Answered step by step

Verified Expert Solution

Question

1 Approved Answer

WIND Ltd rewards its CEO a $90,000 cash bonus if the accounting rate of return on assets (ROA) for the year is more than

![Part B [7 marks] - Given the NPV from Part A, is this a good investment proposal? Why or why not? - Calculate ROA generated b](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/12/63a04885282bc_1671448708444.jpg)

![Part C [7 marks] Suppose that the purchase cost of TP47 is unknown and other information remains the same. At what maximum pu](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/12/63a0488111a9c_1671448704311.jpg)

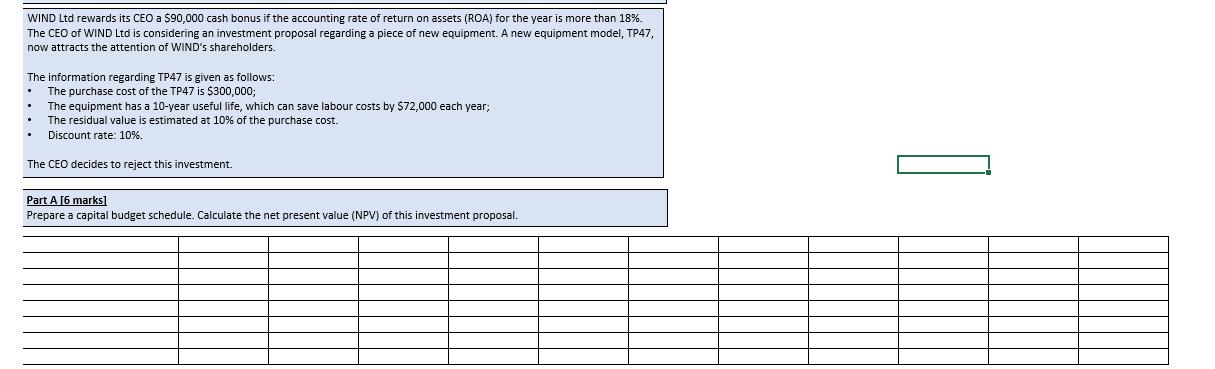

WIND Ltd rewards its CEO a $90,000 cash bonus if the accounting rate of return on assets (ROA) for the year is more than 18%. The CEO of WIND Ltd is considering an investment proposal regarding a piece of new equipment. A new equipment model, TP47, now attracts the attention of WIND's shareholders. The information regarding TP47 is given as follows: The purchase cost of the TP47 is $300,000; . .. The equipment has a 10-year useful life, which can save labour costs by $72,000 each year; The residual value is estimated at 10% of the purchase cost. Discount rate: 10%. The CEO decides to reject this investment. Part A [6 marks] Prepare a capital budget schedule. Calculate the net present value (NPV) of this investment proposal. Part B [7 marks] . Given the NPV from Part A, is this a good investment proposal? Why or why not? Calculate ROA generated by the equipment TP47. Briefly explain why the manager rejects the investment. Your answer Part C [7 marks] Suppose that the purchase cost of TP47 is unknown and other information remains the same. At what maximum purchase will the CEO accept to meet her/his bonus target? Your answer

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started