Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wilson Aviation You have read the Wilson Aviation case. Now, please answer questions in the case using the Excel template below. The template already contains

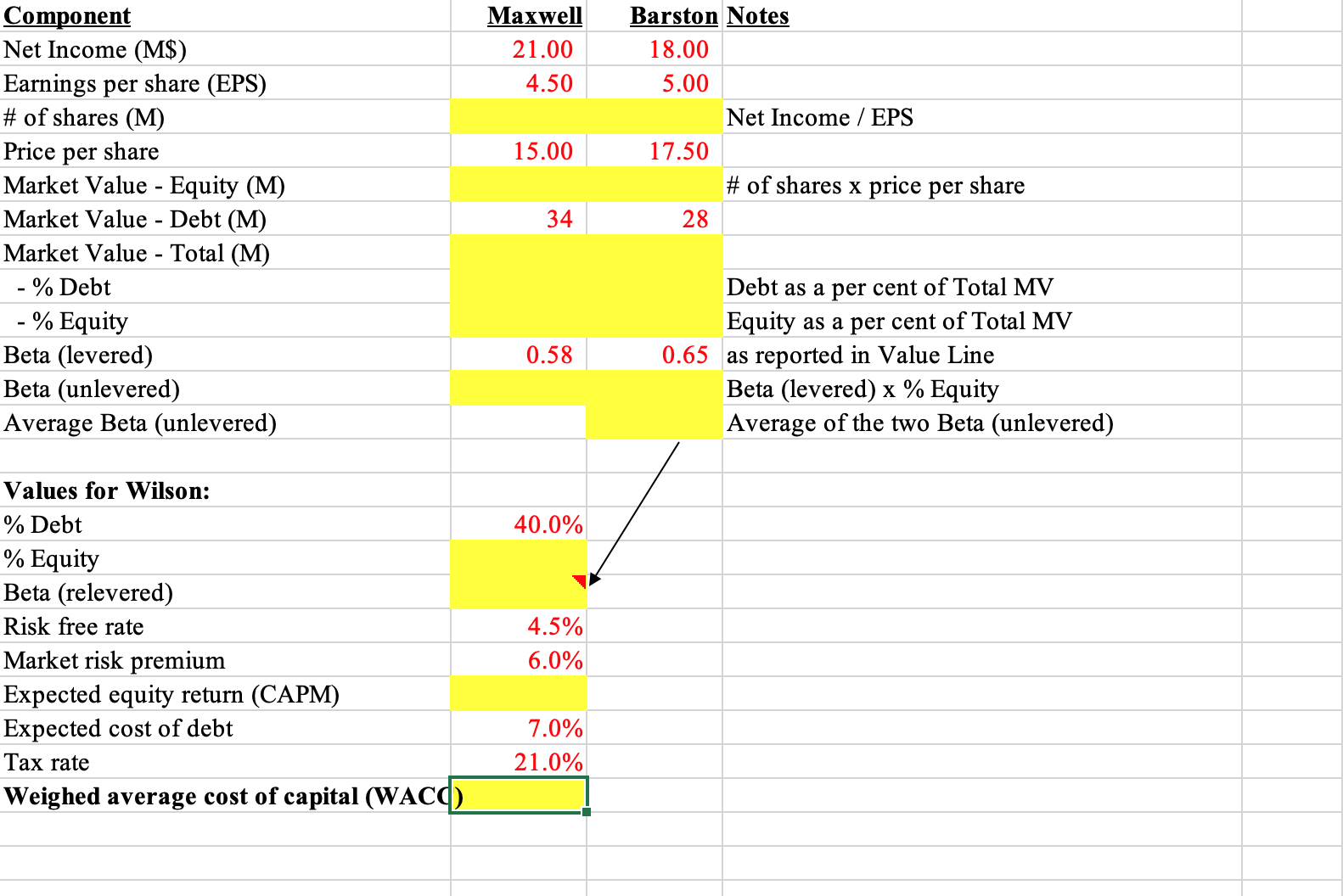

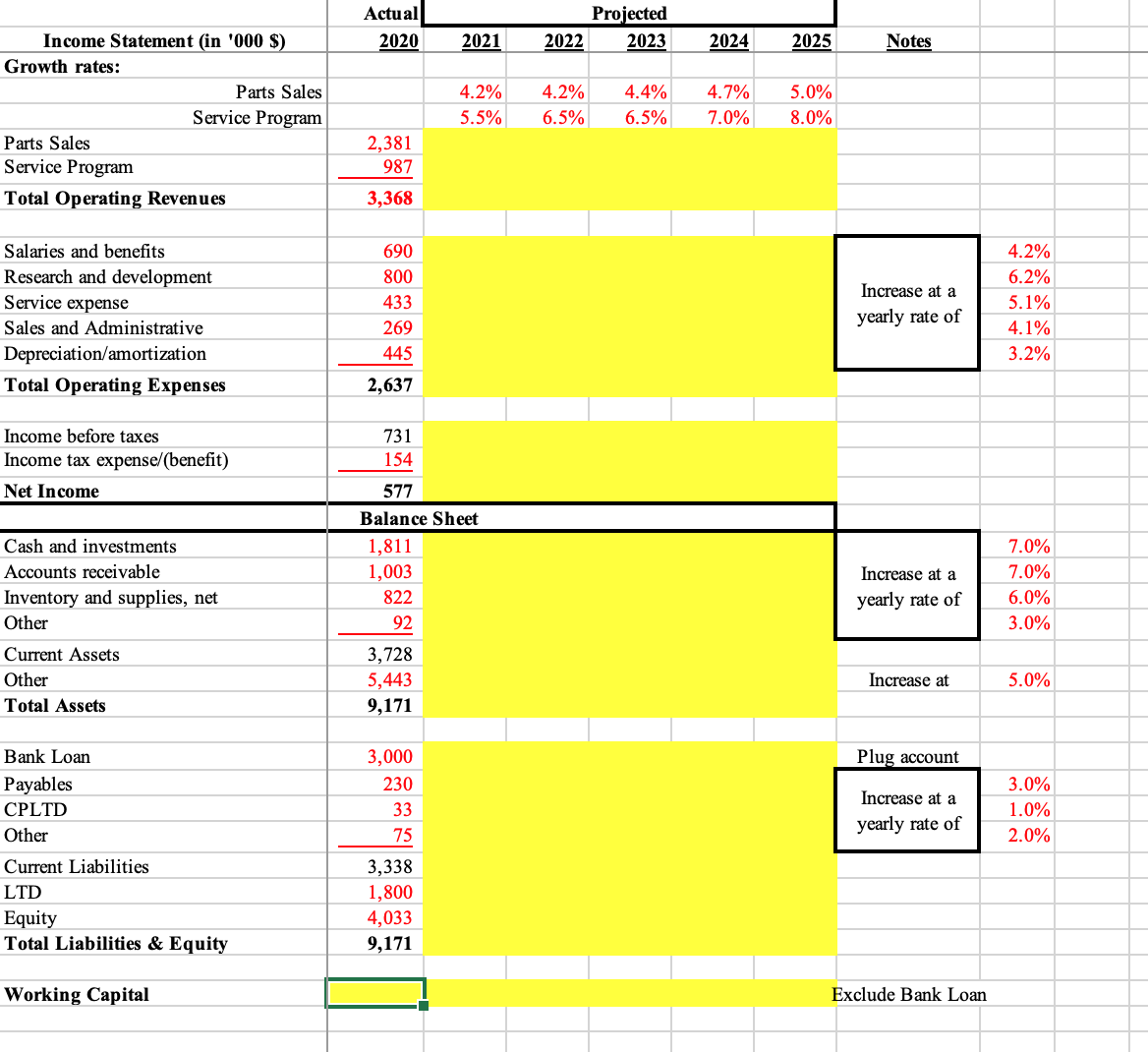

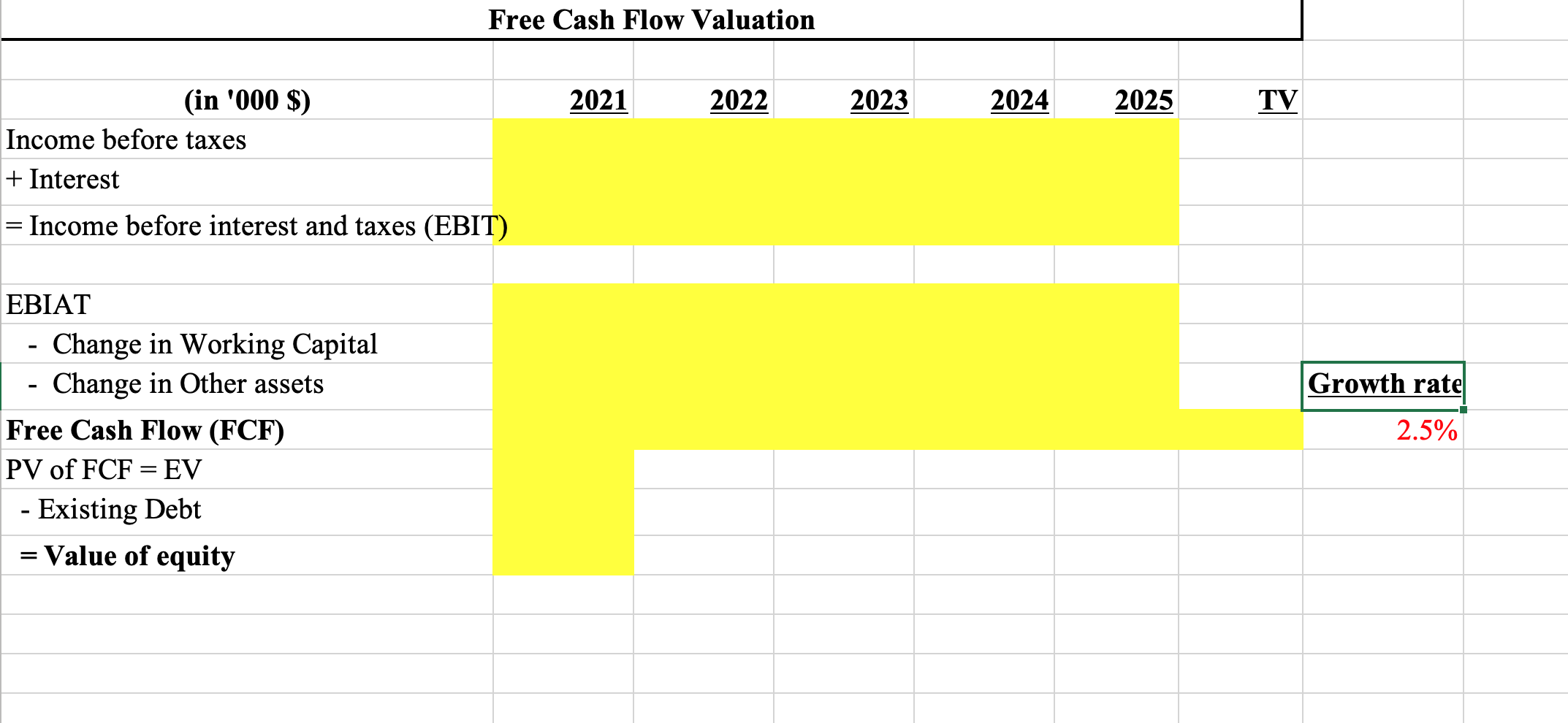

Wilson Aviation You have read the Wilson Aviation case. Now, please answer questions in the case using the Excel template below. The template already contains all the data you need to complete your work. [ Submission If you need help with Excel, explore the resources on the Excel Video Tutorial page. Save your Excel spreadsheet using a naming convention that includes your first and last name and the activity number (or description). Do not add punctuation or special characters. Component Net Income (M\$) Earnings per share (EPS) \# of shares (M) Net Income / EPS Price per share Market Value - Equity (M) \# of shares x price per share Market Value - Debt (M) 28 Market Value - Total (M) - \% Debt Debt as a per cent of Total MV - \% Equity Equity as a per cent of Total MV Beta (levered) 0.580.65 as reported in Value Line Beta (unlevered) Beta (levered) x \% Equity Average Beta (unlevered) Average of the two Beta (unlevered) Values for Wilson: % Debt % Equity Beta (relevered) Risk free rate Market risk premium 4.5% Expected equity return (CAPM) \begin{tabular}{l|l|} Expected cost of debt & 7.0% \\ \hline \end{tabular} \begin{tabular}{ll} Tax rate & 21.0% \\ \hline \end{tabular} Weighed average cost of