Date Date Accounts Accounts Debit Debit Credit Credit c) Alex has a capital balance of $54,000, Brent has a capital balance of $82,000, and Zoey has a capital balance of $ 36,000. They have a profit/loss ratio of 4:2:4. Instructions: Prepare the journal entry on the books of the partnership to record the withdrawal of Zoey from the partnership under each of the following independent assumptions: i) Zoey is paid $ 48,000 from partnership assets. (2 Marks) ii) Zoey is paid $ 27,000 from partnership assets. (2 Marks) i) ii) Date Date Accounts Accounts CALCULATIONS Debit Debit Credit Credit Question #6 (2 Marks Justice Corporation, a public company, reported the following information for the year ended December 31, 2021. Cost of goods sold. Income tax expense. Operating expenses. Sales Sales returns and allowances. Holding Loss on fair value adjustment on equity investments.. ***** $ 450,000 60,000 386,000 1,048,000 28,000 10,400 Instructions: Prepare the statement of comprehensive income for the year ended December 31, 2021 (starting with profit ). The company has a 25% income tax rate.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started