Question

Winkle, Kotter, and Zale is a small law firm that contains 10 partners and 12 support persons. The firm employs a job-order costing system to

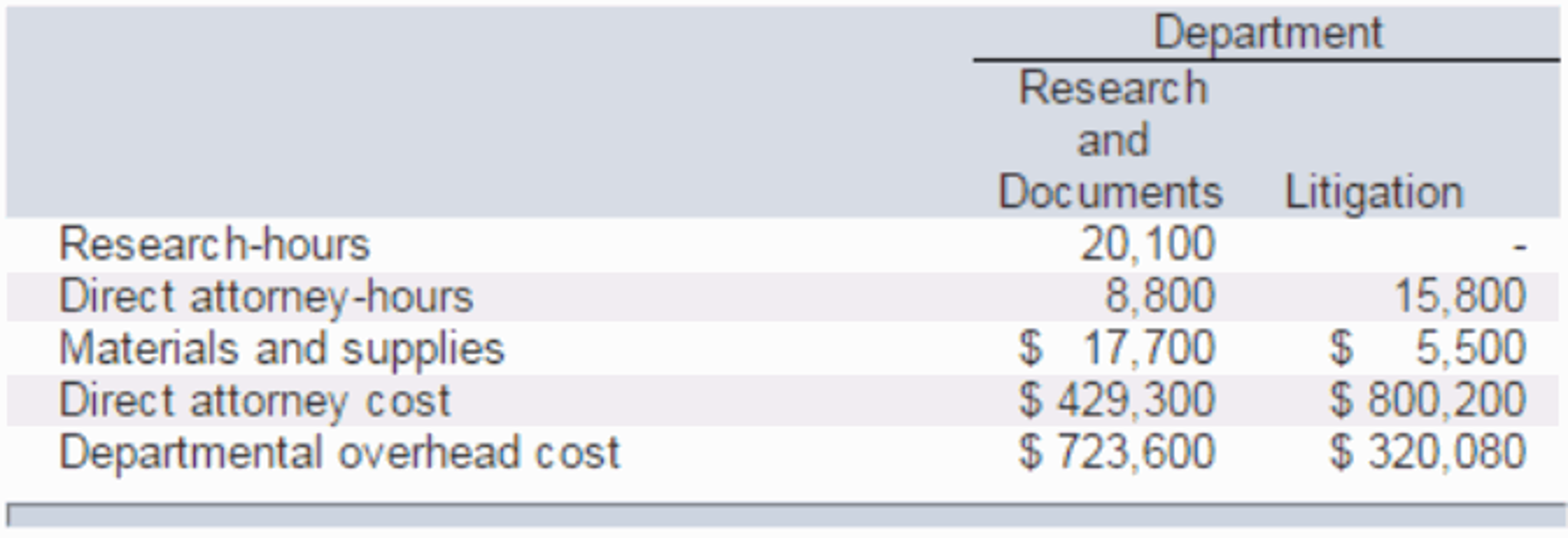

Winkle, Kotter, and Zale is a small law firm that contains 10 partners and 12 support persons. The firm employs a job-order costing system to accumulate costs chargeable to each client, and it is organized into two departmentsthe Research and Documents Department and the Litigation Department. The firm uses predetermined overhead rates to charge the costs of these departments to its clients. At the beginning of the current year, the firm's management made the following estimates for the year:

The predetermined overhead rate in the Research and Documents Department is based on research-hours, and the rate in the Litigation Department is based on direct attorney cost.

