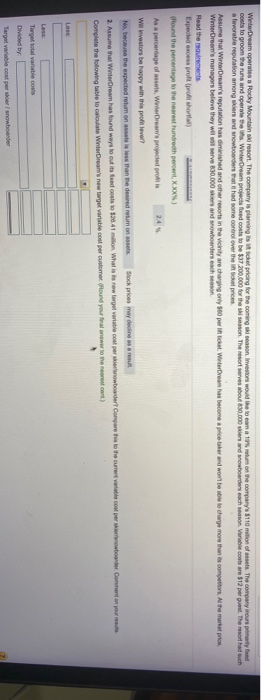

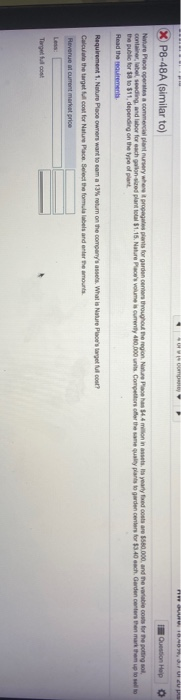

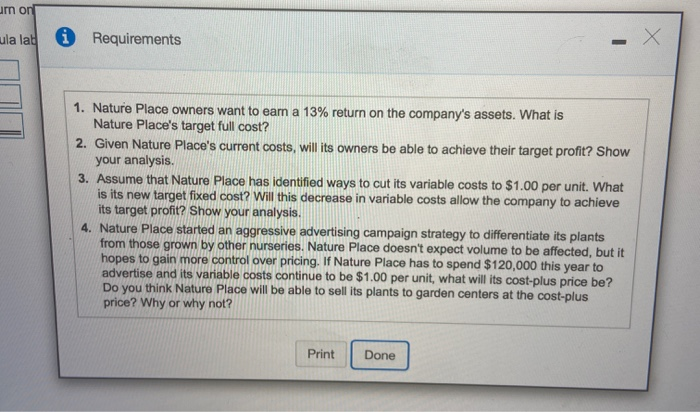

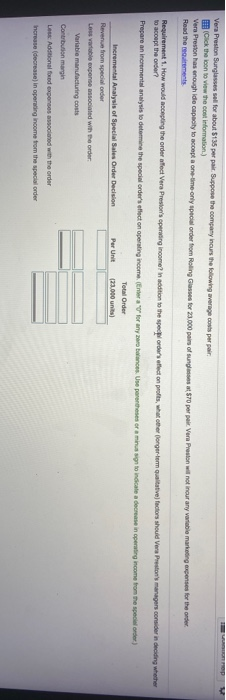

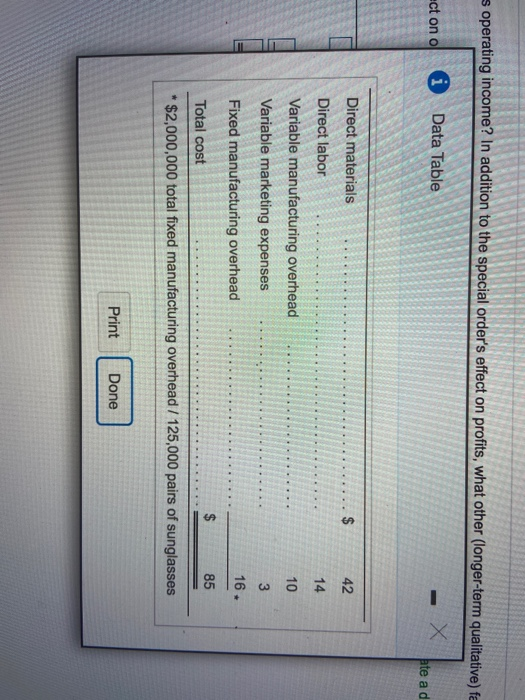

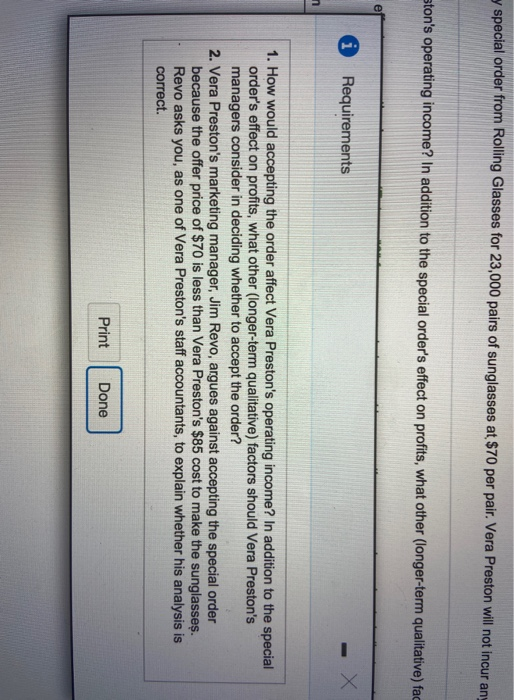

WinterDream operates a Rocky Mountain ski resort. The company is planning to the pricing for the coming sites investors would like to earn a 10% on the company $110 million of assets. The company incurs primary feed costs to groom the runs and operate the Winter Dream project feed costs to be $37,200,000 for the ston. The resort serves the 30.000 kiers and snowboarders cachon Variable costs are $12 pegat. The resorted with a favorable reputation among whers and snowboarders all had some control over the in the price Assume that Winter Dream's reputation has diminished and other resorts in the vicinity are changing only to per i Weteran has become a price and won't be able to charge more than to competers. At the market price Winterrear's managers believe they will serve 830.000 skers and snowboarders each Read the mairements Expediedes profil pro hortal) (Round the percentage to the nearest hundredth percent, X.XXX) As a percentage of assets, Wwe Dream's projected prin wil investors be happy with this profil lever? No, because the expected retumonass is less than the desired return on assets Stock prices may declines are 2. Assume that Winter Dream has found ways to cut its fed costs to $20.41 million What is its new target variable con perserwowtoder compare this to the current variable cost pertoarder Canal Complete the following table to calculate Winter Dean's new target variatie cos per customer Cound your final newer to the recent) Target total variable Died by Target variable cost per sker snowboarder Quon Help X P8-48A (similar to) Nature Place de a commercial planter where proge pots for garden centers throughout the region. Nochmon in . Ita yearly fed costs are $580.000 and the variable costs for the poing so container, label, seeding, and labor for each oned plant total 1.15. Nature Preces volume is curreny 400.000 Competitors offer the same quality plants to garden centers for $3.40 och Garden centers the mark them up to set the public for 1 to $11, depending on the type of plant Read the requirements Requirement 1. Nature Place owners want to com a 13% return on the company's What is Nature Poe's get Mol? Calculate the target full cost for Nature Place Select the formule labels and enter the amounts Revenue at current market price Targeo urn on ula la 0 Requirements X - 1. Nature Place owners want to earn a 13% return on the company's assets. What is Nature Place's target full cost? 2. Given Nature Place's current costs, will its owners be able to achieve their target profit? Show your analysis. 3. Assume that Nature Place has identified ways to cut its variable costs to $1.00 per unit. What is its new target fixed cost? Will this decrease in variable costs allow the company to achieve its target profit? Show your analysis. 