Question

WINDOWS FOUNDRY CASE Ventanas Division is a smelter and refinery in which copper concentrates are processed, mainly to produce anodes and cathodes. This product is

WINDOWS FOUNDRY CASE

Ventanas Division is a smelter and refinery in which copper concentrates are processed, mainly to produce anodes and cathodes. This product is considered among the three best worldwide and reaches a purity of 99.99%, which gives greater added value to the country's main mining resource. Since at least 2009 more than a decade the Windows Division has been making losses for Codelco. In 2021 they reached 66.2 million dollars and in 2020 to 116 million US dollars (before taxes). In 2019, Ventanas melted 107 thousand metric tons of the material. In 2020, meanwhile, there were 117 thousand metric tons, indicators that improved in 2021. However, in its report for that year, the state company had to note that in 2020 there was an impairment of the value of the Division's assets for 24 million dollars. before taxes.

That is why you are in charge of delivering a solution to Codelco, through financial flows that determine the viability of continuing with this company.

CURRENT SITUATION OF THE COMPANY:

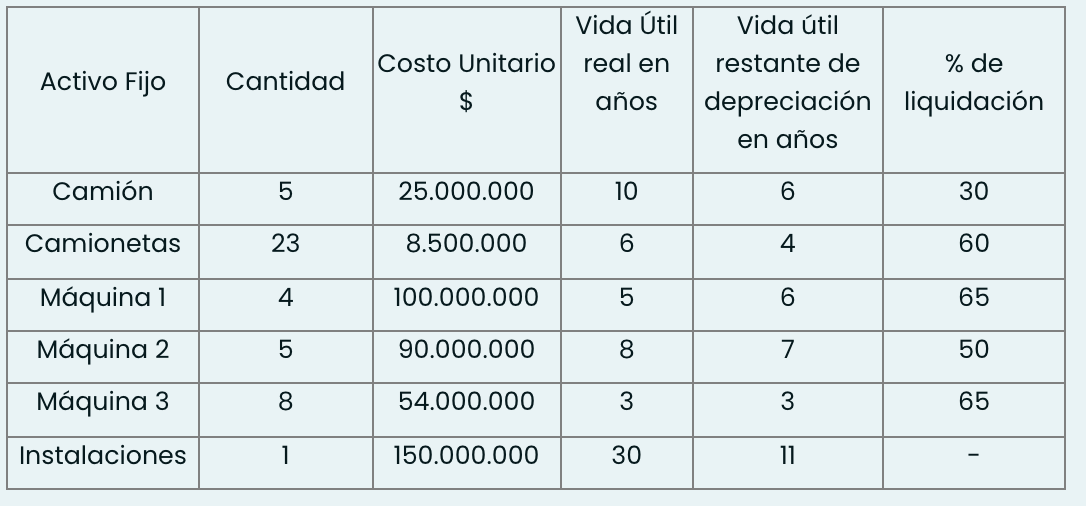

The company spends $1,000,000,000 in annual salaries. In addition to administrative expenses that reach $150,000,000 annually. Fines for environmental contamination corresponding to 20% of annual production. Fixed assets have the following life conditions.

TRANSLATION OF THE TABLE:

Fixed Assets / Quantity / Unit Cost $ / Actual useful life in years / Remaining useful life of depreciation in years / % settlement

Truck

Van

Machine 1

Machine 2

Machine 3

Installations

The company has a discount rate of 10% and projects that the average annual production will be 120,000 metric tons, at an average sales value of $80,000 per metric ton and a variable cost of $60,500 per metric ton. These values were evaluated for a horizon of 8 years. Consider selling the assets at the end of their designated depreciation life and not investing again. Consider a working capital amounting to 40% of the costs of the first year, non-recoverable.

On the other hand, there is the following investment alternative:

INVESTMENT ALTERNATIVE.

