Answered step by step

Verified Expert Solution

Question

1 Approved Answer

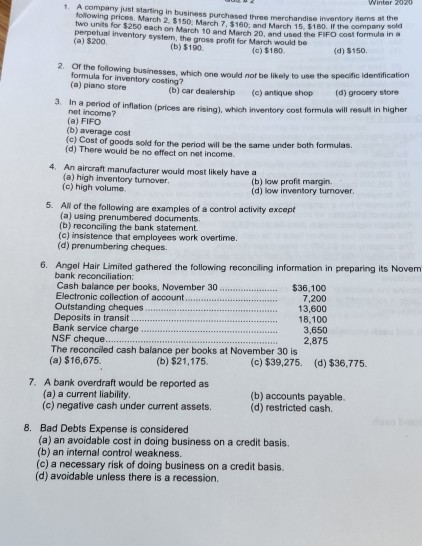

Winter 2020 1. A company just starting in business purchased the merchandise inventory Rems at the following prices March 2. $150 March 7. $160 and

Winter 2020 1. A company just starting in business purchased the merchandise inventory Rems at the following prices March 2. $150 March 7. $160 and March 15 $180, the companys two units for $250 each on March 10 and March 20 and used the FIFO cost formula in perpetual inventory system, the gross profit for March would be (a) $200 (b) $100 (a) $180. (d) 5150 2 of the following businesses, which one would not be likely to use the specific identification formula for inventory costing? (a) piano store (b) car dealership (c) antique shop (d) grocery store 3 In a period of inflation (prices are risinal which inventory cost formula will result in higher net income? (a) FIFO (b) average cost (c) Cost of goods sold for the period will be the same under both formulas (d) There would be no effect on net income 4. An aircraft manufacturer would most likely have a (a) high inventory turnover (b) low profit margin. (c) high volume (d) low inventory turnover. 5. All of the following are examples of a control activity except (a) using prenumbered documents (b) reconciling the bank statement. (c) insistence that employees work overtime. (d) prenumbering cheques. Angel Hair Limited gathered the following reconciling information in preparing its Novem bank reconciliation: Cash balance per books, November 30...................... $36,100 Electronic collection of account.......... 7,200 Outstanding cheques........ 13,600 Deposits in transit. 18.100 Bank service charge.. .. 3.650 NSF cheque..... 2,875 The reconciled cash balance per books at November 30 is (a) $16,675. (b) $21,175. (c) $39,275. (d) $36,775. 7. A bank overdraft would be reported as (a) a current liability (c) negative cash under current assets. (b) accounts payable (d) restricted cash. 8. Bad Debts Expense is considered (a) an avoidable cost in doing business on a credit basis. (b) an internal control weakness. (c) a necessary risk of doing business on a credit basis. (d) avoidable unless there is a recession

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started