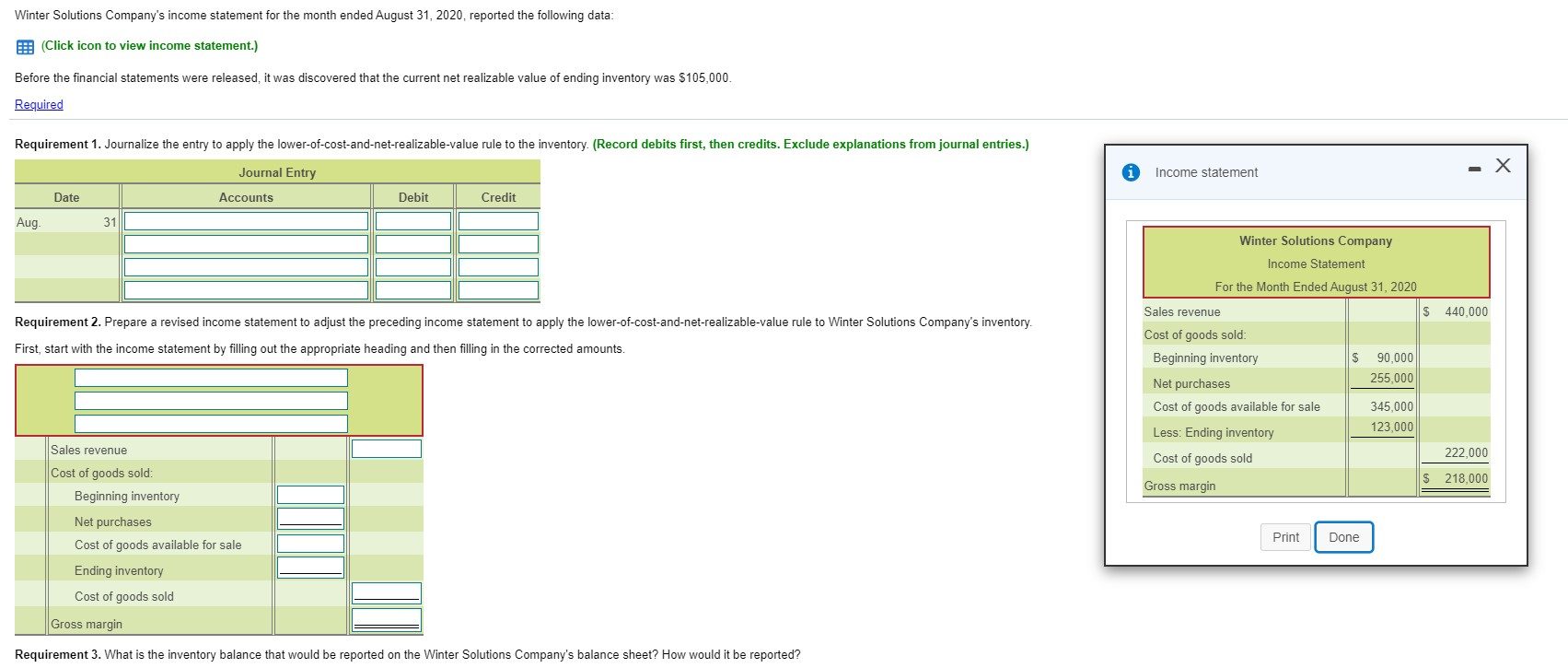

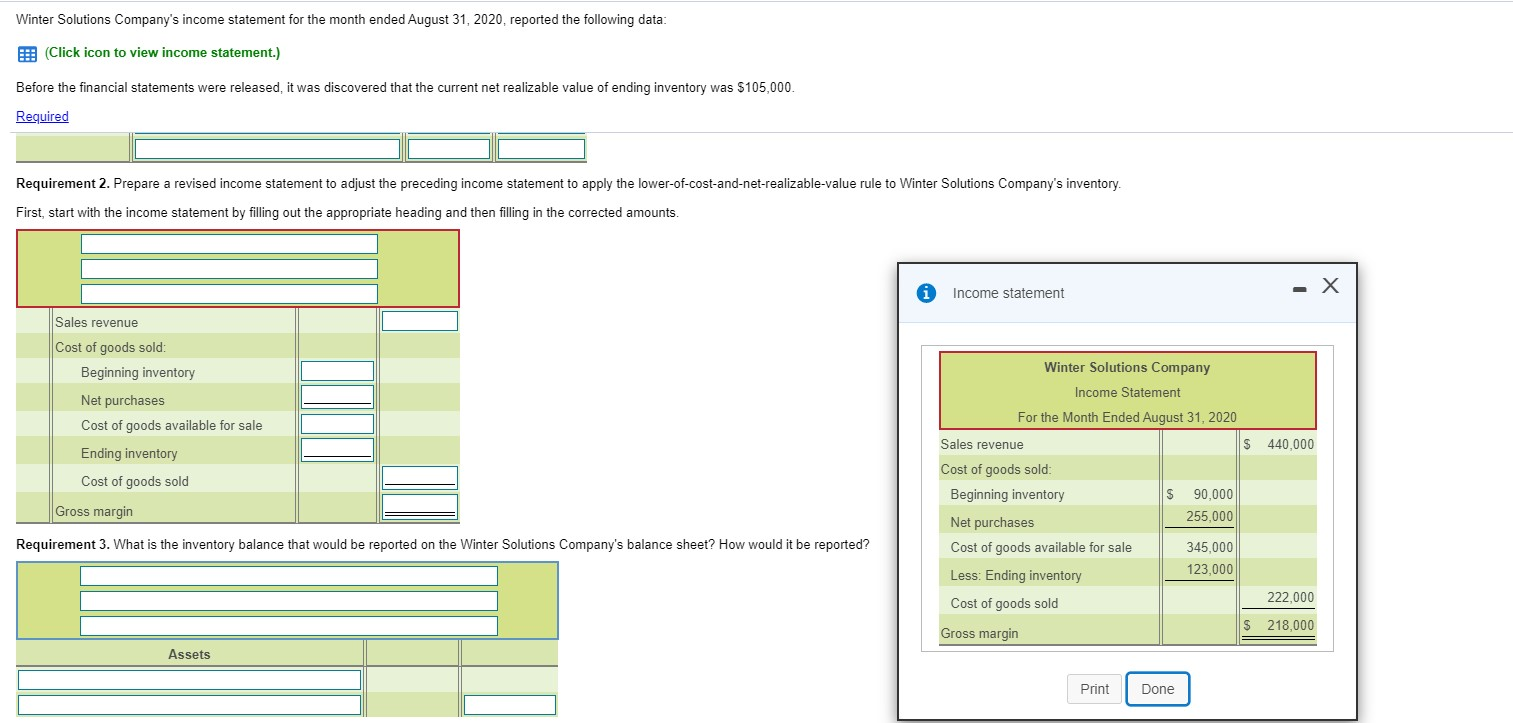

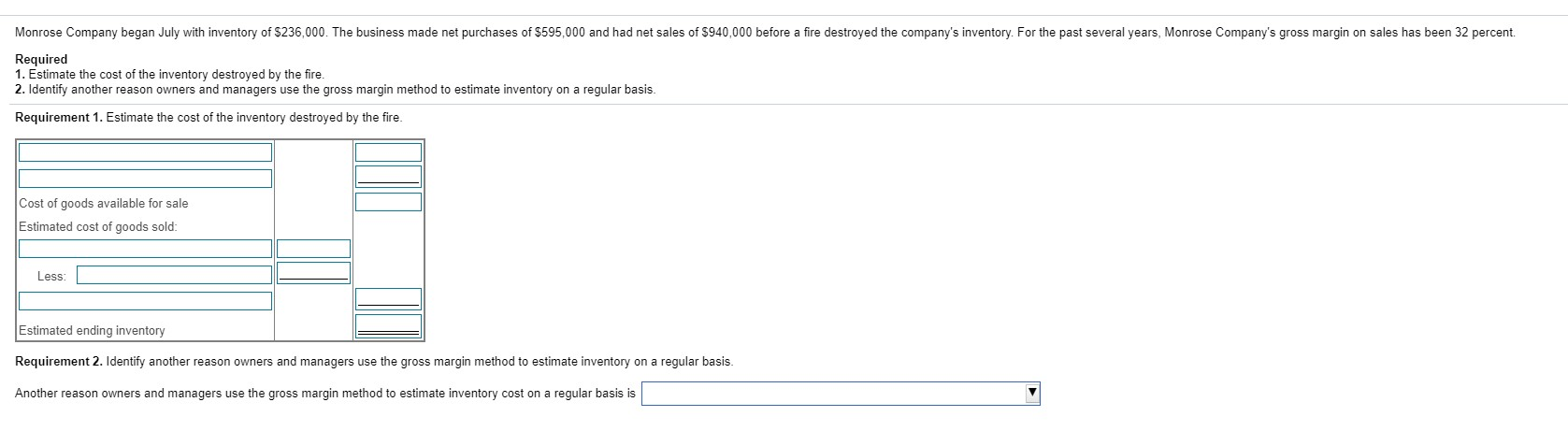

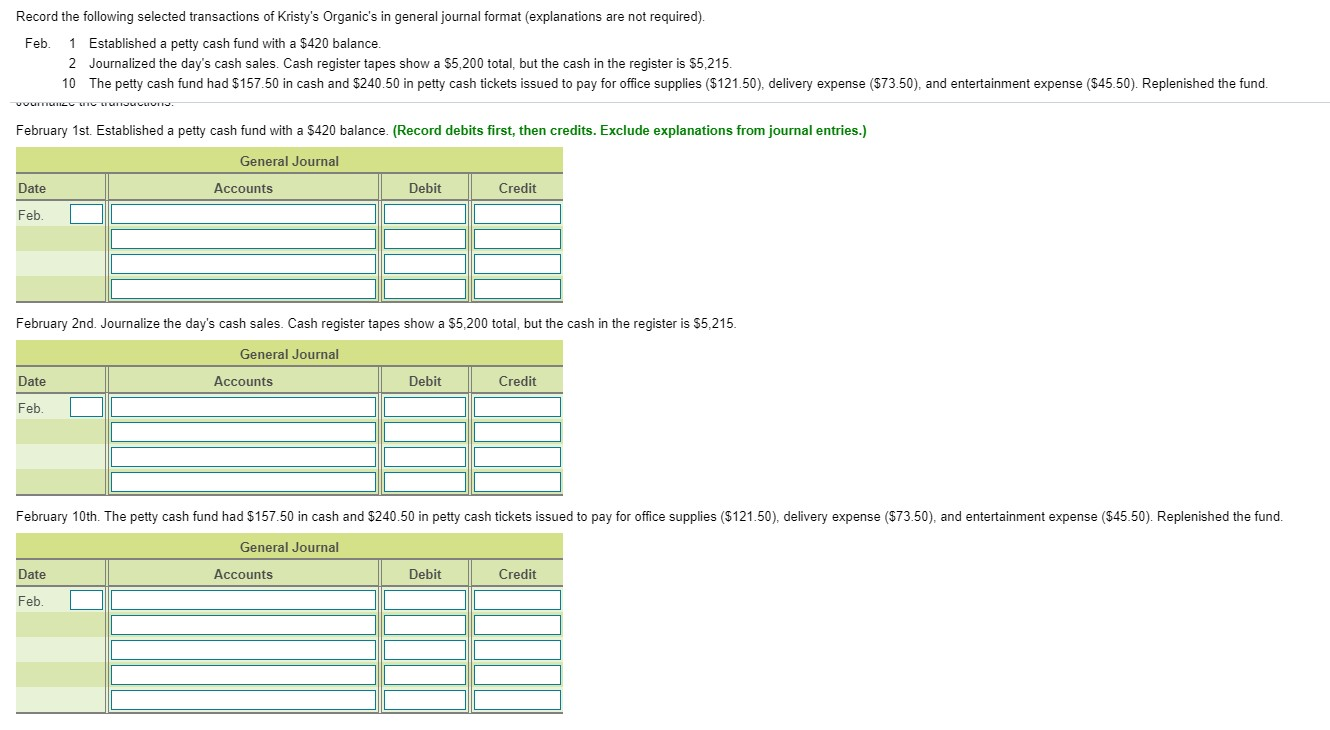

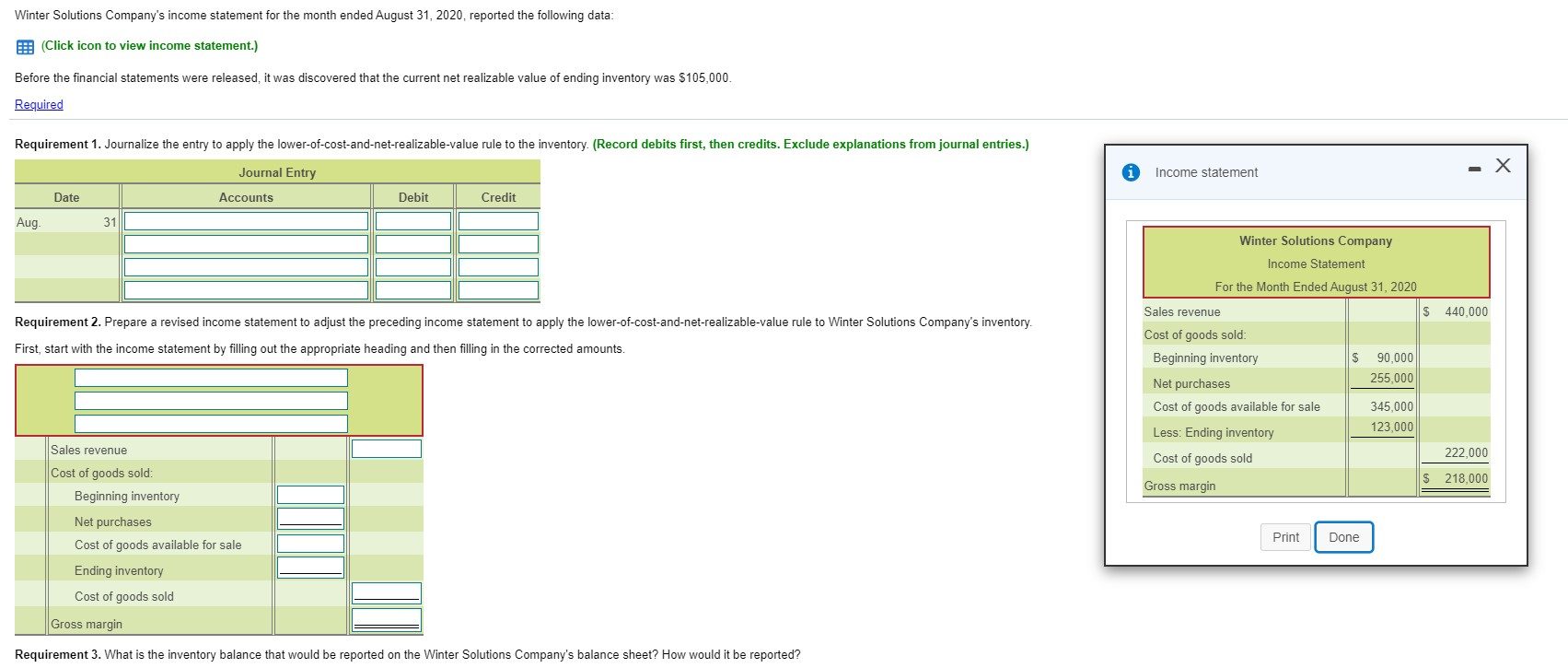

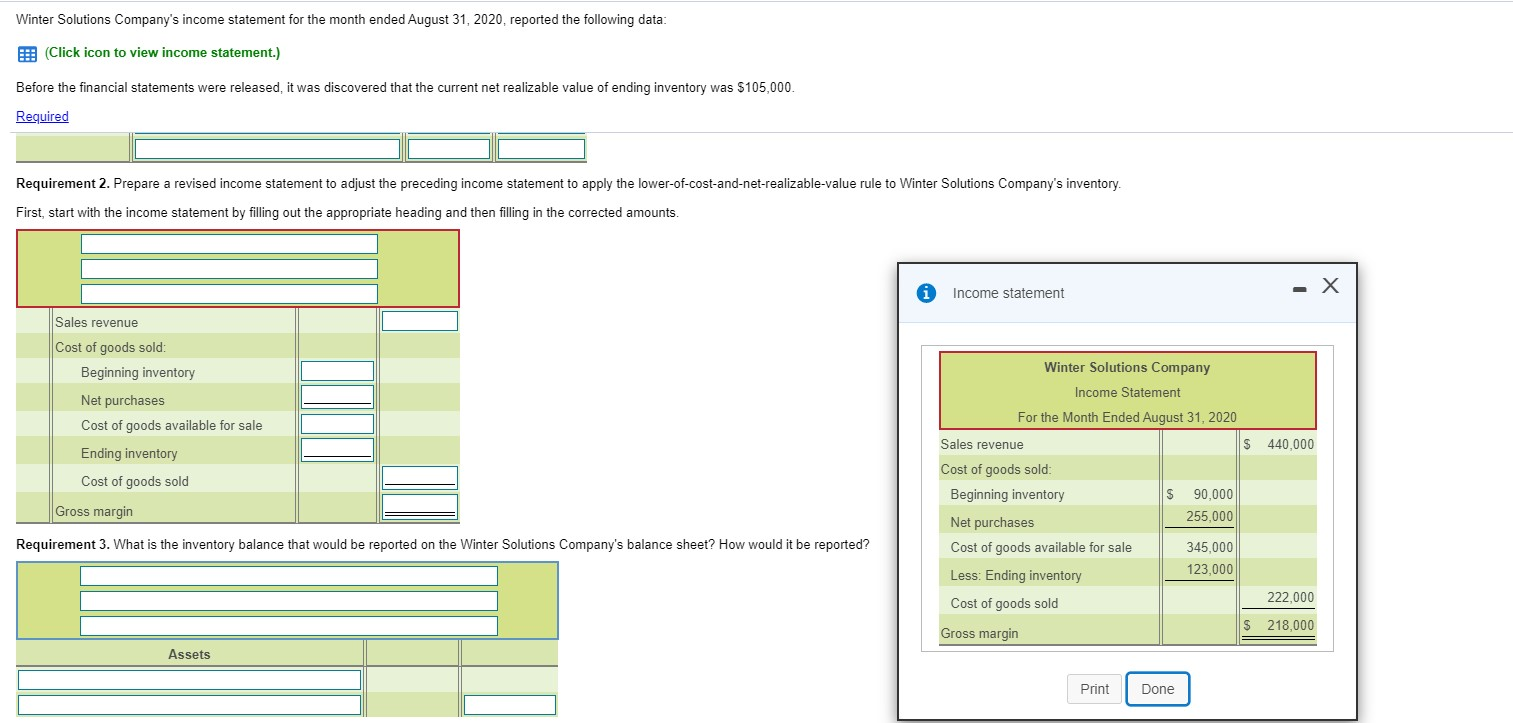

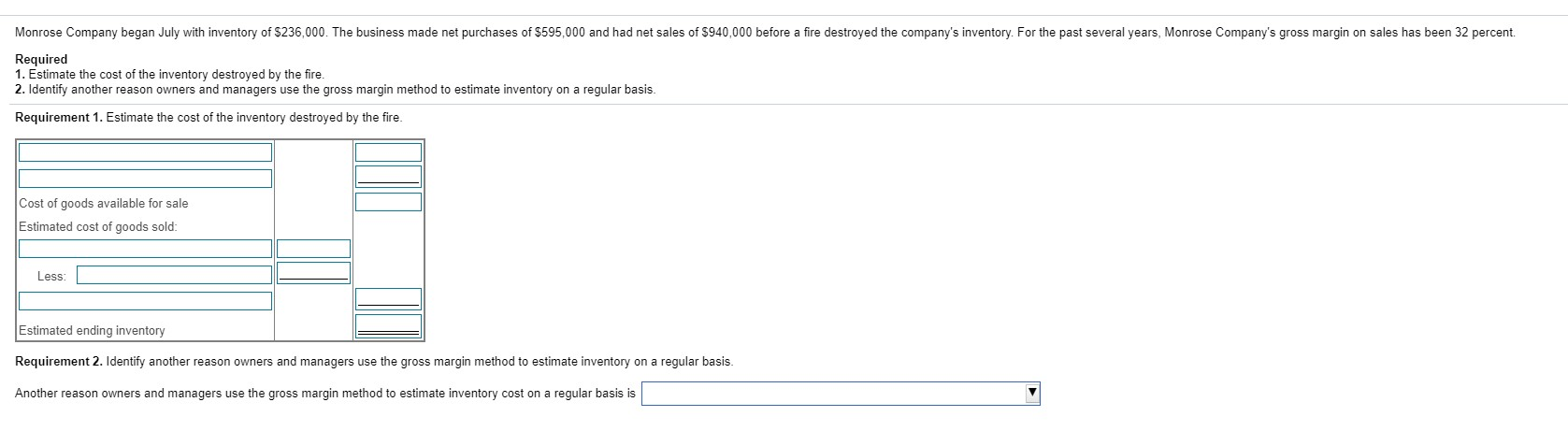

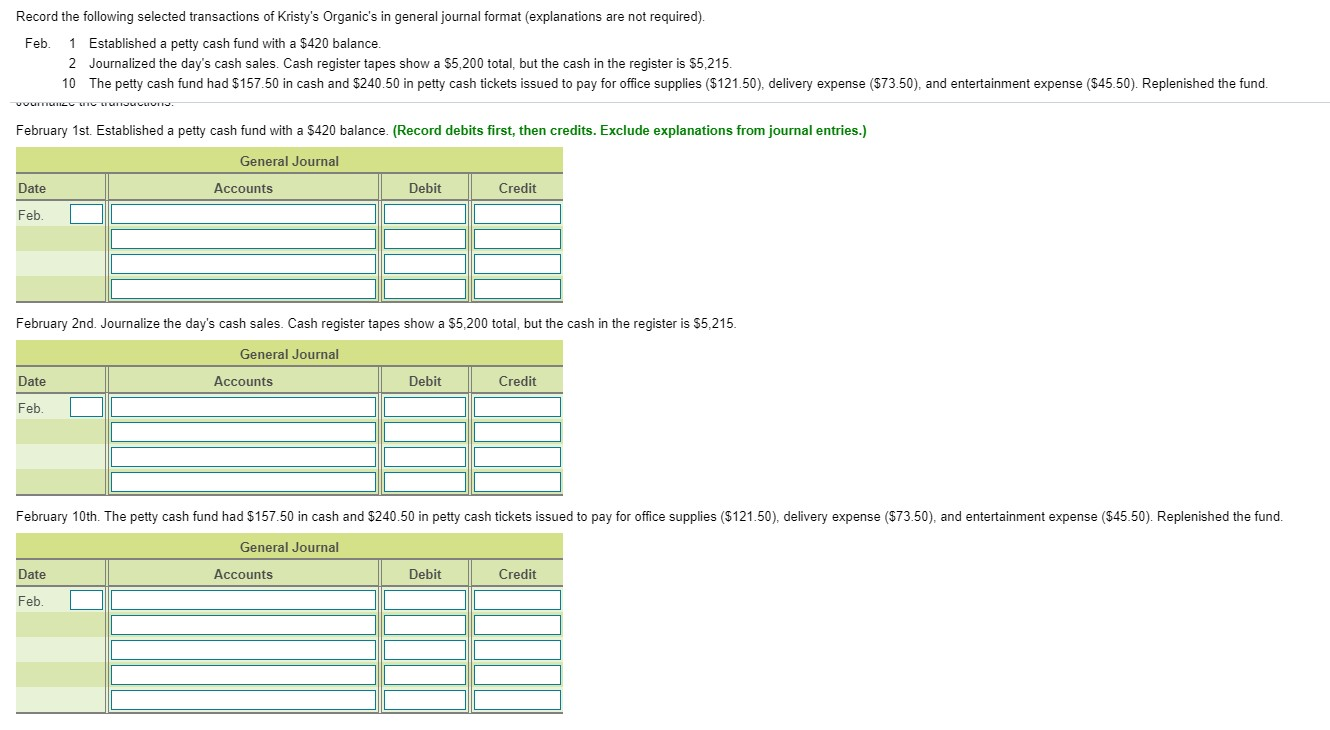

Winter Solutions Company's income statement for the month ended August 31, 2020, reported the following data: (Click icon to view income statement.) Before the financial statements were released, it was discovered that the current net realizable value of ending inventory was $105,000 Required Requirement 1. Journalize the entry to apply the lower-of-cost-and-net-realizable-value rule