capital (WACC) Free Cash Flow Valuation Income before taxes + Interest = Income before interest and taxes (EBIT) EBIAT - Change in Working Capital - Change in Other assets Free Cash Flow (FCF) PV of FCF=EV - Existing Debt = Value of equity Wilson Aviation You have read the Wilson Aviation case. Now, please answer questions in the case using the Excel template below. The template already contains all the data you need to complete your work. [ Submission If you need help with Excel, explore the resources on the Excel Video Tutorial page. Save your Excel spreadsheet using a naming convention that includes your first and last name and the activity number (or description). Do not add punctuation or special characters. Component Net Income (M\$) Earnings per share (EPS) \# of shares (M) Net Income / EPS Price per share Market Value - Equity (M) \# of shares x price per share Market Value - Debt (M) 28 Market Value - Total (M) - \% Debt Debt as a per cent of Total MV - \% Equity Equity as a per cent of Total MV Beta (levered) 0.580.65 as reported in Value Line Beta (unlevered) Beta (levered) x \% Equity Average Beta (unlevered) Average of the two Beta (unlevered) Values for Wilson: % Debt % Equity Beta (relevered) Risk free rate Market risk premium 4.5% Expected equity return (CAPM) \begin{tabular}{l|l|} Expected cost of debt & 7.0% \\ \hline \end{tabular} \begin{tabular}{ll} Tax rate & 21.0% \\ \hline \end{tabular} Weighed average cost of capital (WACC) Free Cash Flow Valuation Income before taxes + Interest = Income before interest and taxes (EBIT) EBIAT - Change in Working Capital - Change in Other assets Free Cash Flow (FCF) PV of FCF=EV - Existing Debt = Value of equity

