Question

Wind Beneath My Wings Inc. employs one person to run its wind energy company and July is the first pay period for this employee. The

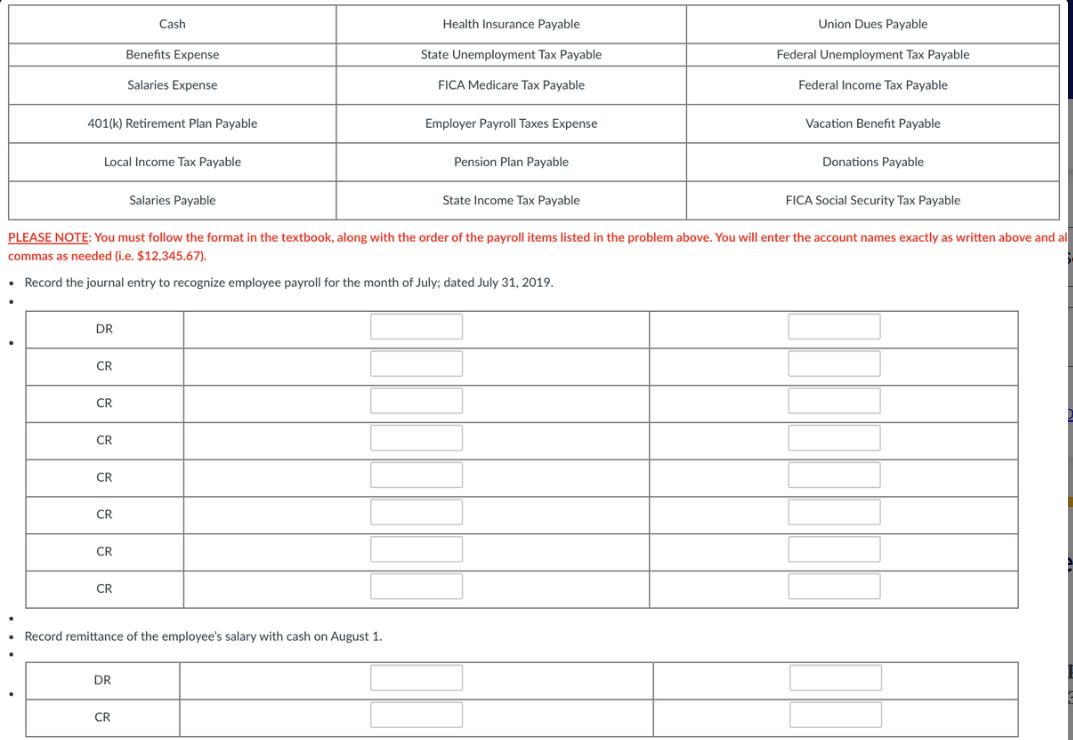

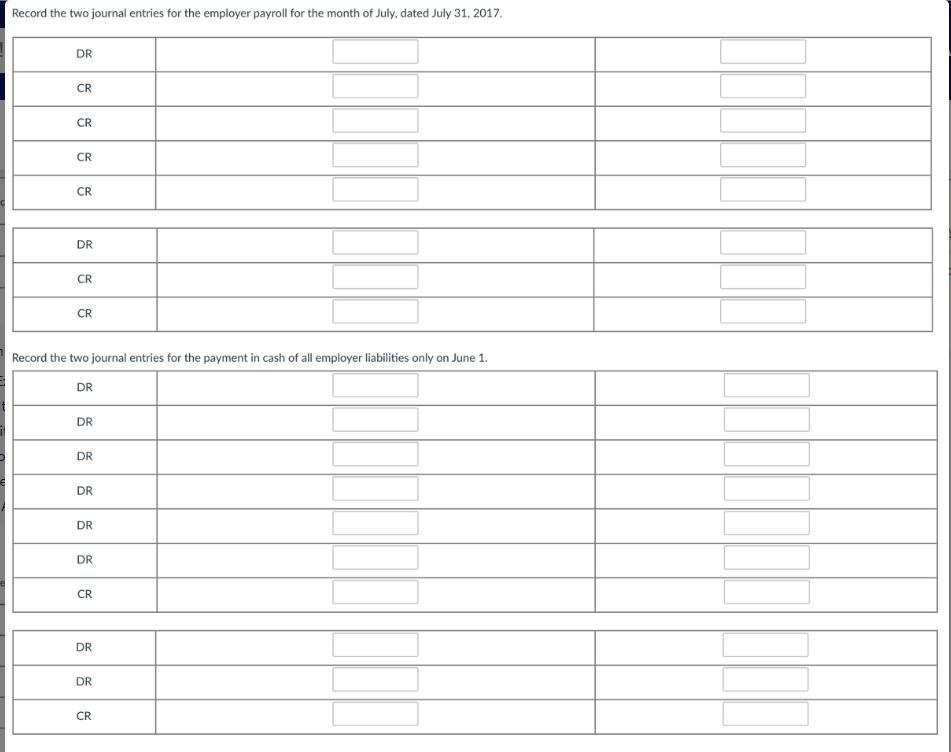

Wind Beneath My Wings Inc. employs one person to run its wind energy company and July is the first pay period for this employee. The employee’s gross income for the month of July is $6,900. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to the employee. Payroll for the month of July is as follows: FICA Social Security tax rate at 6.2%, FICA Medicare tax rate at 1.45%, federal income tax of $445, state income tax of $82, health-care insurance premium of $450, and pension plan of $320. The employee is responsible for covering 35% of the health insurance premium and the employer is responsible for 65% of the health insurance premium. The employer matches 75% of employee pension plan contributions.

Record the two journal entries for the employer payroll for the month of July, dated July 31, 2017. DR CR CR CR CR DR CR CR Record the two journal entries for the payment in cash of all employer liabilities only on June 1. DR DR DR DR DR DR CR DR DR CR

Record the two journal entries for the employer payroll for the month of July, dated July 31, 2017. DR CR CR CR CR DR CR CR Record the two journal entries for the payment in cash of all employer liabilities only on June 1. DR DR DR DR DR DR CR DR DR CR 401(k) Retirement Plan Payable Local Income Tax Payable DR CR CR CR CR CR CR Cash FICA Social Security Tax Payable PLEASE NOTE: You must follow the format in the textbook, along with the order of the payroll items listed in the problem