Question

Windsor Co. is a global manufacturer of printing and imaging equipment. It is now considering the purchase and installation of new automated machinery to recycle

- Windsor Co. is a global manufacturer of printing and imaging equipment. It is now considering the purchase and installation of new automated machinery to recycle and remanufacture toner- and printer cartridges. The companys current recycling process consists of a sequence of operations carried out almost entirely by hand, with the help of hand tools and a simple machine. The investment proposal calls for replacing this process with new automated machinery that costs an estimated 3.5 million dollars fully installed.

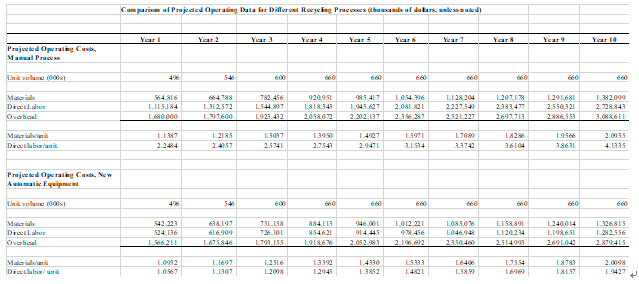

The new equipment could process the companys projected volume using fewer employees, resulting in savings of both direct labor and training costs. It also would require only minimal maintenance expenditures compared to the equipment it replaces, and no significant change in working capital. The following table compares projected operating data for the existing recycling process and the proposed automated process, assuming an inflation of 7% per year.

The new equipment would have a useful life of 10 years and would be depreciated under the straight-line method for both tax and financial reporting purposes. Salvage value is likely to equal disposal costs at the end of the useful life. The manual equipment being replaced would last many more years. Currently, it has a book value of 250,000 dollars, and three years of straight-line depreciation remaining. However, its market value is thought to be at about 175,000 dollars. The firms tax rate is 35%.

- Calculate the free cash flows each year associated with this proposed investment.

- If the discount rate is 12%, should the company go ahead with the proposal?

- If the discount rate is 25%, is the proposal still acceptable? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started