Answered step by step

Verified Expert Solution

Question

1 Approved Answer

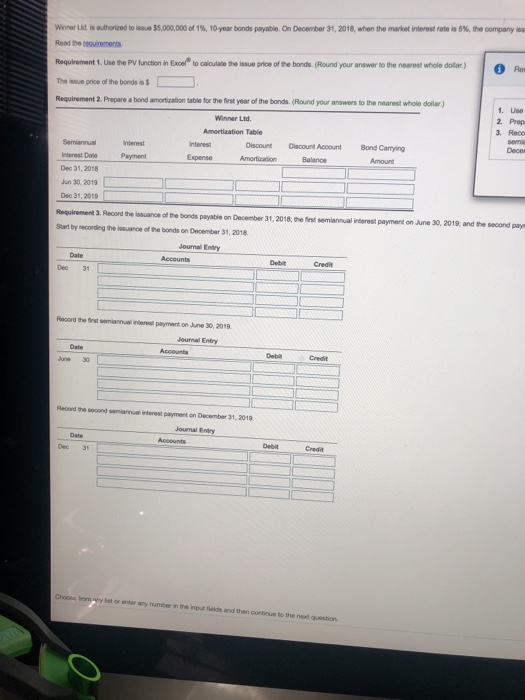

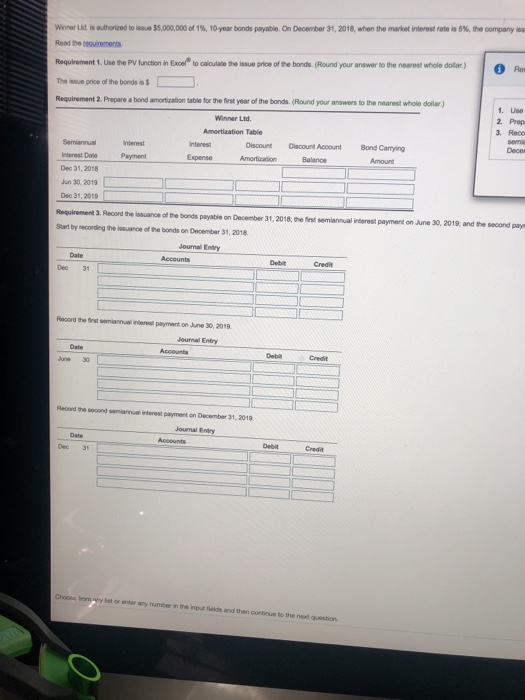

winner ltd is authorized to issue $5,000,000 of 1% 10 year bonds payable . on december 31st 2018 when the market interest rate is 5%

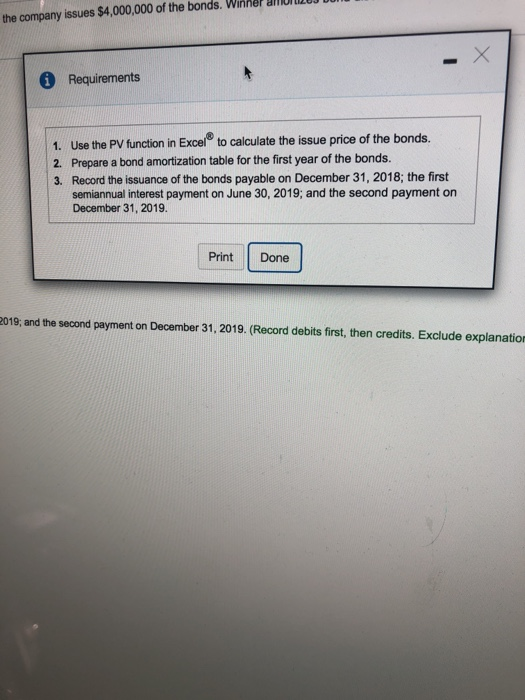

winner ltd is authorized to issue $5,000,000 of 1% 10 year bonds payable . on december 31st 2018 when the market interest rate is 5% the company issues $4,000,000 of the bonds. winner amortizes bond discount using the effective interest method. the semiannual interest dates are june 30 and december 31.

