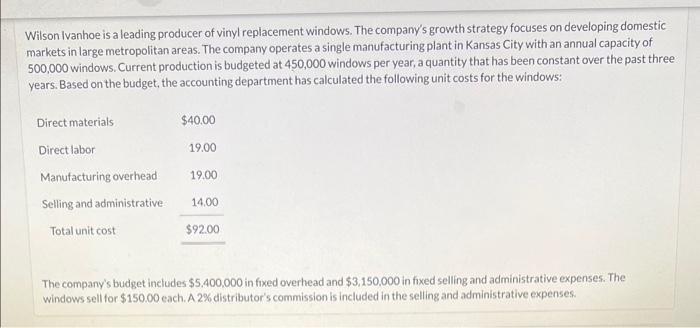

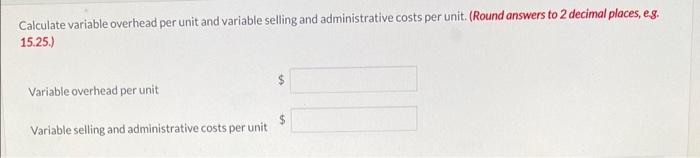

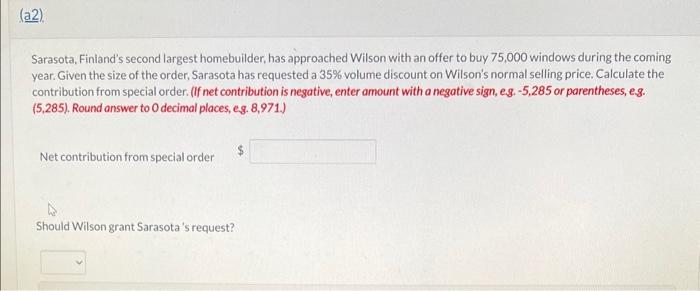

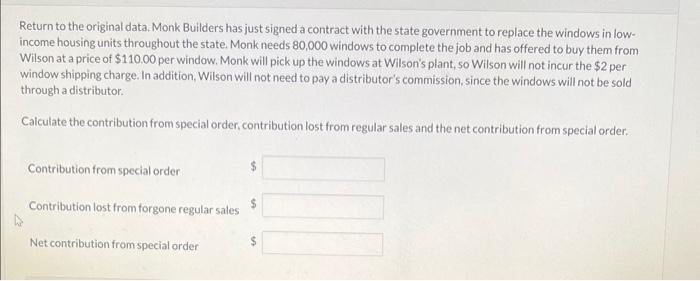

Wilson Ivanhoe is a leading producer of vinyl replacement windows. The company's growth strategy focuses on developing domestic markets in large metropolitan areas. The company operates a single manufacturing plant in Kansas City with an annual capacity of 500,000 windows. Current production is budgeted at 450,000 windows per year, a quantity that has been constant over the past three years. Based on the budget, the accounting department has calculated the following unit costs for the windows: The company's budget includes $5.400.000 in fixed overhead and $3.150.000 in fixed selling and administrative expenses. The windows sell for $150.00 each. A 2% distributor's commission is included in the selling and administrative expenses. Calculate variable overhead per unit and variable selling and administrative costs per unit. (Round answers to 2 decimal places, eg. 15.25.) Variable overhead per unit Variable selling and administrative costs per unit Sarasota, Finland's second largest homebuilder, has approached Wilson with an offer to buy 75,000 windows during the coming year. Given the size of the order, Sarasota has requested a 35% volume discount on Wilson's normal selling price. Calculate the contribution from special order. (If net contribution is negative, enter amount with a negative sign, eg. -5,285 or parentheses, eg. (5,285). Round answer to 0 decimal places, e.g. 8,971.) Net contribution from special order Should Wilson grant Sarasota's request? Return to the original data. Monk Builders has just signed a contract with the state government to replace the windows in lowincome housing units throughout the state. Monk needs 80,000 windows to complete the job and has offered to buy them from Wilson at a price of $110.00 per window, Monk will pick up the windows at Wilson's plant, so Wilson will not incur the $2 per window shipping charge. In addition, Wilson will not need to pay a distributor's commission, since the windows will not be sold through a distributor. Calculate the contribution from special order, contribution lost from regular sales and the net contribution from special order. Contribution from special order Contribution lost from forgone regular sales Net contribution from special order Wilson Ivanhoe is a leading producer of vinyl replacement windows. The company's growth strategy focuses on developing domestic markets in large metropolitan areas. The company operates a single manufacturing plant in Kansas City with an annual capacity of 500,000 windows. Current production is budgeted at 450,000 windows per year, a quantity that has been constant over the past three years. Based on the budget, the accounting department has calculated the following unit costs for the windows: The company's budget includes $5.400.000 in fixed overhead and $3.150.000 in fixed selling and administrative expenses. The windows sell for $150.00 each. A 2% distributor's commission is included in the selling and administrative expenses. Calculate variable overhead per unit and variable selling and administrative costs per unit. (Round answers to 2 decimal places, eg. 15.25.) Variable overhead per unit Variable selling and administrative costs per unit Sarasota, Finland's second largest homebuilder, has approached Wilson with an offer to buy 75,000 windows during the coming year. Given the size of the order, Sarasota has requested a 35% volume discount on Wilson's normal selling price. Calculate the contribution from special order. (If net contribution is negative, enter amount with a negative sign, eg. -5,285 or parentheses, eg. (5,285). Round answer to 0 decimal places, e.g. 8,971.) Net contribution from special order Should Wilson grant Sarasota's request? Return to the original data. Monk Builders has just signed a contract with the state government to replace the windows in lowincome housing units throughout the state. Monk needs 80,000 windows to complete the job and has offered to buy them from Wilson at a price of $110.00 per window, Monk will pick up the windows at Wilson's plant, so Wilson will not incur the $2 per window shipping charge. In addition, Wilson will not need to pay a distributor's commission, since the windows will not be sold through a distributor. Calculate the contribution from special order, contribution lost from regular sales and the net contribution from special order. Contribution from special order Contribution lost from forgone regular sales Net contribution from special order