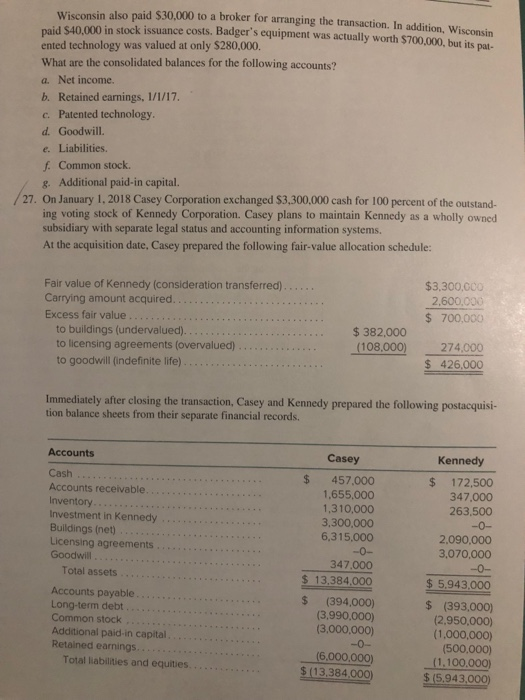

Winansin also paid $30,000 to a broker for arranging the transaction. In addition, Wisconsin nad 540.000 in stock issuance costs. Badger's equipment was actually worth $700,000, but its ented technology was valued at only $280,000. What are the consolidated balances for the following accounts? a. Net income. b. Retained earnings, 1/1/17. c. Patented technology. d. Goodwill. e. Liabilities. f. Common stock. 8. Additional paid-in capital. 27. On January 1, 2018 Casey Corporation exchanged $3,300,000 cash for 100 percent of the outstand- ing voting stock of Kennedy Corporation. Casey plans to maintain Kennedy as a wholly owned subsidiary with separate legal status and accounting information systems. At the acquisition date, Casey prepared the following fair value allocation schedule: Fair value of Kennedy (consideration transferred).. Carrying amount acquired. ...... Excess fair value... to buildings (undervalued).... to licensing agreements (overvalued)..... to goodwill findefinite life) $3,300,000 2,600.000 $ 700,000 $ 382,000 (108.000) 274.000 $ 426.000 Immediately after closing the transaction, Casey and Kennedy prepared the following postacquisi- tion balance sheets from their separate financial records. Accounts $ Casey 457.000 1,655,000 1,310,000 3,300,000 6,315,000 Cash Accounts receivable.. Inventory.. Investment in Kennedy ..... Buildings (net) Licensing agreements ... Goodwill........... Total assets ............. Accounts payable ..... Long-term debt..... Common stock .. Additional paid-in capital..... Retained earnings...... ... Total liabilities and equities... 347.000 $ 13,384.000 $ (394.000) (3,990,000) (3,000,000) Kennedy $ 172,500 347.000 263,500 -O- 2,090,000 3.070,000 --0- $ 5.943.000 $ (393,000) (2,950,000) (1.000.000) (500,000) (1.100.000) $(5,943,000) -0- (6,000,000) $ (13,384.000 Prepare an acquisition date consolidated balance sheet for Casey Corporation and its Kennedy Corporation. 8. On January 1, 2018, Marshall Company acquired 100 percent of the outstanding common stock Tucker Company. To acquire these shares, Marshall issued $200,000 in long-term liabilities and