Question

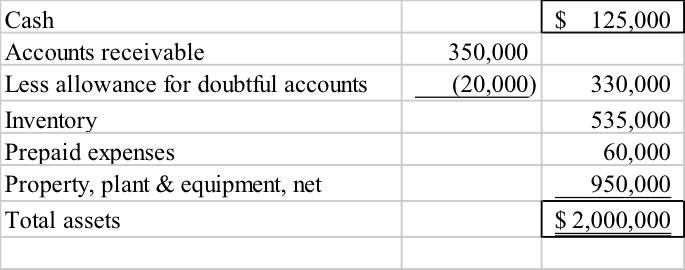

Wilson Company had a current ratio of 3.2:1 at the end of 2015. The asset section of the company's balance sheet is provided below: 1)

Wilson Company had a current ratio of 3.2:1 at the end of 2015. The asset section of the company's balance sheet is provided below:

1) Compute Wilson Company's end-of-year working capital. 2) Compute the company's quick (acid-test) ratio. 3) The company has a debt agreement with its bank that authorizes the bank to call in its loan to the company if the company's current ratio falls below 3:1 as of the last day of any month during the term of the loan. During January 2015, the company engaged in the three following transactions: (a) Collected $100,000 on account; (b) Purchased inventory on account, $50,000 (c) Paid accounts payable, $60,000 Will the company be in default after completing all three of these transactions? Justify your answer.

S Cash 125,000 350,000 Accounts receivable Less allowance for doubtful accounts (20,000) 330,000 535,000 Inventory 60,000 Prepaid expenses 950.000 Property, plant & equipment, net Total assets 2,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started