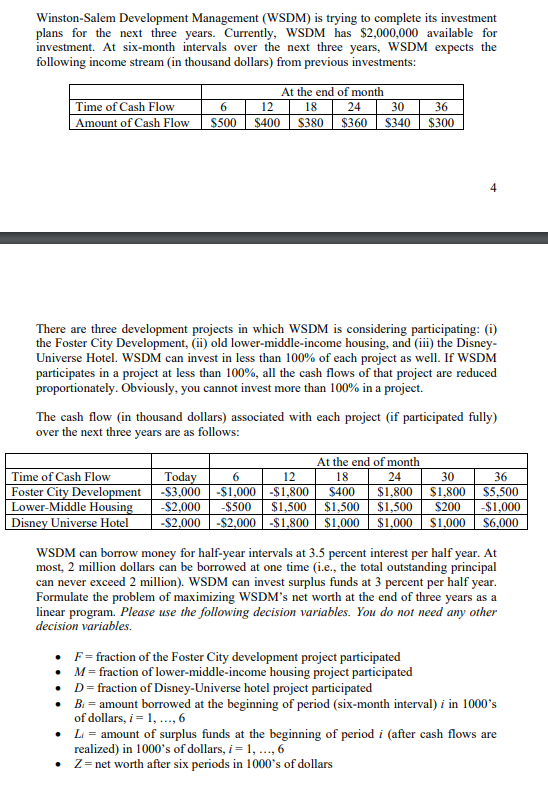

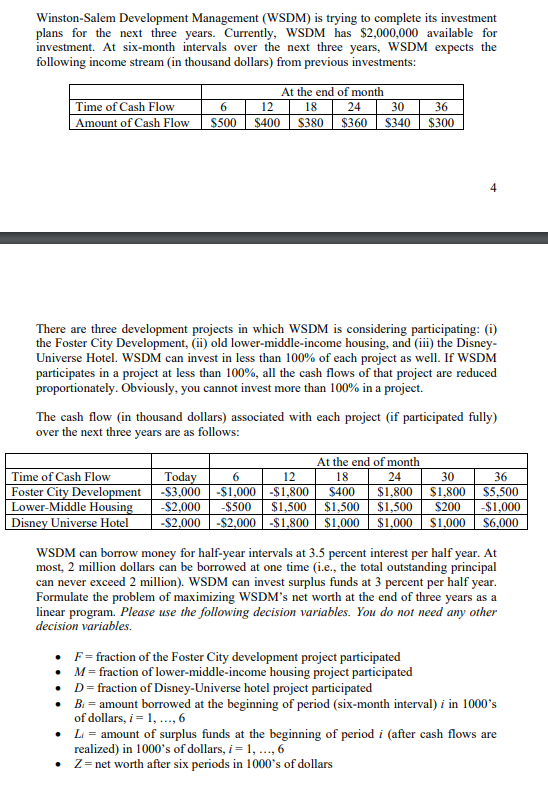

Winston-Salem Development Management (WSDM) is trying to complete its investment plans for the next three years. Currently, WSDM has $2,000,000 available for investment. At six-month intervals over the next three years, WSDM expects the following income stream (in thousand dollars) from previous investments: At the end of month Time of Cash Flow 6 12 18 24 30 36 Amount of Cash Flow $500 $400 $380 $360 S340 $300 4 There are three development projects in which WSDM is considering participating: (1) the Foster City Development, (ii) old lower-middle-income housing, and (iii) the Disney- Universe Hotel. WSDM can invest in less than 100% of each project as well. If WSDM participates in a project at less than 100%, all the cash flows of that project are reduced proportionately. Obviously, you cannot invest more than 100% in a project. The cash flow (in thousand dollars) associated with each project (if participated fully) over the next three years are as follows: At the end of month Time of Cash Flow Today 6 12 18 24 30 36 Foster City Development $3,000-$1,000-$1,800 $400 $1,800 $1,800 $5,500 Lower-Middle Housing $2,000 -$500 $1,500 $1,500 $1,500 $200 -$1,000 Disney Universe Hotel -$2,000-$2,000-$1,800 $1,000 $1,000 $1,000 $6,000 WSDM can borrow money for half-year intervals at 3.5 percent interest per half year. At most, 2 million dollars can be borrowed at one time (i.e., the total outstanding principal can never exceed 2 million). WSDM can invest surplus funds at 3 percent per half year. Formulate the problem of maximizing WSDM's net worth at the end of three years as a linear program. Please use the following decision variables. You do not need any other decision variables. F=fraction of the Foster City development project participated M=fraction of lower-middle-income housing project participated D= fraction of Disney-Universe hotel project participated Bi = amount borrowed at the beginning of period (six-month interval) i in 1000's of dollars, i = 1, ..., 6 Li = amount of surplus funds at the beginning of period i (after cash flows are realized) in 1000's of dollars, i = 1, ..., 6 Z=net worth after six periods in 1000's of dollars Winston-Salem Development Management (WSDM) is trying to complete its investment plans for the next three years. Currently, WSDM has $2,000,000 available for investment. At six-month intervals over the next three years, WSDM expects the following income stream (in thousand dollars) from previous investments: At the end of month Time of Cash Flow 6 12 18 24 30 36 Amount of Cash Flow $500 $400 $380 $360 S340 $300 4 There are three development projects in which WSDM is considering participating: (1) the Foster City Development, (ii) old lower-middle-income housing, and (iii) the Disney- Universe Hotel. WSDM can invest in less than 100% of each project as well. If WSDM participates in a project at less than 100%, all the cash flows of that project are reduced proportionately. Obviously, you cannot invest more than 100% in a project. The cash flow (in thousand dollars) associated with each project (if participated fully) over the next three years are as follows: At the end of month Time of Cash Flow Today 6 12 18 24 30 36 Foster City Development $3,000-$1,000-$1,800 $400 $1,800 $1,800 $5,500 Lower-Middle Housing $2,000 -$500 $1,500 $1,500 $1,500 $200 -$1,000 Disney Universe Hotel -$2,000-$2,000-$1,800 $1,000 $1,000 $1,000 $6,000 WSDM can borrow money for half-year intervals at 3.5 percent interest per half year. At most, 2 million dollars can be borrowed at one time (i.e., the total outstanding principal can never exceed 2 million). WSDM can invest surplus funds at 3 percent per half year. Formulate the problem of maximizing WSDM's net worth at the end of three years as a linear program. Please use the following decision variables. You do not need any other decision variables. F=fraction of the Foster City development project participated M=fraction of lower-middle-income housing project participated D= fraction of Disney-Universe hotel project participated Bi = amount borrowed at the beginning of period (six-month interval) i in 1000's of dollars, i = 1, ..., 6 Li = amount of surplus funds at the beginning of period i (after cash flows are realized) in 1000's of dollars, i = 1, ..., 6 Z=net worth after six periods in 1000's of dollars