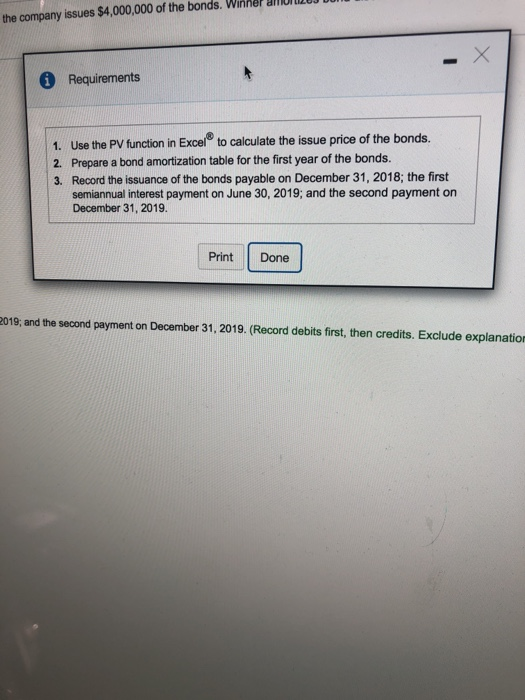

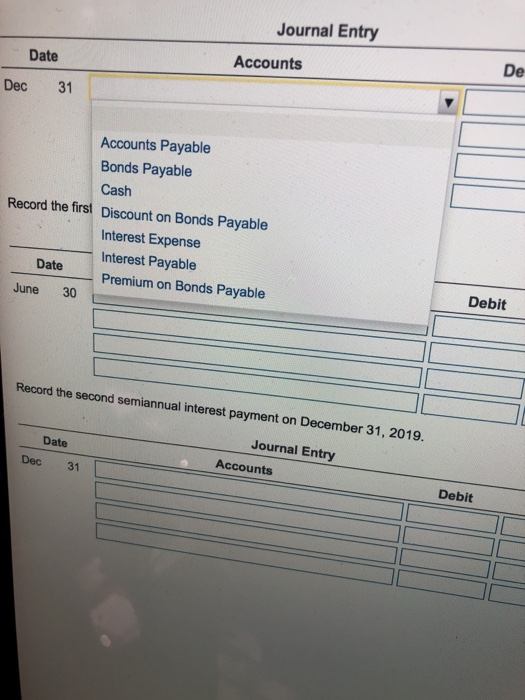

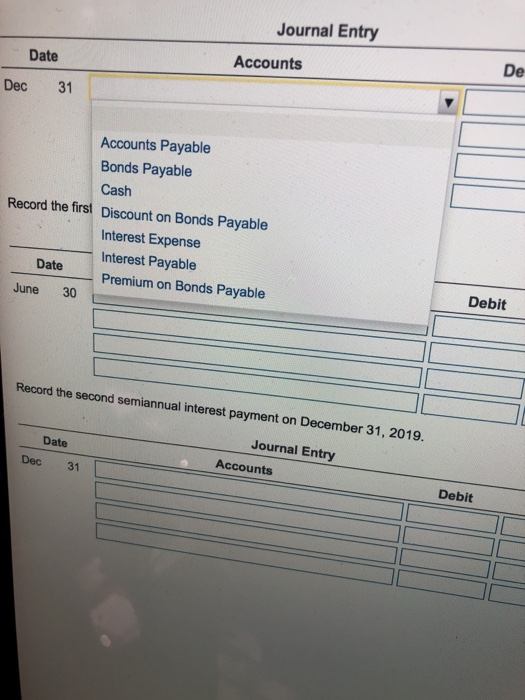

Werer Lld is"thorized toiss" S5,000,000 of 1%, 10year bonds payable. December 31, 2018, when the market nte esrae a sk me oompany is Read the quirements Requirement 1. Use the PV function in Excel t The issue price of the bonds is Requirement 2 Prepare a bond amortication table for the first year of the bonds. (Round your answers to the nearest whole dollax) to caloulabe the issue price of the bonds. (Round your answer to the nearest whole dolar) 1. Use 2. Prep 3. Reco Winner Ltd Amortization Table Discount Discount Account Bond Carrying nterest Interest eterest Dal Dec 31, 2018 Jun 30, 2019 Dec 31, 2019 Amount Expense Requirement 3. Reord the issuance of the bonds payablie on December 31, 2018, the first semiannual inberest payment on June 30 Start by necording the issuance of the bonds on December 31, 2018 2019 and the second pays Journal Entry Date Debit Credit Dec 31 Racord the first semiannual interest payment on June 30, 2018 ournal Entry Date Credit June 30 Reoord the second semiannual interest payment on December 31, 2019 Journal Entry Credit Dec 3 ist er onter any nmeer in the rout fialds 0 then continuo to the next qmton the company issues $4,000,000 of the bonds. Winner aMOIOS Requirements 1. Use the PV function in Excel to calculate the issue price of the bonds. 2. Prepare a bond amortization table for the first year of the bonds. Record the issuance of the bonds payable on December 31, 2018; the first semiannual interest payment on June 30, 2019; and the second payment on December 31, 2019. 3. Print Done 2019, and the second payment on December 31, 2019. (Record debits first, then credits. Exclude explanatio Journal Entry De Accounts Date Dec 31 Accounts Payable Bonds Payable Cash Record the first Discount on Bonds Payable Interest Expense Interest Payable Date Premium on Bonds Payable June 30 Debit Record the second semiannual interest payment on December 31, 2019. Journal Entry Date Accounts Dec 31 Debit ID

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started