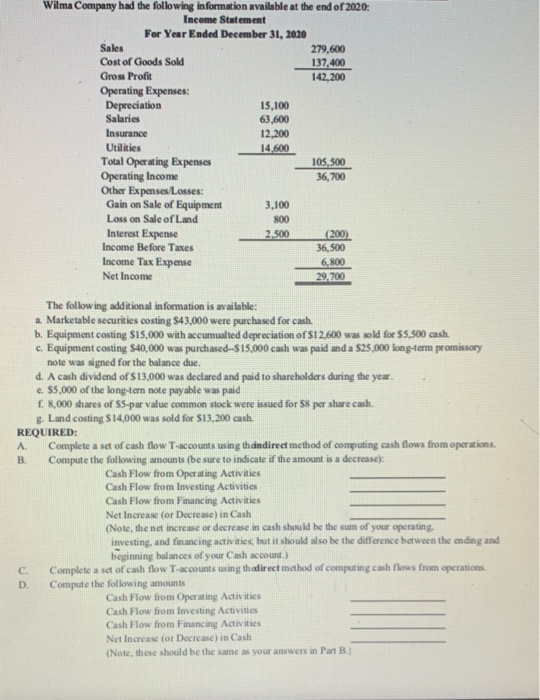

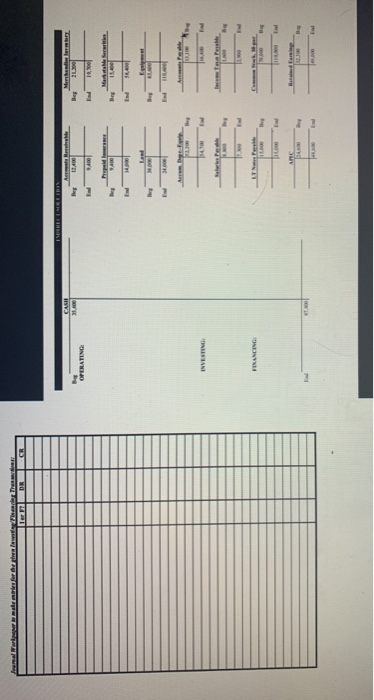

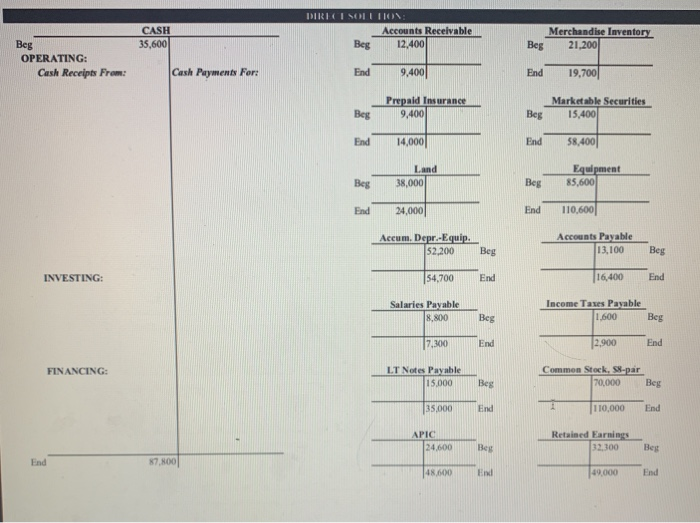

Wilma Company had the following information available at the end of 2020: Income Statement For Year Ended December 31, 2020 Sales 279,600 Cost of Goods Sold 137,400 Gross Profit 142,200 Operating Expenses: Depreciation 15.100 Salaries 63.600 Insurance 12,200 Utilities 14.600 Total Operating Expenses 105,500 Operating Income 36,700 Other Expenses Losses: Gain on Sale of Equipment 3.100 Loss on Sale of Land 800 Interest Expense 2.500 (200) Income Before Taxes 36,500 Income Tax Expense 6,800 Net Income 29,700 The following additional information is available: a Marketable securities costing S43,000 were purchased for cash. b. Equipment casting S15,000 with accumuulted depreciation of $12,600 was sold for $5.500 cash c. Equipment costing $40,000 was purchased--S15.000 cash was paid and a $25,000 long-term promissory note was signed for the balance due d. A cash dividend of S13,000 was declared and paid to shareholders during the year. e. $5,000 of the long-term note payable was paid f. 8,000 shares of SS-par value common stock were issued for Sper share cash. . Land costing $14,000 was sold for $13,200 cash. REQUIRED: A Complete a set of cash flow T-accounts using theindirect method of computing cash flows from operations. B Compute the following amounts (be sure to indicate if the amount is a decrease): Cash Flow from Operating Activities Cash Flow from Investing Activities Cash Flow from Financing Activities Net Increase (or Decrease) in Cash (Note, the net increase or decrease in cash should be the sum of your operating, investing, and financing activities, but it should also be the difference between the ending and beginning balances of your Cash account.) C Complete a set of cash flow T-accounts using thadirect method of computing cash flows from operations D Compute the following amounts Cash Flow from Operating Activities Cash Flow from Investing Activities Cash Flow from Financing Activities Net Increase for Decrease) in Cash (Note, these should be the same as your answers in Part 1 Nefer CASH AR DADO Beg 21.30 OPERATING 400 1,700 Mare Serre WA 1.00 Law leg INVESTIN 4 Here FINANCING CASH 35,600 DIRECT SOLUTION Accounts Receivable Beg 12,400 Merchandise Inventory Beg 21,200 Beg OPERATING: Cash Receipts From: Cash Payments For: End 9,400 End 19,700 Prepaid Insurance 9,400 Marketable Securities 15.400 Beg Beg End 14,000 End 58,400 Land 38,000 Equipment 85,600 Beg Beg End 24,000 End 110.600 Accum. Depr.-Equip 52,200 Accounts Payable 13,100 Beg Beg INVESTING: 54,700 End 16,400 End Salaries Payable 8.800 Income Taxes Payable 1.600 Beg Beg 7,300 End 2,900 End FINANCING: LT Notes Payable 15,000 Common Stock, S8-par 70,000 Beg Beg 35.000 End 110,000 End APIC 24600 Retained Earnings 32,300 Beg End 87,800 48.600 End End