Answered step by step

Verified Expert Solution

Question

1 Approved Answer

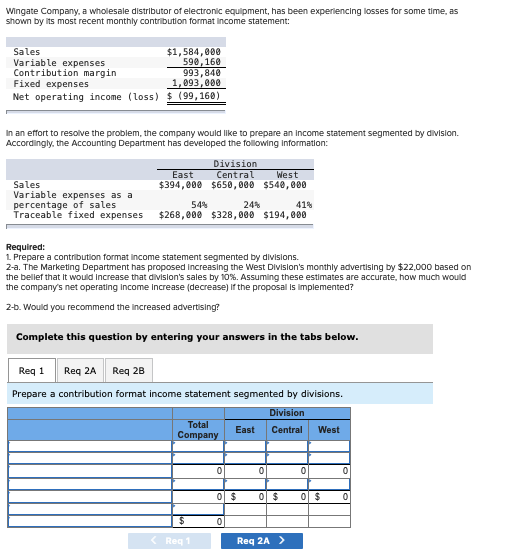

Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for some time, as shown by its most recent monthly contribution format

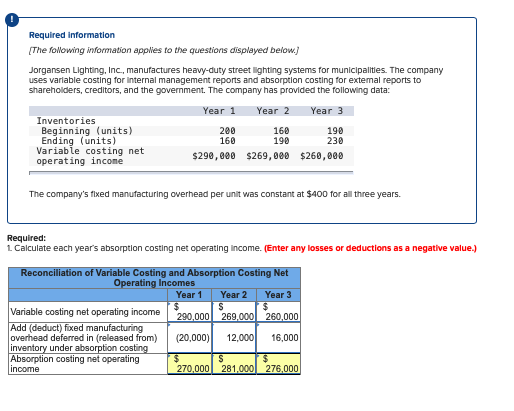

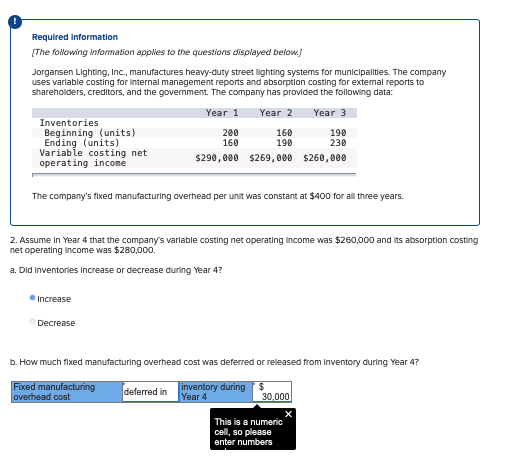

Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement: Sales Variable expenses Contribution margin $1,584,000 590,160 993,840 Fixed expenses 1,093,000 Net operating income (loss) $ (99,160) In an effort to resolve the problem, the company would like to prepare an income statement segmented by division. Accordingly, the Accounting Department has developed the following information: Sales Variable expenses as a percentage of sales Traceable fixed expenses Division Central East West $394,000 $650,000 $540,000 54% 41% $268,000 $328,000 $194,000 Required: 1. Prepare a contribution format income statement segmented by divisions. 2-a. The Marketing Department has proposed increasing the West Division's monthly advertising by $22,000 based on the belief that it would increase that division's sales by 10%. Assuming these estimates are accurate, how much would the company's net operating income increase (decrease) If the proposal is implemented? 2-b. Would you recommend the Increased advertising? Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Prepare a contribution format income statement segmented by divisions. Division Central West Total Company $ < Req 1 0 24% 0 $ 0 East 0 0 $ Req 2A > 0 0 $ 0 0 Required information [The following information applies to the questions displayed below.] Jorgansen Lighting, Inc., manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: Year 1 Year 2 Year 3 200 160 160 190 190 230 $290,000 $269,000 $260,000 Inventories Beginning (units) Ending (units) Variable costing net operating income The company's fixed manufacturing overhead per unit was constant at $400 for all three years. Required: 1. Calculate each year's absorption costing net operating income. (Enter any losses or deductions as a negative value.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Variable costing net operating income Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing Absorption costing net operating income Year 2 S 290,000 269,000 (20,000) 12,000 $ 270,000 $ 281,000 Year 3 $ 260,000 16,000 $ 276,000 Required information [The following information applies to the questions displayed below.] Jorgansen Lighting, Inc., manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: Year 1 Year 2 Year 3 160 190 230 190 $269,000 $260,000 Inventories Beginning (units) Ending (units) Variable costing net operating income The company's fixed manufacturing overhead per unit was constant at $400 for all three years. 2. Assume In Year 4 that the company's variable costing net operating income was $260,000 and its absorption costing net operating income was $280,000. a. Did Inventories increase or decrease during Year 4? Increase 200 160 $290,000 Decrease b. How much fixed manufacturing overhead cost was deferred or released from inventory during Year 4? Fixed manufacturing overhead cost inventory during $ Year 4 deferred in 30,000 This is a numeric cell, so please enter numbers X

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Req 1 Contribution format income statement segmented by divisions Req 2a Increase in net operating i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started