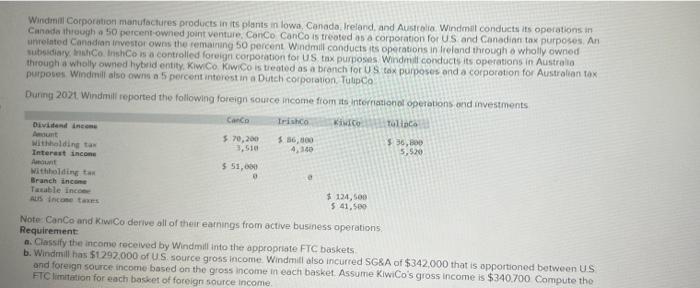

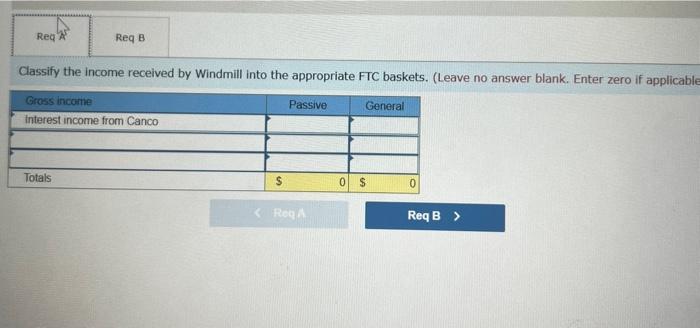

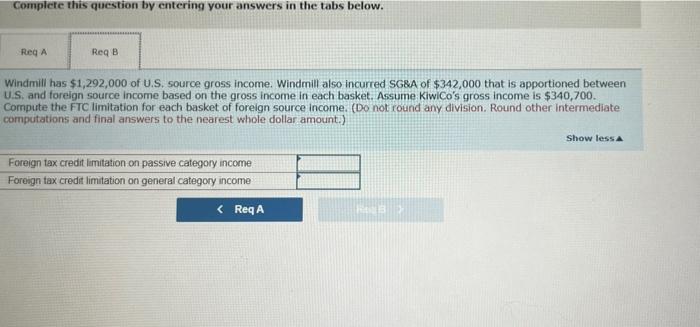

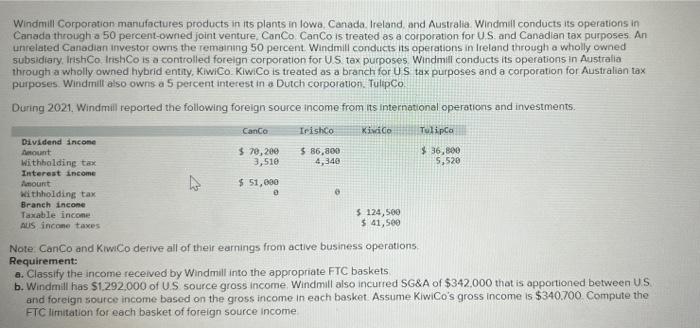

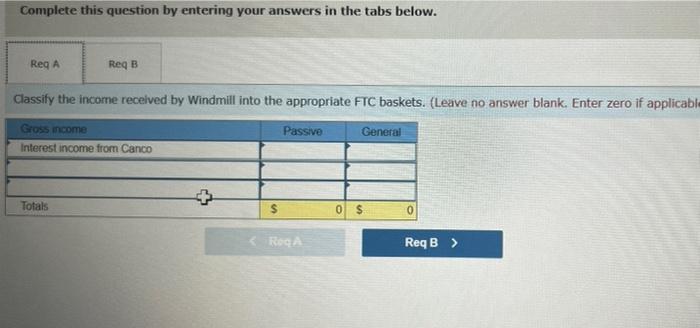

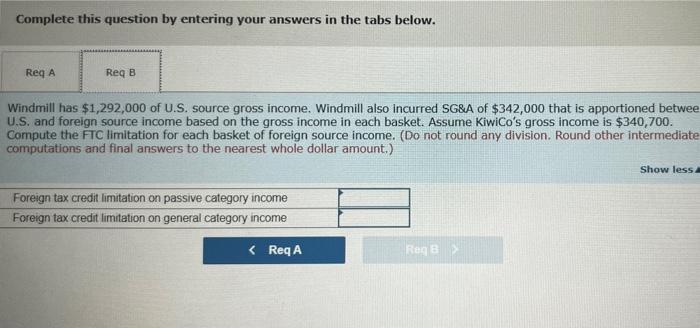

Windmill Corporation manufactures products in its plants in lowa, Canada, Ireland, and Australia Windmill conducts its operations in Canada through a 50 percent-owned joint venture ConCo CanCo is treated as a corporation for US and Canadian tax purposes. An unrelated Canadian investor own the remaining 50 percent Windmill conducts its operations in Ireland through a wholly owned subsidiary, Co InshCons a controlled foreign corporation for US tax purposes Windmill conducts its operations in Australia through a wholly owned hybridentity, Kiw. Co KiwiCo is treated as a branch for US tax purposes and a corporation for Australian tax purposes. Windmill also owns a 5 percent interest in a Dutch corporation Tulpo During 2021 Windmill reported the following foreign source come from its international operations and investments Canco Irisho Kivico Tolloca Divind income 5.70,200 $ 56,000 $ 35,00 withholding ta 3,510 4,140 Interest income $ 51,000 Withholding to a Branch income Taxable ince $ 124,500 AUS income taxes 5 41,500 Note CanCo and KiwiCo derive all of their earnings from active business operations Requirement a. Classify the income received by Windmill into the appropriate FTC baskets b. Windmill has $1292.000 of US source gross income. Windmill also incurred SG&A of $342,000 that is apportioned between US and foreign source income based on the gross income in each basket. Assume KiwiCo's gross income is $340.700 Compute the FTC limitation for each basket of foreign source income 5.520 Req Req B Classify the income received by Windmill into the appropriate FTC baskets. (Leave no answer blank. Enter zero if applicable Gross income Interest income from Canco Passive General Totals $ 0$ 0 Reg ReqB > Complete this question by entering your answers in the tabs below. Req A Req B Windmill has $1,292,000 of U.S. source gross income. Windmill also incurred SG&A of $342,000 that is apportioned between U.S. and foreign source Income based on the gross income in each