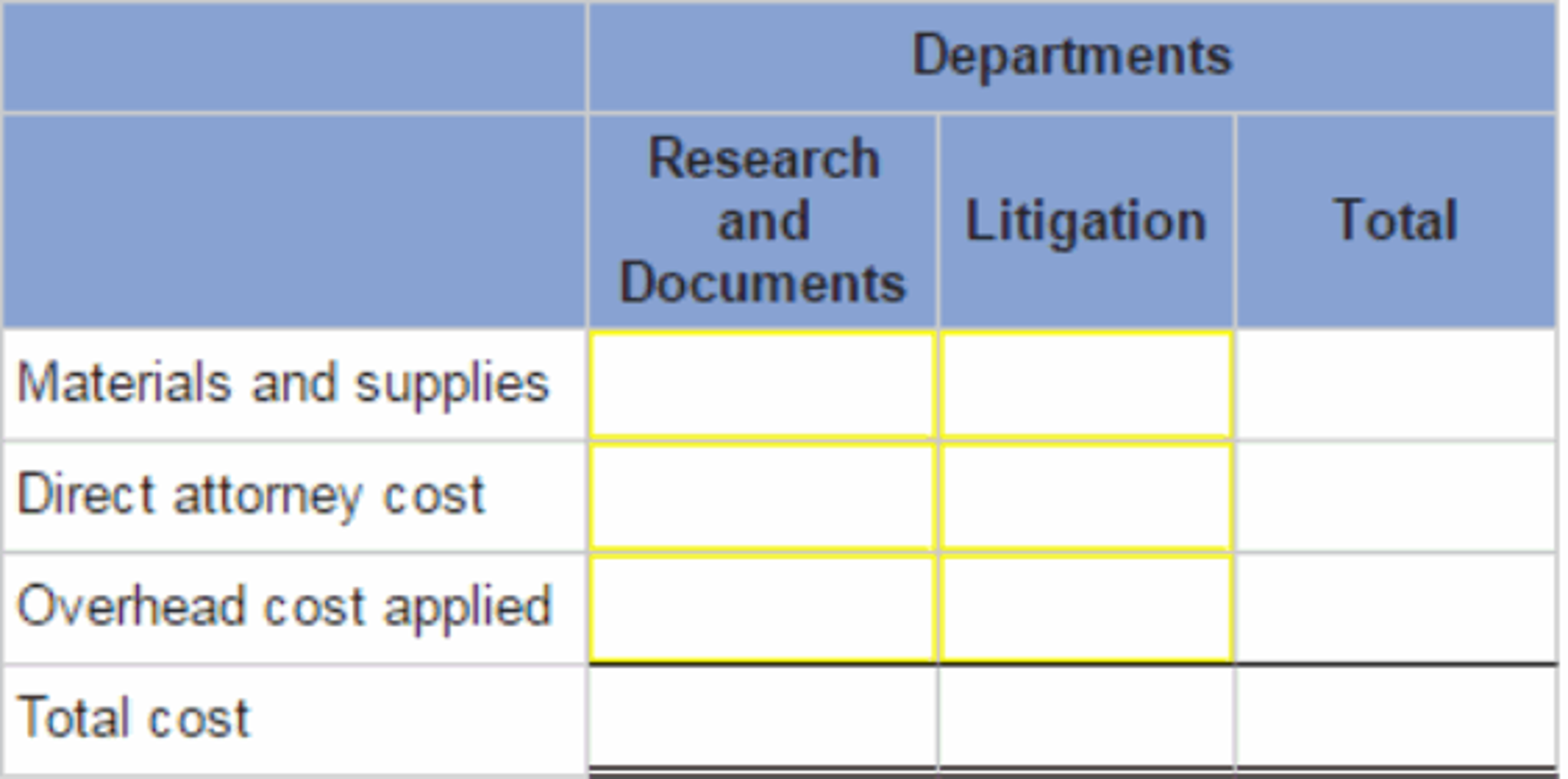

The costs charged to each client are made up of three elements: materials and supplies used, direct attorney costs incurred, and an applied amount of overhead from each department in which work is performed on the case.