Wilson Aviation You have read the Wilson Aviation case. Now, please answer questions in the case using the Excel template below. The template already contains all the data you need to complete your work. [ Submission If you need help with Excel, explore the resources on the Excel Video Tutorial page. Save your Excel spreadsheet using a naming convention that includes your first and last name and the activity number (or description). Do not add punctuation or special characters. Component Net Income (M\$) Earnings per share (EPS) \# of shares (M) Net Income / EPS Price per share Market Value - Equity (M) \# of shares x price per share Market Value - Debt (M) 28 Market Value - Total (M) - \% Debt Debt as a per cent of Total MV - \% Equity Equity as a per cent of Total MV Beta (levered) 0.580.65 as reported in Value Line Beta (unlevered) Beta (levered) x \% Equity Average Beta (unlevered) Average of the two Beta (unlevered) Values for Wilson: % Debt % Equity Beta (relevered) Risk free rate Market risk premium 4.5% Expected equity return (CAPM) \begin{tabular}{l|l|} Expected cost of debt & 7.0% \\ \hline \end{tabular} \begin{tabular}{ll} Tax rate & 21.0% \\ \hline \end{tabular} Weighed average cost of capital (WACC) Free Cash Flow Valuation Income before taxes + Interest = Income before interest and taxes (EBIT) EBIAT - Change in Working Capital - Change in Other assets Free Cash Flow (FCF) PV