to the inventory. (Record debits first, then credits. Exclude explanations from journal entries.) - X Journal Entry Income statement Date Accounts Debit Credit Aug 31 Requirement 2. Prepare a revised income statement to adjust the preceding income statement to apply the lower-of-cost-and-net-realizable-value rule to Winter Solutions Company's inventory First, start with the income statement by filling out the appropriate heading and then filling in the corrected amounts. S Winter Solutions Company Income Statement For the Month Ended August 31, 2020 Sales revenue 440,000 Cost of goods sold: Beginning inventory 90,000 255,000 Net purchases Cost of goods available for sale 345,000 Less: Ending inventory 123,000 222,000 Cost of goods sold $ 218,000 Gross margin Sales revenue Cost of goods sold: Beginning inventory Print Done Net purchases Cost of goods available for sale Ending inventory Cost of goods sold Gross margin Requirement 3. What is the inventory balance that would be reported on the Winter Solutions Company's balance sheet? How would it be reported? Winter Solutions Company's income statement for the month ended August 31, 2020, reported the following data: E: (Click icon to view income statement.) Before the financial statements were released, it was discovered that the current net realizable value of ending inventory was $105,000. Required Requirement 2. Prepare a revised income statement to adjust the preceding income statement to apply the lower-of-cost-and-net-realizable-value rule to Winter Solutions Company's inventory. First, start with the income statement by filling out the appropriate heading and then filling in the corrected amounts. Income statement Sales revenue Cost of goods sold: Beginning inventory Net purchases Cost of goods available for sale Ending inventory Cost of goods sold Winter Solutions Company Income Statement For the Month Ended August 31, 2020 Sales revenue S 440,000 Cost of goods sold: Beginning inventory S 90,000 Net purchases 255,000 Cost of goods available for sale 345,000 123,000 Less: Ending inventory 222,000 Cost of goods sold $ 218,000 Gross margin Gross margin Requirement 3. What