Answered step by step

Verified Expert Solution

Question

1 Approved Answer

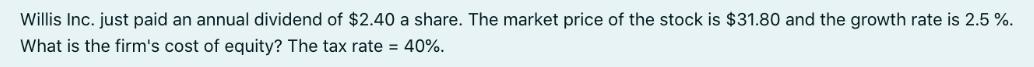

Willis Inc. just paid an annual dividend of $2.40 a share. The market price of the stock is $31.80 and the growth rate is

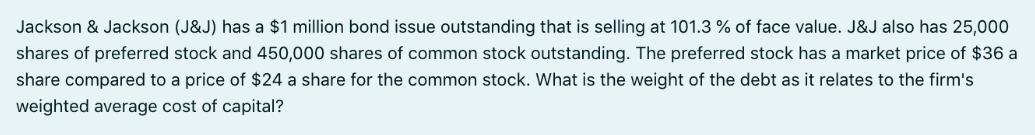

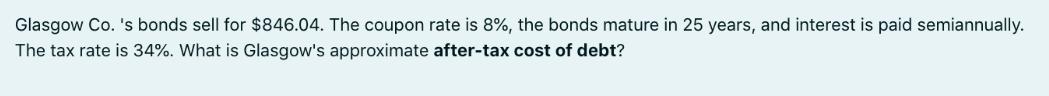

Willis Inc. just paid an annual dividend of $2.40 a share. The market price of the stock is $31.80 and the growth rate is 2.5 %. What is the firm's cost of equity? The tax rate = 40%. Jackson & Jackson (J&J) has a $1 million bond issue outstanding that is selling at 101.3 % of face value. J&J also has 25,000 shares of preferred stock and 450,000 shares of common stock outstanding. The preferred stock has a market price of $36 a share compared to a price of $24 a share for the common stock. What is the weight of the debt as it relates to the firm's weighted average cost of capital? Glasgow Co.'s bonds sell for $846.04. The coupon rate is 8%, the bonds mature in 25 years, and interest is paid semiannually. The tax rate is 34%. What is Glasgow's approximate after-tax cost of debt?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Define variables D1 Next years dividend we know the current dividend is 240 so D1 240 1 growth rate P0 Current market price of the stock 3180 g Growth ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started