above. You will enter the account names exactly as written above and al commas as needed (i.e. $12,345.67). Record the journal entry to recognize employee payroll for the month of July; dated July 31, 2019. CR Benefits Expense Salaries Expense DR CR Record remittance of the employee's salary with cash on August 1. Salaries Payable Health Insurance Payable State Unemployment Tax Payable FICA Medicare Tax Payable Employer Payroll Taxes Expense Pension Plan Payable Union Dues Payable Federal Unemployment Tax Payable Federal Income Tax Payable State Income Tax Payable Vacation Benefit Payable Donations Payable 401(k) Retirement Plan Payable Local Income Tax Payable DR CR CR CR CR CR CR Cash FICA Social Security Tax Payable PLEASE NOTE: You must follow the format in the textbook, along with the order of the payroll items listed in the problem above. You will enter the account names exactly as written above and al commas as needed (i.e. $12,345.67). Record the journal entry to recognize employee payroll for the month of July; dated July 31, 2019. CR Benefits Expense Salaries Expense DR CR Record remittance of the employee's salary with cash on August 1. Salaries Payable Health Insurance Payable State Unemployment Tax Payable FICA Medicare Tax Payable Employer Payroll Taxes Expense Pension Plan Payable Union Dues Payable Federal Unemployment Tax Payable Federal Income Tax Payable State Income Tax Payable Vacation Benefit Payable Donations Payable

Step by Step Solution

3.53 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Journal entries are entered account books to record each and every financ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started