is the inventory balance that would be reported on the Winter Solutions Company's balance sheet? How would it be reported? Assets Print Done Monrose Company began July with inventory of $236,000. The business made net purchases of $595,000 and had net sales of $940,000 before a fire destroyed the company's inventory. For the past several years, Monrose Company's gross margin on sales has been 32 percent. Required 1. Estimate the cost of the inventory destroyed by the fire. 2. Identify another reason owners and managers use the gross margin method to estimate inventory on a regular basis. Requirement 1. Estimate the cost of the inventory destroyed by the fire Cost of goods available for sale Estimated cost of goods sold Less: Estimated ending inventory Requirement 2. Identify another reason owners and managers use the gross margin method to estimate inventory on a regular basis. Another reason owners and managers use the gross margin method to estimate inventory cost on a regular basis is Record the following selected transactions of Kristy's Organic's in general journal format (explanations are not required). Feb. 1 Established a petty cash fund with a $420 balance. 2 Journalized the day's cash sales. Cash register tapes show a $5,200 total, but the cash in the register is $5,215. 10 The petty cash fund had $157.50 in cash and $240.50 in petty cash tickets issued to pay for office supplies ($121.50), delivery expense ($73.50), and entertainment expense ($45.50). Replenished the fund. VUUTTIL IT rurrucuori February 1st. Established a petty cash fund with a $420 balance. (Record debits first, then credits. Exclude explanations from journal entries.) General Journal Date Accounts Debit Credit Feb. February 2nd. Journalize the day's cash sales. Cash register tapes show a $5,200 total, but the cash in the register is $5,215. General Journal Date Accounts Debit Credit Feb February 10th. The petty cash fund had $157.50 in cash and $240.50 in petty cash tickets issued to pay for office supplies ($121.50), delivery expense (573.50), and entertainment expense (545.50). Replenished the fund. General Journal Date Accounts Debit Credit Feb