of FCF=EV - Existing Debt = Value of equity Wilson Aviation You have read the Wilson Aviation case. Now, please answer questions in the case using the Excel template below. The template already contains all the data you need to complete your work. [ Submission If you need help with Excel, explore the resources on the Excel Video Tutorial page. Save your Excel spreadsheet using a naming convention that includes your first and last name and the activity number (or description). Do not add punctuation or special characters. Component Net Income (M\$) Earnings per share (EPS) \# of shares (M) Net Income / EPS Price per share Market Value - Equity (M) \# of shares x price per share Market Value - Debt (M) 28 Market Value - Total (M) - \% Debt Debt as a per cent of Total MV - \% Equity Equity as a per cent of Total MV Beta (levered) 0.580.65 as reported in Value Line Beta (unlevered) Beta (levered) x \% Equity Average Beta (unlevered) Average of the two Beta (unlevered) Values for Wilson: % Debt % Equity Beta (relevered) Risk free rate Market risk premium 4.5% Expected equity return (CAPM) \begin{tabular}{l|l|} Expected cost of debt & 7.0% \\ \hline \end{tabular} \begin{tabular}{ll} Tax rate & 21.0% \\ \hline \end{tabular} Weighed average cost of capital (WACC) Free Cash Flow Valuation Income before taxes + Interest = Income before interest and taxes (EBIT) EBIAT - Change in Working Capital - Change in Other assets Free Cash Flow (FCF) PV of FCF=EV - Existing Debt = Value of equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started