---

--- ---------

---------

---

---

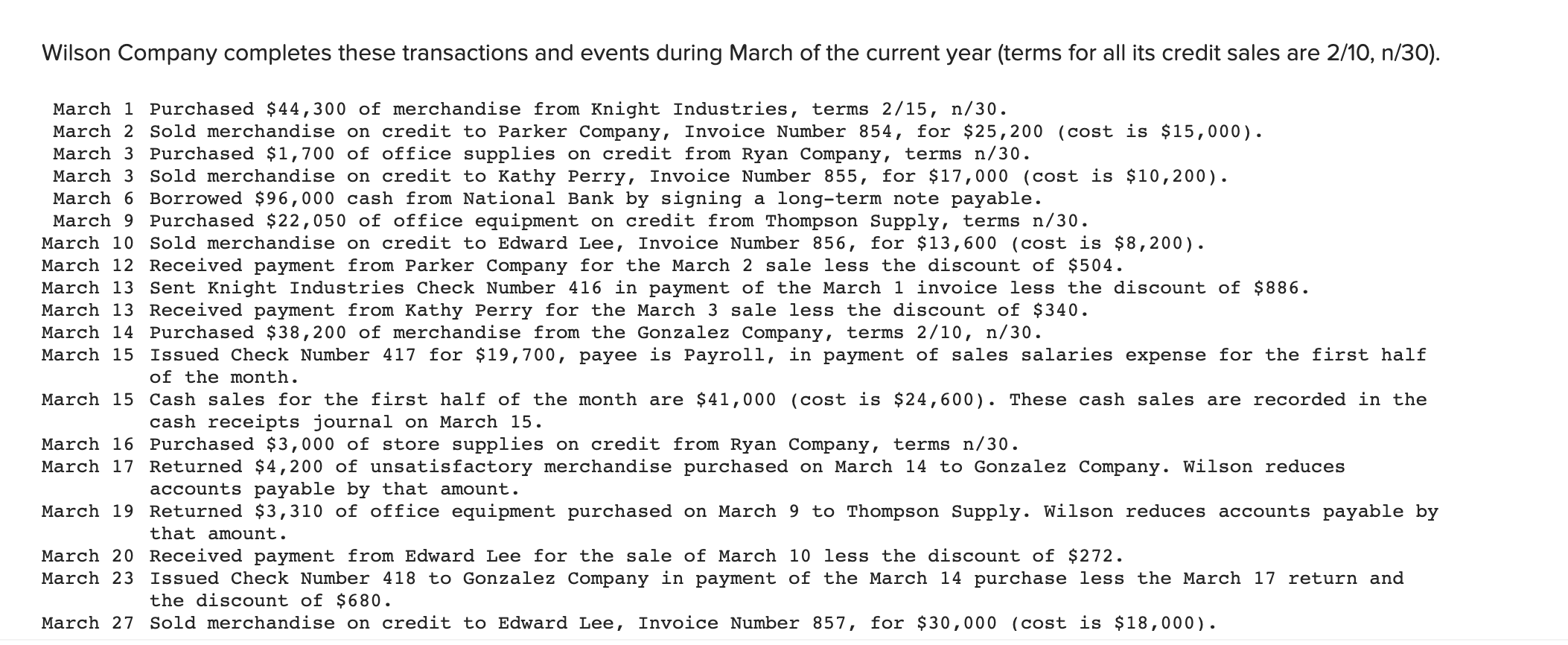

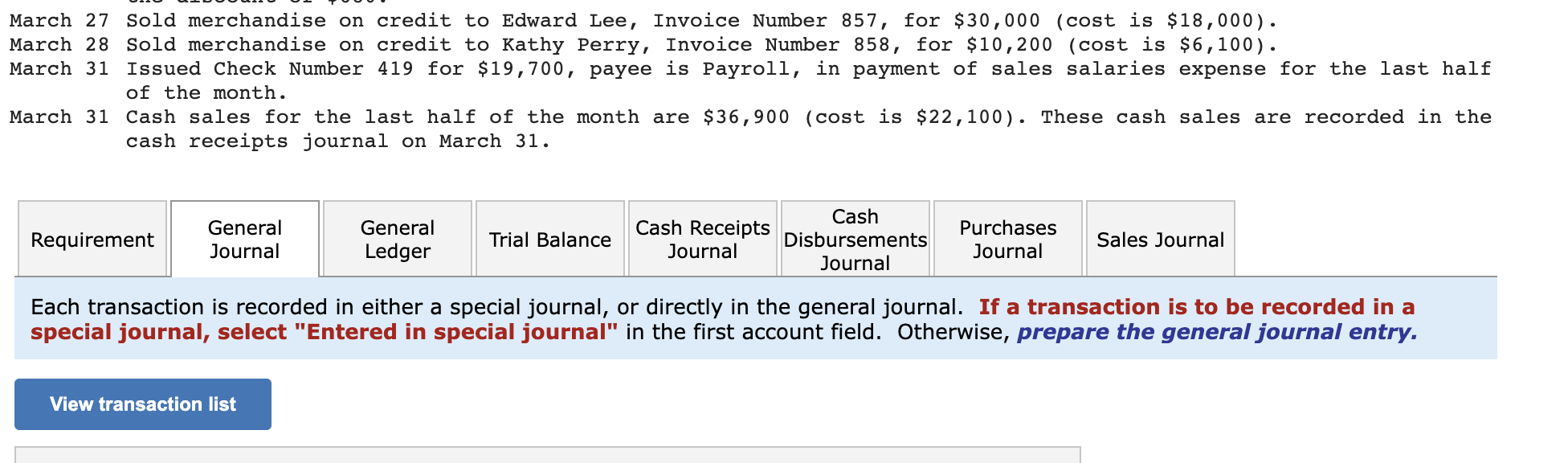

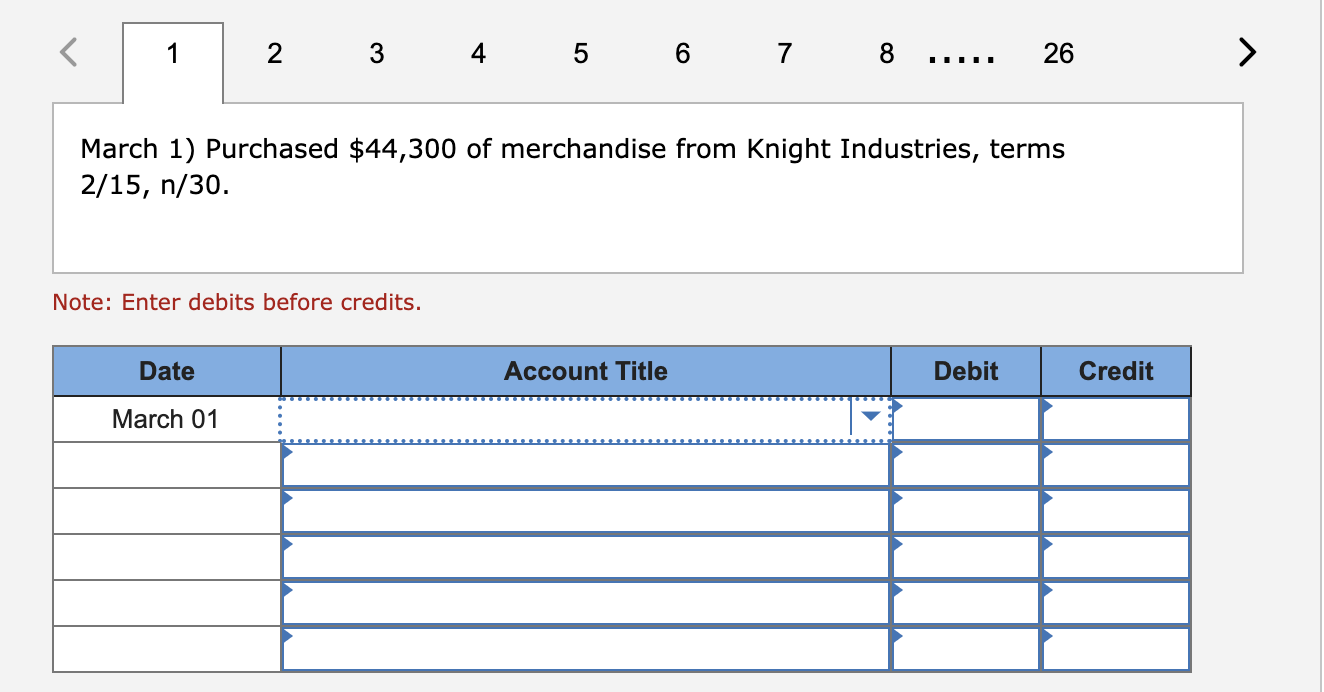

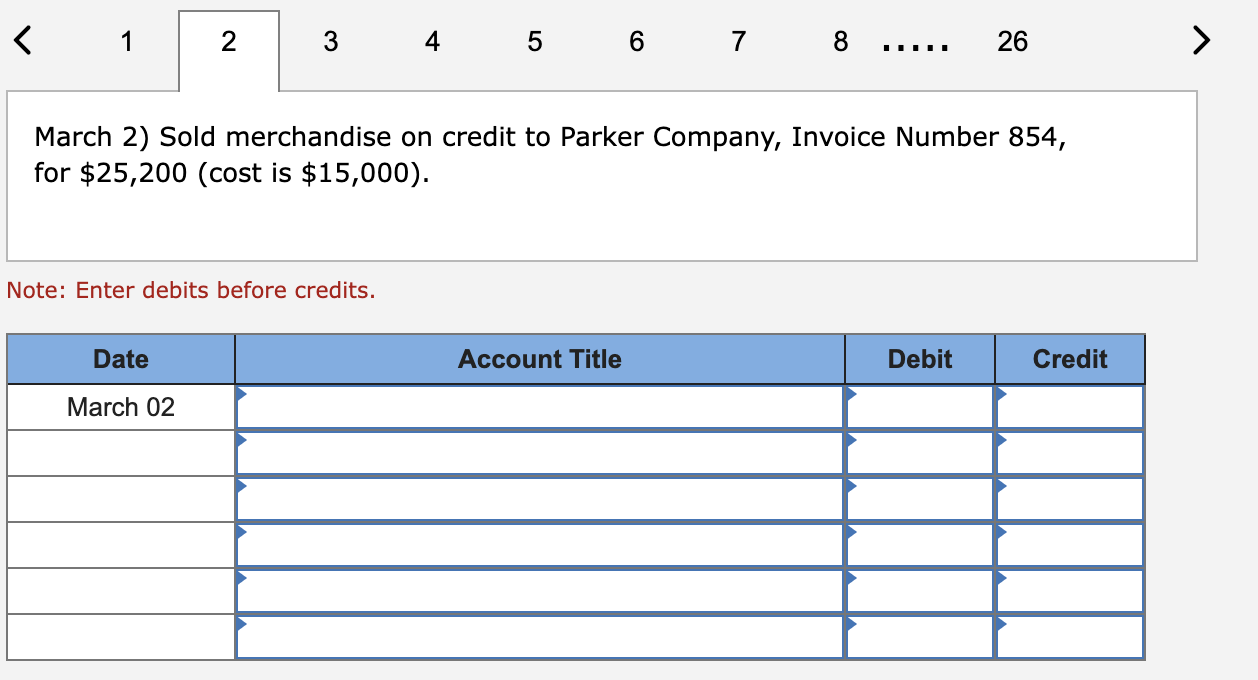

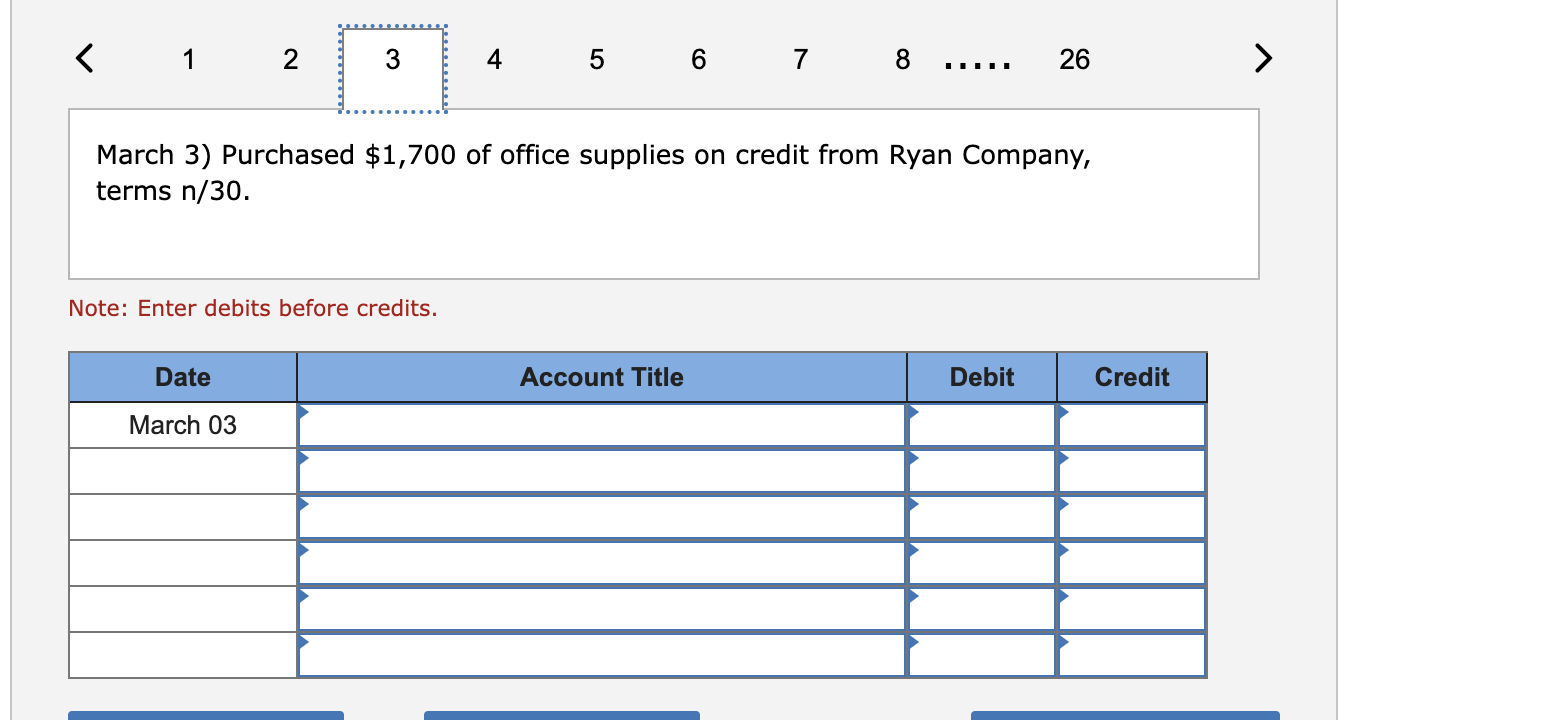

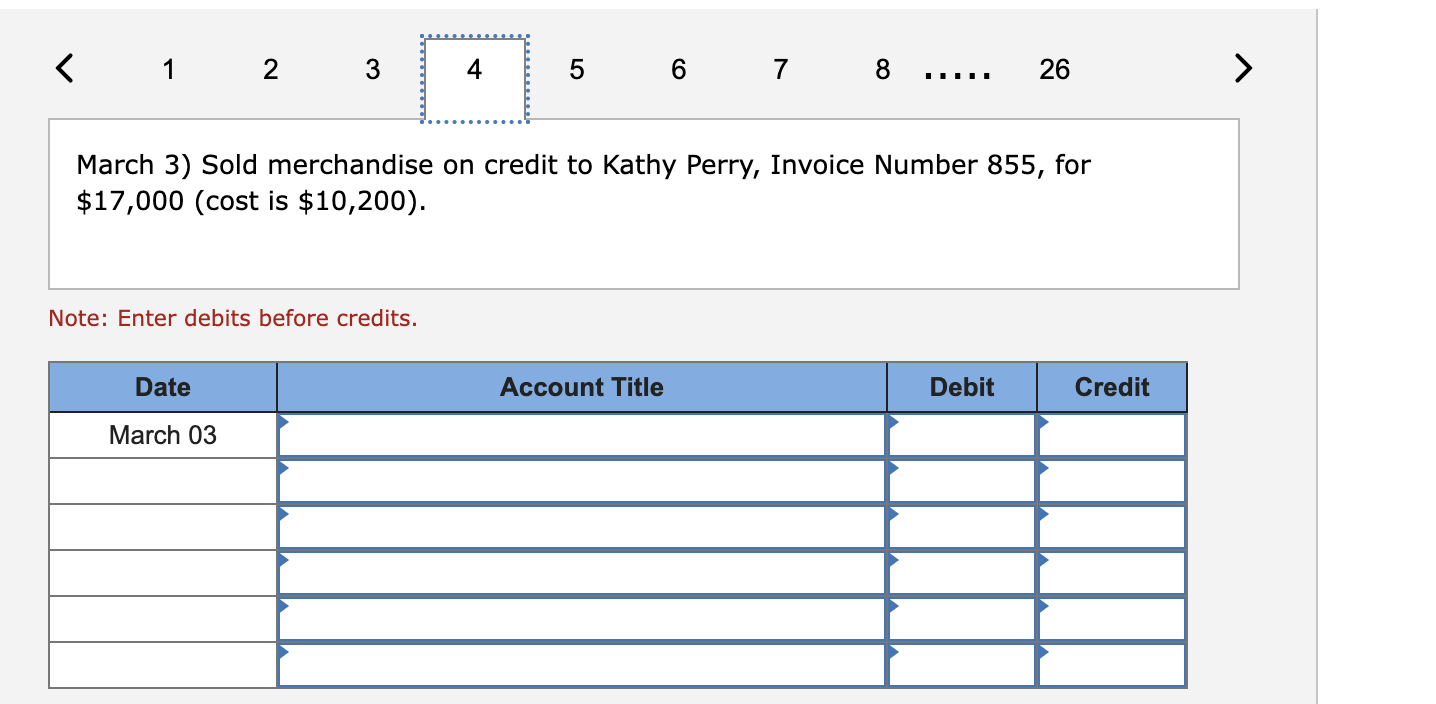

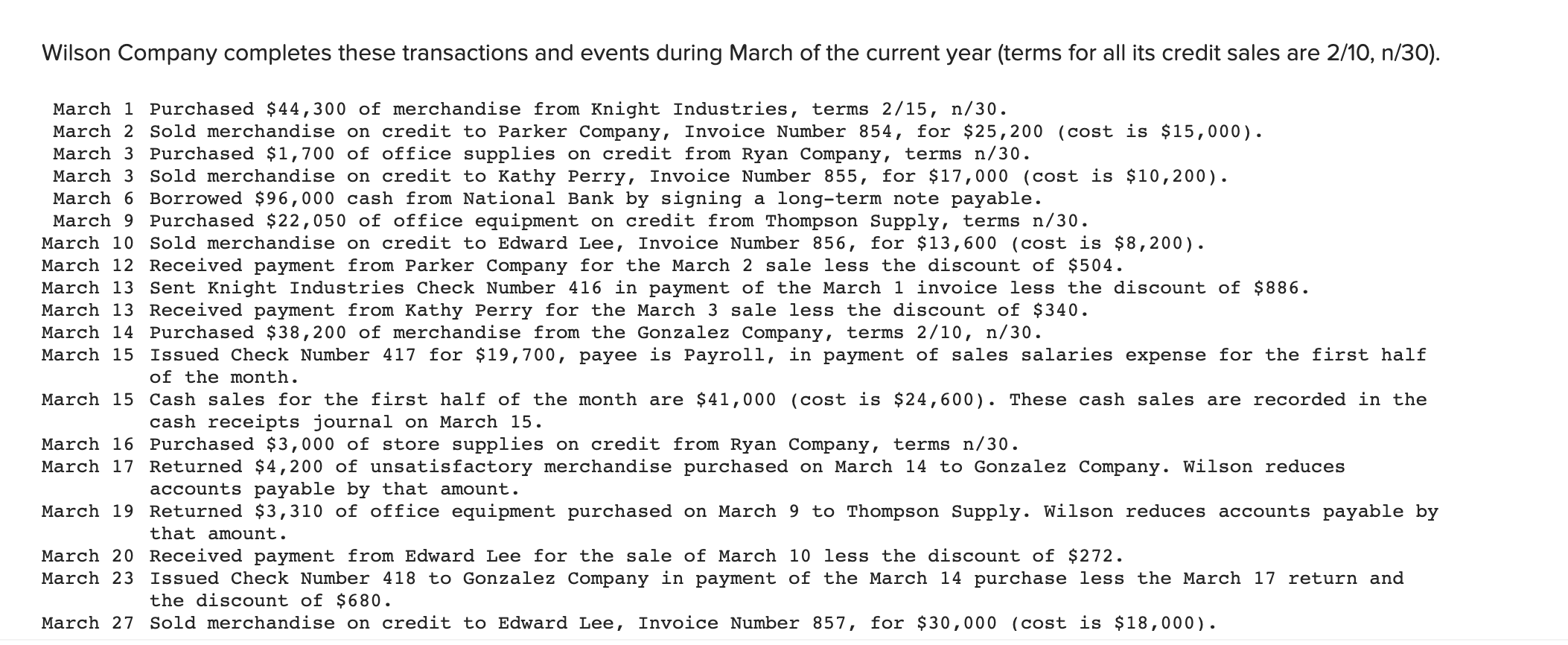

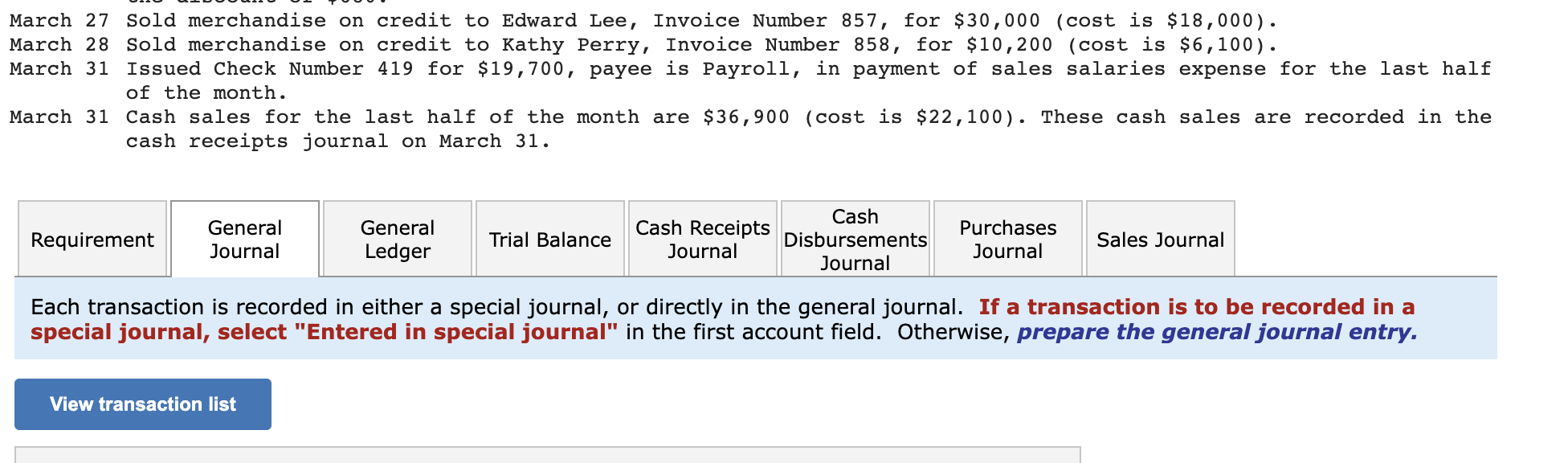

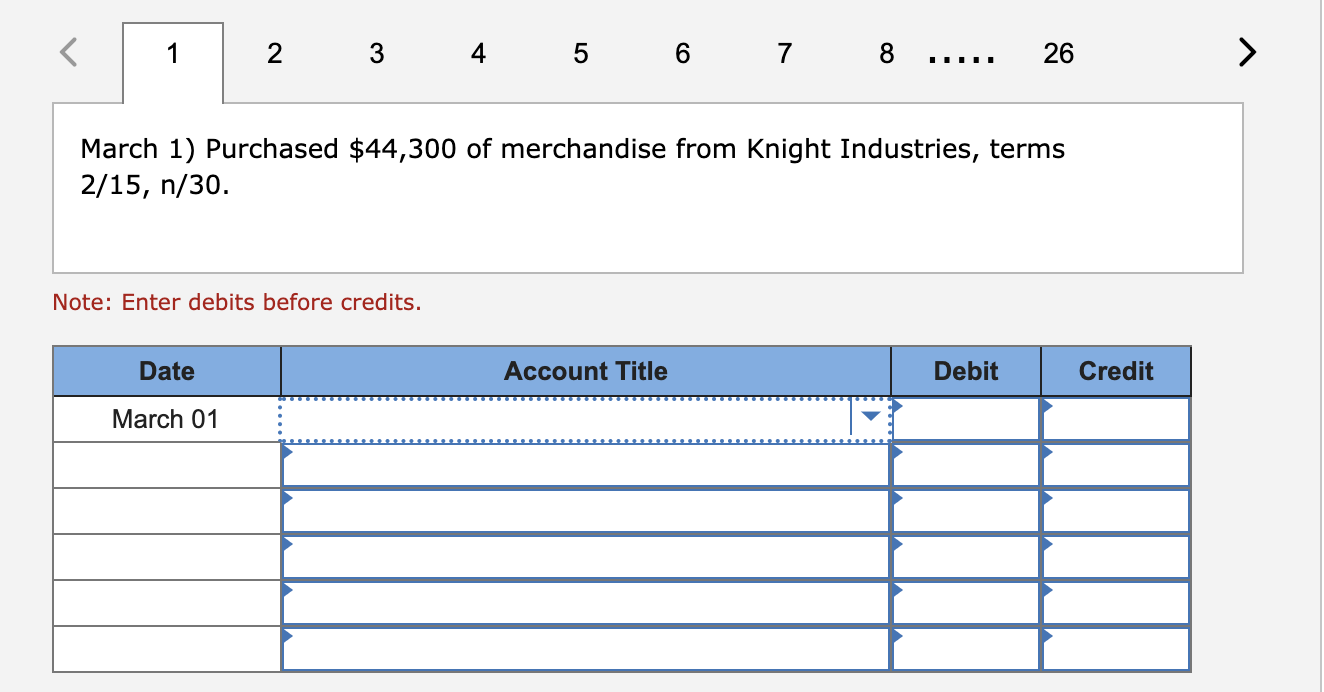

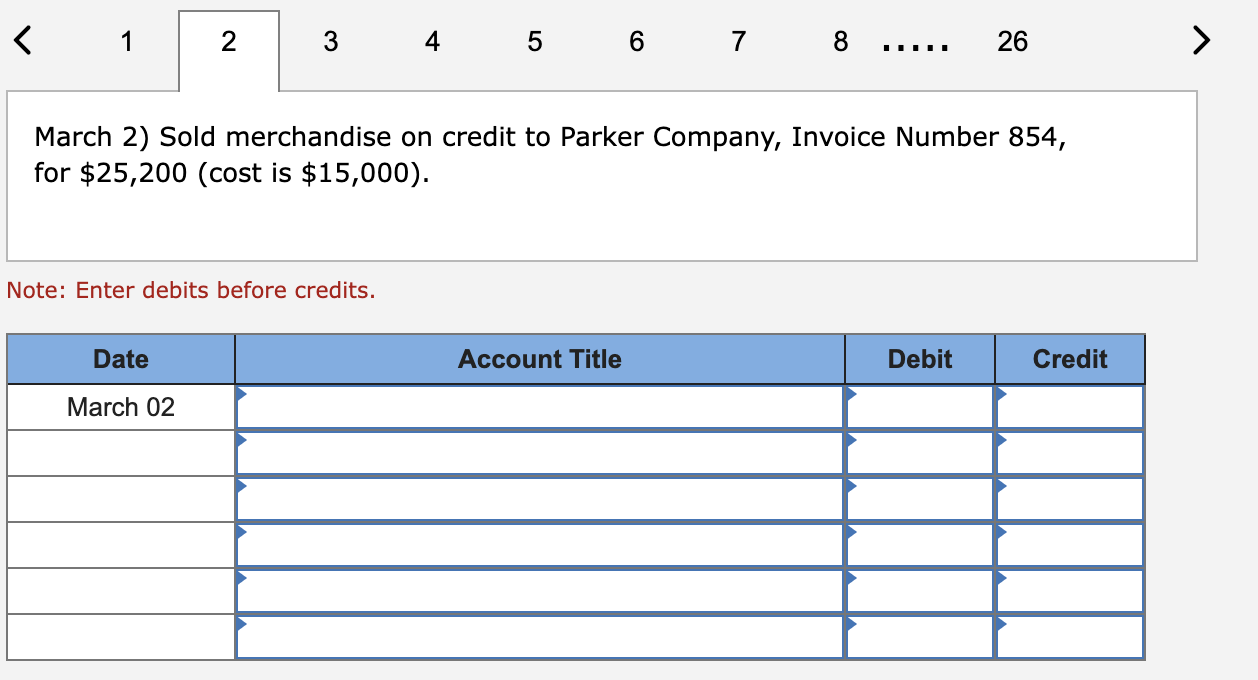

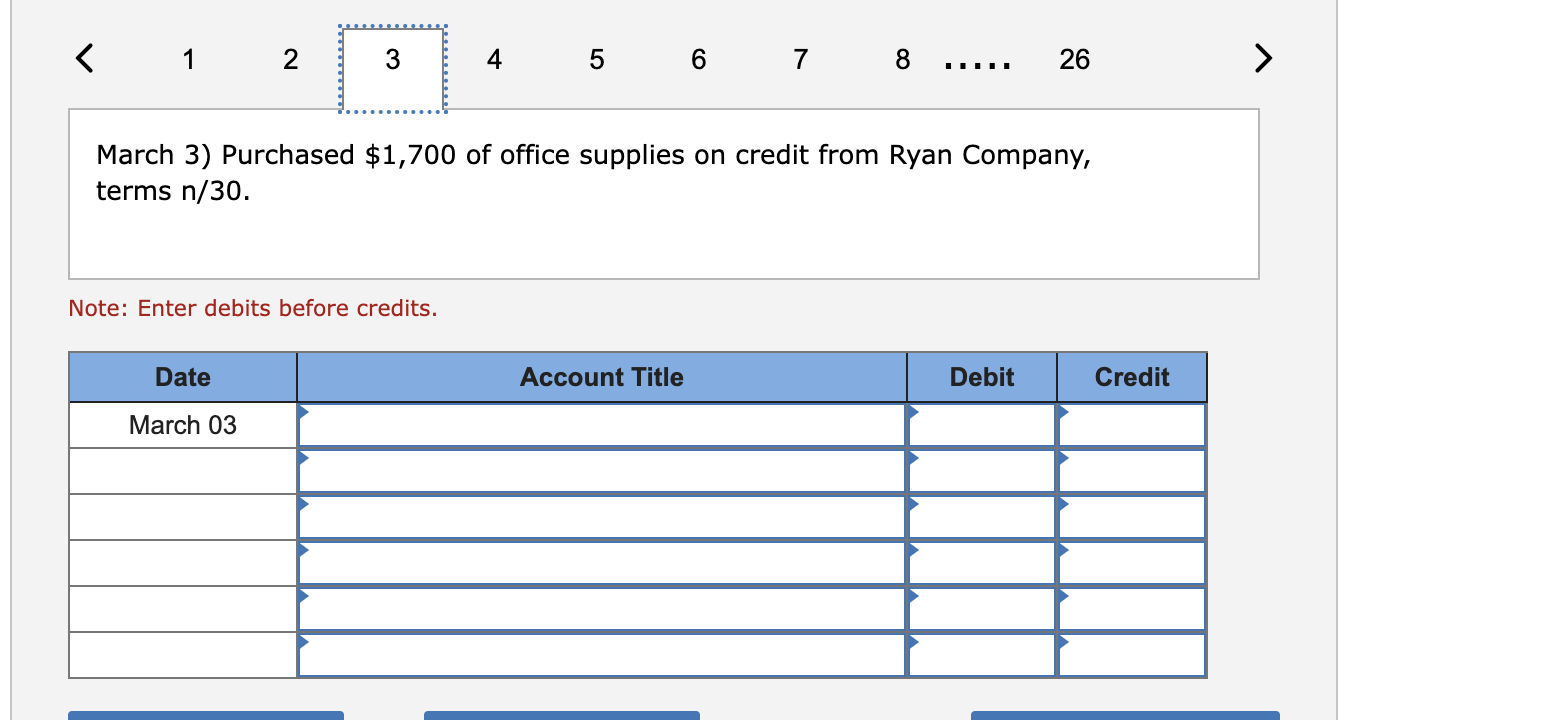

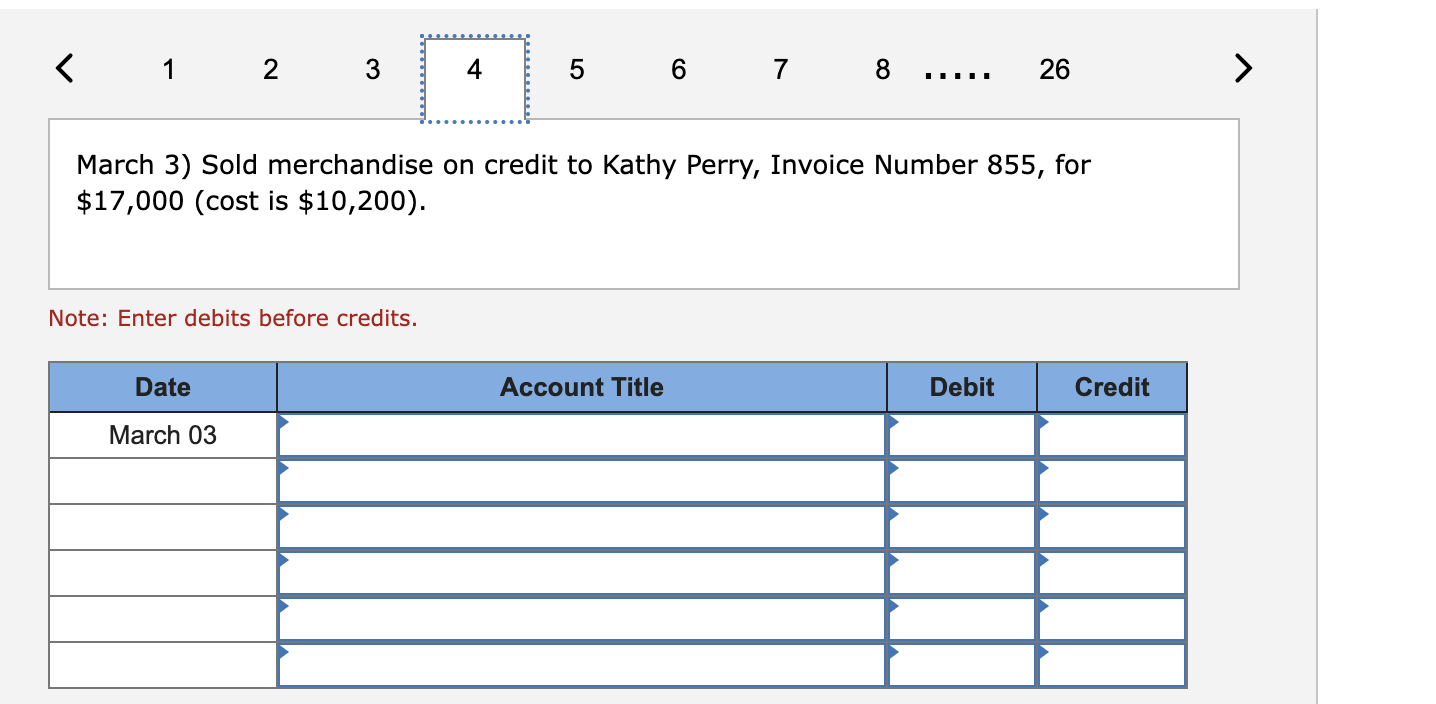

Wilson Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10,n/30 ). March 1 Purchased $44,300 of merchandise from Knight Industries, terms 2/15,n/30. March 2 Sold merchandise on credit to Parker Company, Invoice Number 854, for $25,200 (cost is $15,000). March 3 Purchased $1,700 of office supplies on credit from Ryan Company, terms n/30. March 3 Sold merchandise on credit to Kathy Perry, Invoice Number 855, for $17,000 (cost is $10,200). March 6 Borrowed $96,000 cash from National Bank by signing a long-term note payable. March 9 Purchased $22,050 of office equipment on credit from Thompson Supply, terms n/30. March 10 Sold merchandise on credit to Edward Lee, Invoice Number 856, for $13,600 (cost is $8,200). March 12 Received payment from Parker Company for the March 2 sale less the discount of $504. March 13 Sent Knight Industries Check Number 416 in payment of the March 1 invoice less the discount of $886. March 13 Received payment from Kathy Perry for the March 3 sale less the discount of $340. March 14 Purchased $38,200 of merchandise from the Gonzalez Company, terms 2/10,n/30. March 15 Issued Check Number 417 for $19,700, payee is Payroll, in payment of sales salaries expense for the first half of the month. March 15 Cash sales for the first half of the month are $41,000 (cost is $24,600 ). These cash sales are recorded in the cash receipts journal on March 15. March 16 Purchased $3,000 of store supplies on credit from Ryan Company, terms n/30. March 17 Returned $4,200 of unsatisfactory merchandise purchased on March 14 to Gonzalez Company. Wilson reduces accounts payable by that amount. March 19 Returned $3,310 of office equipment purchased on March 9 to Thompson Supply. Wilson reduces accounts payable by that amount. March 20 Received payment from Edward Lee for the sale of March 10 less the discount of $272. March 23 Issued Check Number 418 to Gonzalez Company in payment of the March 14 purchase less the March 17 return and the discount of $680. March 27 Sold merchandise on credit to Edward Lee, Invoice Number 857 , for $30,000 (cost is $18,000). Each transaction is recorded in either a special journal, or directly in the general journal. If a transaction is to be recorded in a special journal, select "Entered in special journal" in the first account field. Otherwise, prepare the general journal entry. View transaction list March 1) Purchased $44,300 of merchandise from Knight Industries, terms 2/15,n/30. Note: Enter debits before credits. March 2) Sold merchandise on credit to Parker Company, Invoice Number 854, for $25,200 (cost is $15,000 ). Note: Enter debits before credits. March 3) Purchased $1,700 of office supplies on credit from Ryan Company, terms n/30. Note: Enter debits before credits. March 3) Sold merchandise on credit to Kathy Perry, Invoice Number 855 , for $17,000 (cost is $10,200 ). Note: Enter debits before credits. Wilson Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10,n/30 ). March 1 Purchased $44,300 of merchandise from Knight Industries, terms 2/15,n/30. March 2 Sold merchandise on credit to Parker Company, Invoice Number 854, for $25,200 (cost is $15,000). March 3 Purchased $1,700 of office supplies on credit from Ryan Company, terms n/30. March 3 Sold merchandise on credit to Kathy Perry, Invoice Number 855, for $17,000 (cost is $10,200). March 6 Borrowed $96,000 cash from National Bank by signing a long-term note payable. March 9 Purchased $22,050 of office equipment on credit from Thompson Supply, terms n/30. March 10 Sold merchandise on credit to Edward Lee, Invoice Number 856, for $13,600 (cost is $8,200). March 12 Received payment from Parker Company for the March 2 sale less the discount of $504. March 13 Sent Knight Industries Check Number 416 in payment of the March 1 invoice less the discount of $886. March 13 Received payment from Kathy Perry for the March 3 sale less the discount of $340. March 14 Purchased $38,200 of merchandise from the Gonzalez Company, terms 2/10,n/30. March 15 Issued Check Number 417 for $19,700, payee is Payroll, in payment of sales salaries expense for the first half of the month. March 15 Cash sales for the first half of the month are $41,000 (cost is $24,600 ). These cash sales are recorded in the cash receipts journal on March 15. March 16 Purchased $3,000 of store supplies on credit from Ryan Company, terms n/30. March 17 Returned $4,200 of unsatisfactory merchandise purchased on March 14 to Gonzalez Company. Wilson reduces accounts payable by that amount. March 19 Returned $3,310 of office equipment purchased on March 9 to Thompson Supply. Wilson reduces accounts payable by that amount. March 20 Received payment from Edward Lee for the sale of March 10 less the discount of $272. March 23 Issued Check Number 418 to Gonzalez Company in payment of the March 14 purchase less the March 17 return and the discount of $680. March 27 Sold merchandise on credit to Edward Lee, Invoice Number 857 , for $30,000 (cost is $18,000). Each transaction is recorded in either a special journal, or directly in the general journal. If a transaction is to be recorded in a special journal, select "Entered in special journal" in the first account field. Otherwise, prepare the general journal entry. View transaction list March 1) Purchased $44,300 of merchandise from Knight Industries, terms 2/15,n/30. Note: Enter debits before credits. March 2) Sold merchandise on credit to Parker Company, Invoice Number 854, for $25,200 (cost is $15,000 ). Note: Enter debits before credits. March 3) Purchased $1,700 of office supplies on credit from Ryan Company, terms n/30. Note: Enter debits before credits. March 3) Sold merchandise on credit to Kathy Perry, Invoice Number 855 , for $17,000 (cost is $10,200 ). Note: Enter debits before credits

---

--- ---------

---------

---

---