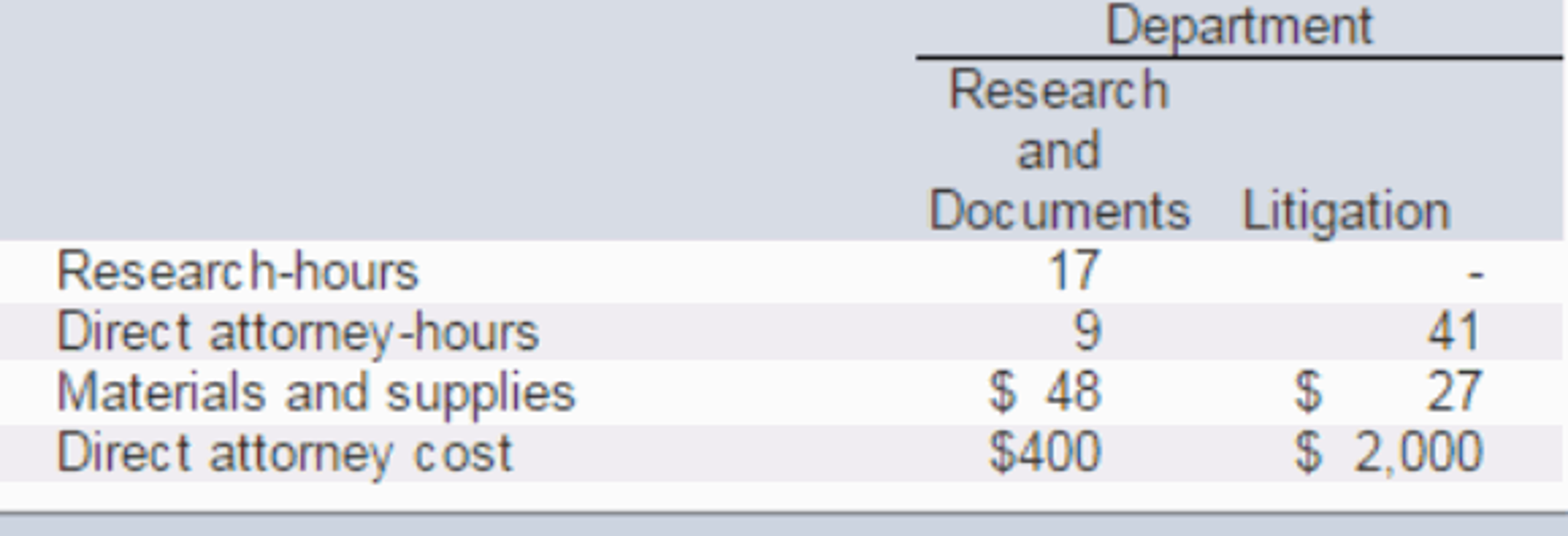

Case 618-3 was initiated on February 10 and completed on June 30. During this period, the following costs and time were recorded on the case:

Question 1A: Compute the predetermined overhead rate used during the year in the Research and Documents Department.

Question 1A: Compute the predetermined overhead rate used during the year in the Research and Documents Department.

Question 1B: Compute the predetermined overhead rate used during the year in the Litigation Department.

Question 2: Using the rates you computed in (1) above, compute the total overhead cost applied to Case 6183.

Question 3: What would be the total cost charged to Case 6183? Show computations by department and in total for the case.