basket. Assume KiwiCo's gross income is $340,700. Compute the FTC limitation for each basket of foreign source income. (Do not round any division. Round other intermediate computations and final answers to the nearest whole dollar amount.) Show less Foreign tax credit limitation on passive category income Foreign tax credit limitation on general category income Complete this question by entering your answers in the tabs below. Reg A Req B Windmill has $1,292,000 of U.S. source gross income. Windmill also incurred SG&A of $342,000 that is apportioned betwee U.S. and foreign source income based on the gross income in each basket. Assume KiwiCo's gross income is $340,700. Compute the FTC limitation for each basket of foreign source income. (Do not round any division. Round other intermediate computations and final answers to the nearest whole dollar amount.) Show less Foreign tax credit limitation on passive category income Foreign tax credit limitation on general category income Complete this question by entering your answers in the tabs below. Req A Req B Windmill has $1,292,000 of U.S. source gross income. Windmill also incurred SG&A of $342,000 that is apportioned between U.S. and foreign source Income based on the gross income in each basket. Assume KiwiCo's gross income is $340,700. Compute the FTC limitation for each basket of foreign source income. (Do not round any division. Round other intermediate computations and final answers to the nearest whole dollar amount.) Show less Foreign tax credit limitation on passive category income Foreign tax credit limitation on general category income Complete this question by entering your answers in the tabs below. Reg A Req B Windmill has $1,292,000 of U.S. source gross income. Windmill also incurred SG&A of $342,000 that is apportioned betwee U.S. and foreign source income based on the gross income in each basket. Assume KiwiCo's gross income is $340,700. Compute the FTC limitation for each basket of foreign source income. (Do not round any division. Round other intermediate computations and final answers to the nearest whole dollar amount.) Show less Foreign tax credit limitation on passive category income Foreign tax credit limitation on general category income