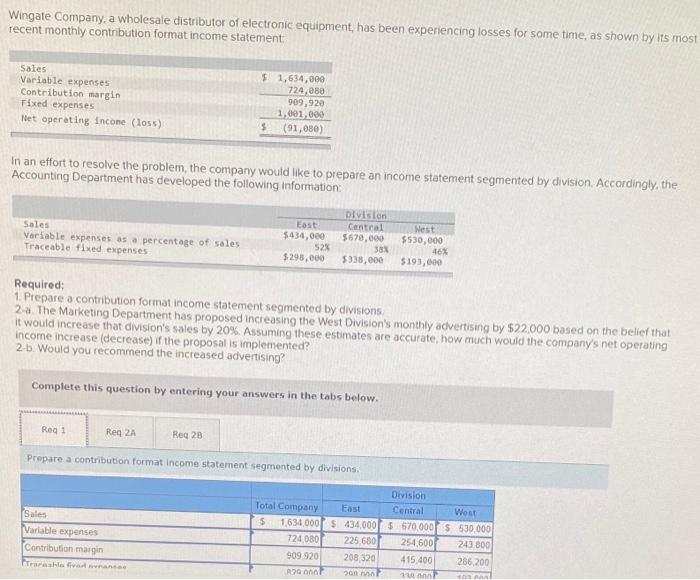

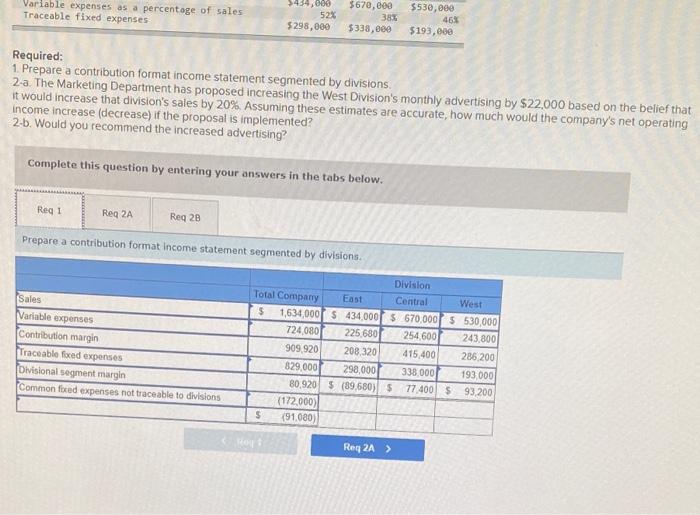

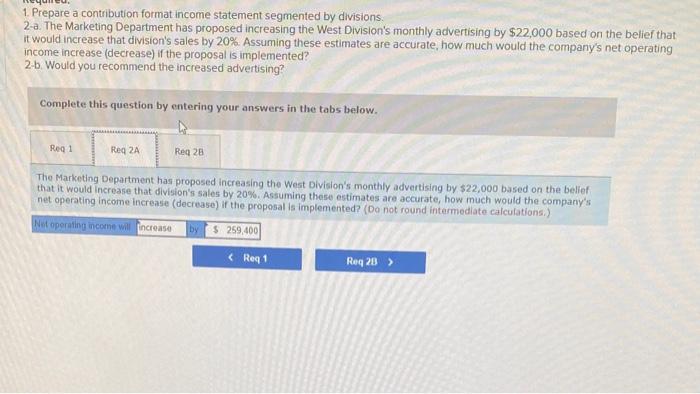

Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) $1,634,000 724,080 909,920 1.001,000 $ (91,880) In an effort to resolve the problem, the company would like to prepare an income statement segmented by division. Accordingly, the Accounting Department has developed the following information Sales Variable expenses as a percentage of sales Traceable fixed expenses East 5434,000 52% $ 298,000 Division Central $670,000 38% 5338,000 West $530,000 46% $195,000 Required: 1. Prepare a contribution format income statement segmented by divisions 2-a. The Marketing Department has proposed increasing the West Division's monthly advertising by $22,000 based on the belief that it would increase that division's sales by 20%. Assuming these estimates are accurate, how much would the company's net operating income increase (decrease) If the proposal is implemented? 2b. Would you recommend the increased advertising Complete this question by entering your answers in the tabs below. Reg1 Req 2A Reg 20 Prepare a contribution format income statement segmented by divisions. Sales Variable expenses Contribution margin Division Total Company East Central West 5 1634 000 $ 434.000 5 570.000 $ 530,000 724060 225 680 254,6001 243.800 909 920 208 320 415.400 286,200 Ronal 10 ml 10 Variable expenses as a percentage of sales Traceable fixed expenses 5439.000 52% $298,000 5670, eee 383 5338,800 $530,000 465 $193,000 Required: 1. Prepare a contribution format income statement segmented by divisions. 2-a The Marketing Department has proposed increasing the West Division's monthly advertising by $22,000 based on the belief that it would increase that division's sales by 20% Assuming these estimates are accurate, how much would the company's net operating Income increase (decrease) if the proposal is implemented? 2-6. Would you recommend the increased advertising? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 2B Prepare a contribution format Income statement segmented by divisions Sales Variable expenses Contribution margin fraceable foed expenses Divisional segment margin Common foued expenses not traceable to divisions Division Total Company East Central West $ 1,634,0001 5 4340001 5 670,000 5 530,000 724 080 225.680 254 600 243,800 909.920 208 320 415.400 286 200 829,000 298,000 338.000 193 000 80.920 5 (89,680) 5 77.400 593 200 (172,000) 5 (91.080) Req2A > 1. Prepare a contribution format income statement segmented by divisions. 2-a. The Marketing Department has proposed increasing the West Division's monthly advertising by $22,000 based on the belief that it would increase that division's sales by 20%. Assuming these estimates are accurate, how much would the company's net operating income increase (decrease) if the proposal is implemented? 2b. Would you recommend the increased advertising? Complete this question by entering your answers in the tabs below. Reg1 Red 2A Reg 28 The Marketing Department has proposed increasing the West Division's monthly advertising by $22,000 based on the belief that it would increase that division's sales by 20%. Assuming these estimates are accurate, how much would the company's net operating income increase (decrease) ir the proposal is implemented? (Do not round intermediate calculations.) Net operating income will increase $ 259,400 by