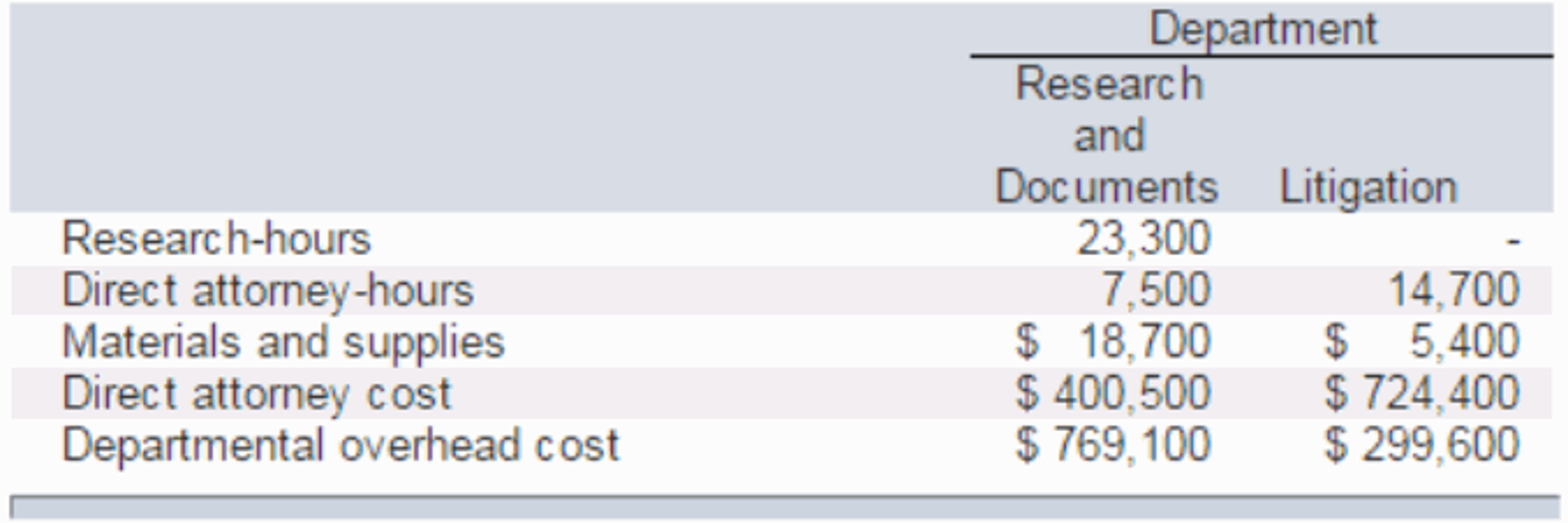

At the end of the year, the firms records revealed the following actual cost and operating data for all cases handled during the year:

At the end of the year, the firms records revealed the following actual cost and operating data for all cases handled during the year:

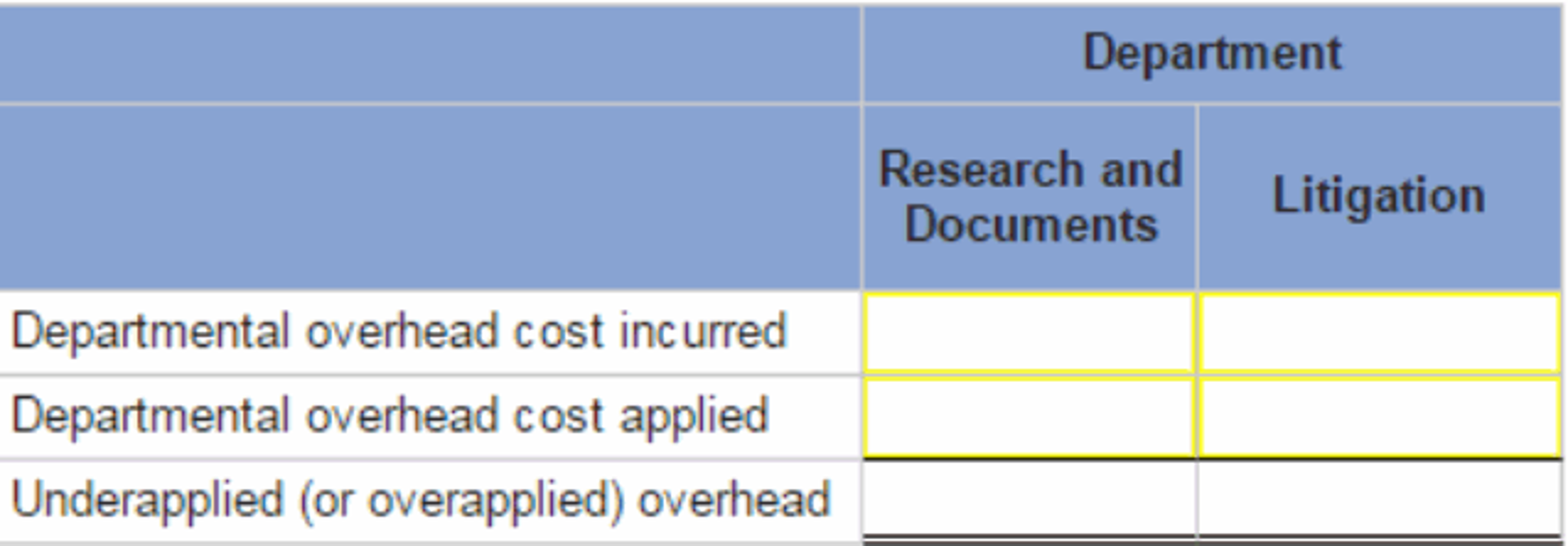

Question 4: Determine the amount of underapplied or overapplied overhead cost in each department for the year.

Question 4: Determine the amount of underapplied or overapplied overhead cost in each department for the year.

Updated, hope this works.

Department Researc and Documents Litigation Research-hours Direct attorney-hours Materials and supplies Direct attorney cost Departmental overhead cost 20,100 15,800 $ 17,700 5,500 $429,300 800,200 $723,600 320,080 8,800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started