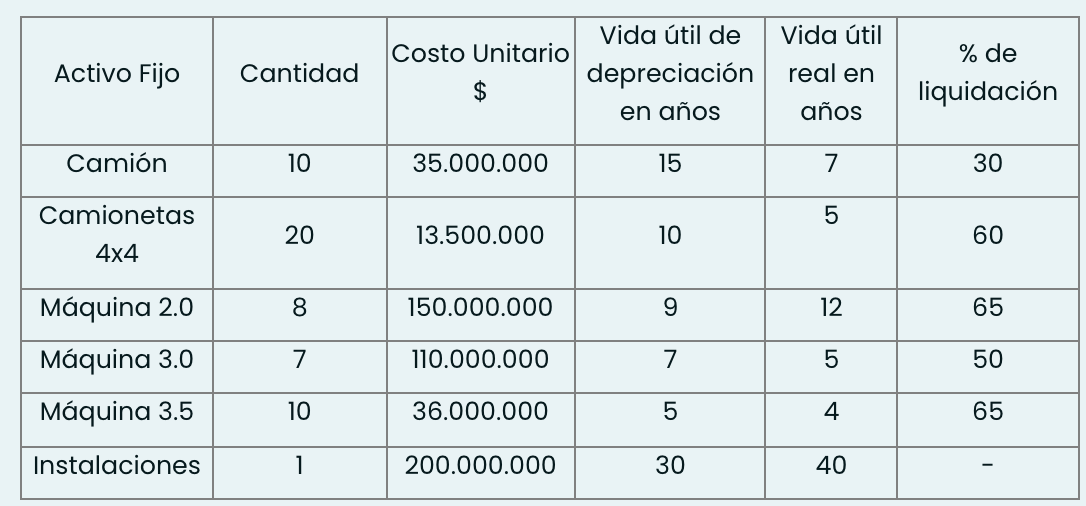

Sell fixed assets today at 50% liquidation value for all. This will bring investment in new machinery of better quality and that will reduce environmental quality by 10% compared to the current one. The investment is as follows:

Production will increase by 8% each year from the first year with respect to the current situation, variable costs are reduced by 5% per year until year 5 and then remain fixed until evaluation period 10. The working capital would be 15% of the disbursable expenses of the first year, non-recoverable.

Fixed and administrative costs remain as stated in the current situation of the company.

It should also be considered:

i) Assets are changed when they reach their actual useful life.

ii) The released assets must be valued and considered as income.

iii) The scrap value of the project must be calculated by the economic method

iv) A tax is considered to be 27%

v) Banco de Chile proposes that you borrow 70% of the investment in fixed assets with a company loan, at a real annual interest rate of 1.5%, for 10 years.

1) Investment Alternative Financial Cash Flow 2) At what price should you sell the ton to obtain a NPV of $100,000,000,000? 3) Deliver an analysis and comparative table of results point 1 and 2.

Activo Fijo Camin Camionetas Mquina 1 Mquina 2 Mquina 3 Instalaciones Cantidad 5 23 4 5 8 1 Costo Unitario $ 25.000.000 8.500.000 100.000.000 90.000.000 54.000.000 150.000.000 Vida til real en aos 10 6 5 8 3 30 Vida til restante de depreciacin en aos 6 4 6 7 3 11 % de liquidacin 30 60 65 50 65 I Activo Fijo Camin Camionetas 4x4 Mquina 2.0 Mquina 3.0 Mquina 3.5 Instalaciones Cantidad 10 20 8 7 10 1 Costo Unitario $ 35.000.000 13.500.000 150.000.000 110.000.000 36.000.000 200.000.000 Vida til de depreciacin en aos 15 10 9 7 5 30 Vida til real en aos 7 5 12 5 4 40 % de liquidacin 30 60 65 50 65 I Activo Fijo Camin Camionetas Mquina 1 Mquina 2 Mquina 3 Instalaciones Cantidad 5 23 4 5 8 1 Costo Unitario $ 25.000.000 8.500.000 100.000.000 90.000.000 54.000.000 150.000.000 Vida til real en aos 10 6 5 8 3 30 Vida til restante de depreciacin en aos 6 4 6 7 3 11 % de liquidacin 30 60 65 50 65 I Activo Fijo Camin Camionetas 4x4 Mquina 2.0 Mquina 3.0 Mquina 3.5 Instalaciones Cantidad 10 20 8 7 10 1 Costo Unitario $ 35.000.000 13.500.000 150.000.000 110.000.000 36.000.000 200.000.000 Vida til de depreciacin en aos 15 10 9 7 5 30 Vida til real en aos 7 5 12 5 4 40 % de liquidacin 30 60 65 50 65Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started