Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wirh an initial Investment of a semi truck for $160,000 and cash flows for 7 years and an expected residual value of the semi truck

Wirh an initial Investment of a semi truck for $160,000 and cash flows for 7 years and an expected residual value of the semi truck of $25,000 after thr 7 years, what is the NPV for this semi truck assuming a 7% discount rate? What would be the IRR? (HINT: 7th year cash flows will be cash+ residual value)

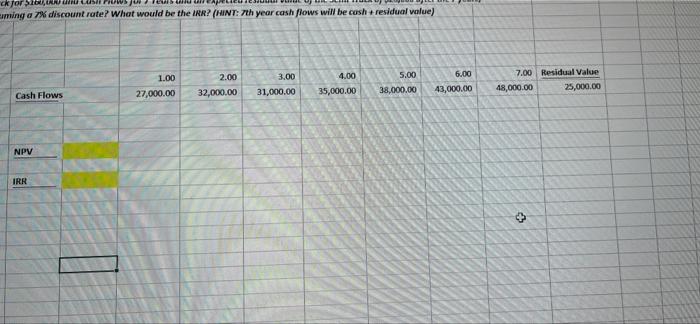

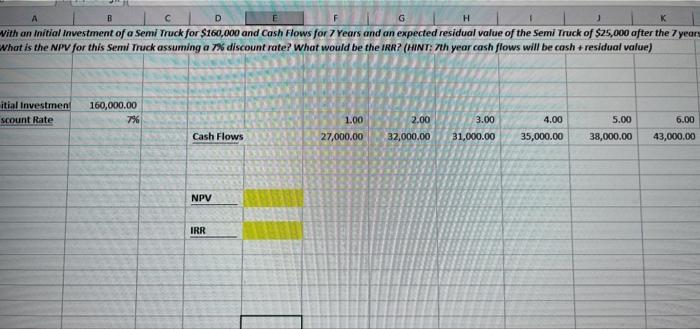

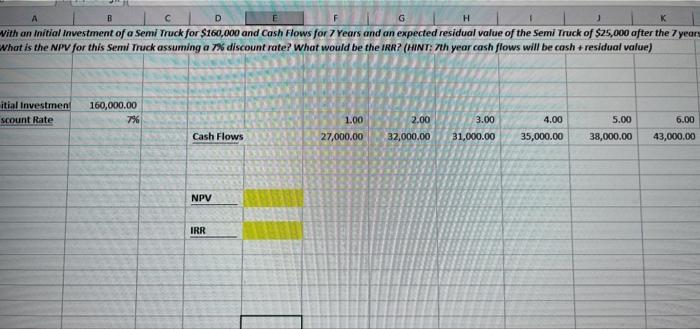

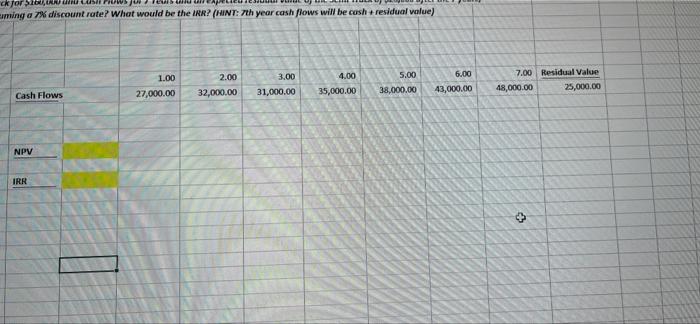

A B D G H with an initial Investment of a Semi Truck for $160,000 and Cash Flows for 7 years and an expected residual value of the Semi Truck of $25,000 after the 7 years What is the NPV for this Semi Truck assuming a 7% discount rate? What would be the IRR? (HINT: 7th year cash flows will be cash + residual value) itial investment scount Rate 160,000.00 7% 2.00 3.00 5.00 6.00 1.00 27,000.00 4.00 35,000.00 Cash Flows 32,000.00 31,000.00 38,000.00 43,000.00 NPV IRR ckfors, ming a 7% discount rate? What would be the IRR? (HINT: 7th year cash flows will be cosh residual value) 6.00 1.00 2.00 32,000.00 3.00 31,000.00 4.00 35,000.00 5.00 38,000.00 7.00 Residual Value 48,000.00 25,000.00 43,000.00 Cash Flows 27,000.00 NPV IRR + Initial Investment: $160,000

Discount Rate: 7%

Cash Flows: $27000, $32000, $31000, $35000, $38000, $43000, $48000

Residual Value: $25000

What is NPV and IRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started