Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Window Help erg 100% zsa- Fri 9:09 AM ereader.chegg.com ce Windows Media Suggested Sites See What's Hot Web Sice Gallery Google Apple Disney ESPN Yahoo!

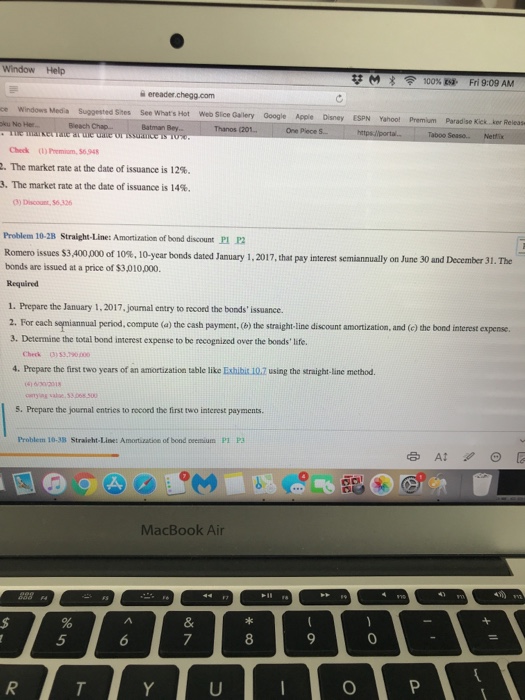

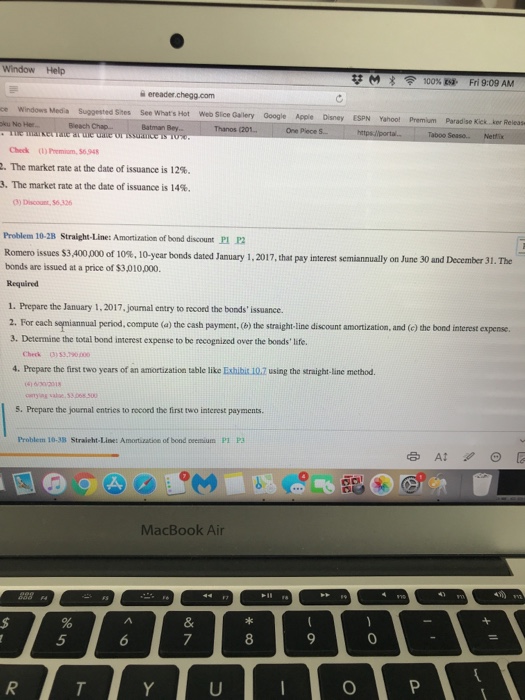

Window Help erg 100% zsa- Fri 9:09 AM ereader.chegg.com ce Windows Media Suggested Sites See What's Hot Web Sice Gallery Google Apple Disney ESPN Yahoo! Premium Paradise Kick .ker Releas Batman Bey One Plece Check () Premio56,948 -The market rate at the date of issuance is 12% The market rate at the date of issuance is 14%. ) Discoun 56.326 Problem 10-2B Straight-Line: Amortization of bond discount Pl P2 bonds dated January 1,2017, that pay interest semiannually on June 30 and December 31.The Romero issues$3,400,000 of 10%, 10-year bonds are issued at a price of $3,010,000 1. Prepare the January 1, 2017,jounal entry to record the bonds' issuance. 2. For each semiannual period, compute (a) the cash payment, (b) the straight-line discount amortization, and (c) the bond interest 3. Determine the total bond interest expense to be recognized over the bonds' life. Check 3)53,79000o 4. Prepare the first two ycars of an amortization table like Exhibit 10.Z using the straight-line method 4) 602018 anyjng sale, 33068 500 5. Prepare the journal entries to record the first two interest payments. Problem 10-38 Straleht-Line: Amortizatioe of bond peemium PI P3 MacBook Air 8

Window Help erg 100% zsa- Fri 9:09 AM ereader.chegg.com ce Windows Media Suggested Sites See What's Hot Web Sice Gallery Google Apple Disney ESPN Yahoo! Premium Paradise Kick .ker Releas Batman Bey One Plece Check () Premio56,948 -The market rate at the date of issuance is 12% The market rate at the date of issuance is 14%. ) Discoun 56.326 Problem 10-2B Straight-Line: Amortization of bond discount Pl P2 bonds dated January 1,2017, that pay interest semiannually on June 30 and December 31.The Romero issues$3,400,000 of 10%, 10-year bonds are issued at a price of $3,010,000 1. Prepare the January 1, 2017,jounal entry to record the bonds' issuance. 2. For each semiannual period, compute (a) the cash payment, (b) the straight-line discount amortization, and (c) the bond interest 3. Determine the total bond interest expense to be recognized over the bonds' life. Check 3)53,79000o 4. Prepare the first two ycars of an amortization table like Exhibit 10.Z using the straight-line method 4) 602018 anyjng sale, 33068 500 5. Prepare the journal entries to record the first two interest payments. Problem 10-38 Straleht-Line: Amortizatioe of bond peemium PI P3 MacBook Air 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started