4. Nature Place started an aggressive advertising campaign strategy to differentiate its plants from those grown by other nurseries. Nature Place doesn't expect volume to be affected, but it hopes to gain more control over pricing. If Nature Place has to spend $120,000 this year to advertise and its variable costs continue to be $1.00 per unit, what will its cost-plus price be? Do you think Nature Place will be able to sell its plants to garden centers at the cost-plus price? Why or why not? Print Done Vera Preston Sunglasses sell for about $135 per pair Suppose the company incurs the following average cost per pair (Cick the loon to view the cost information) Vera Preston has enough ide capacity to accept a one-time only special order from Roling Glasses for 23.000 pair of sungle 570 par pair Vera Preston will not incur any variable marketing expenses for the order Read the girements Requirement 1. How would accepting the order affect Vers Preston's operating income in addition to the secondary effect on profits, what other longer-term qualitative factors should Vera Preston's managers consider in deciding whether Prepare an incremental analysis to determine the special order's effect on operating income (Enter a for any zarobancs. Une parentheses or a mhus sign to indicate a decrease in operating income from the special order) Total Order Incremental Analysis of Special Sales Order Decision Per Unit (230.000 units] Revenge from special order Loss variable expense associated with the order: Variable manufacturing costs Contribution margin Less Additional food expenses associated with the order Increase (decrease in operating income from the special order s operating income? In addition to the special order's effect on profits, what other (longer-term qualitative) fa ct on o Data Table ate ad Direct materials $ 42 14 10 + + Direct labor Variable manufacturing overhead Variable marketing expenses Fixed manufacturing overhead 3 16. $ 85 Total cost $2,000,000 total fixed manufacturing overhead / 125,000 pairs of sunglasses Print Done y special order from Rolling Glasses for 23,000 pairs of sunglasses at $70 per pair. Vera Preston will not incur any ston's operating income? In addition to the special order's effect on profits, what other (longer-term qualitative) fac * Requirements n 1. How would accepting the order affect Vera Preston's operating income? In addition to the special order's effect on profits, what other (longer-term qualitative) factors should Vera Preston's managers consider in deciding whether to accept the order? 2. Vera Preston's marketing manager, Jim Revo, argues against accepting the special order because the offer price of $70 is less than Vera Preston's $85 cost to make the sunglasses. Revo asks you, as one of Vera Preston's staff accountants, to explain whether his analysis is correct. Print Done