With all of the information provided please fill in the blanks for 1-15. Please & thank you :)

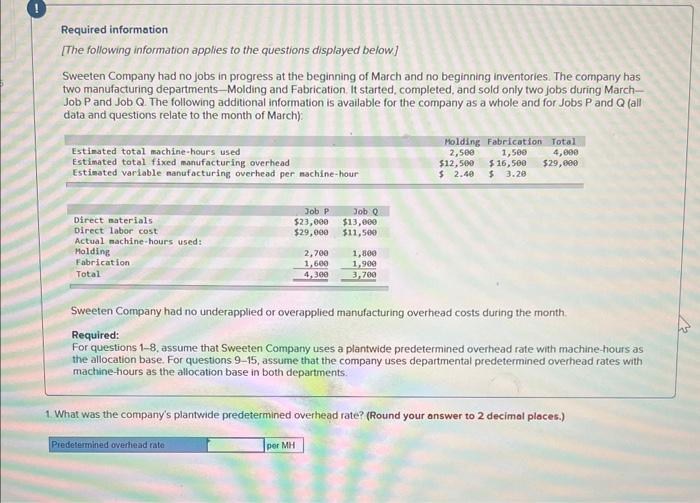

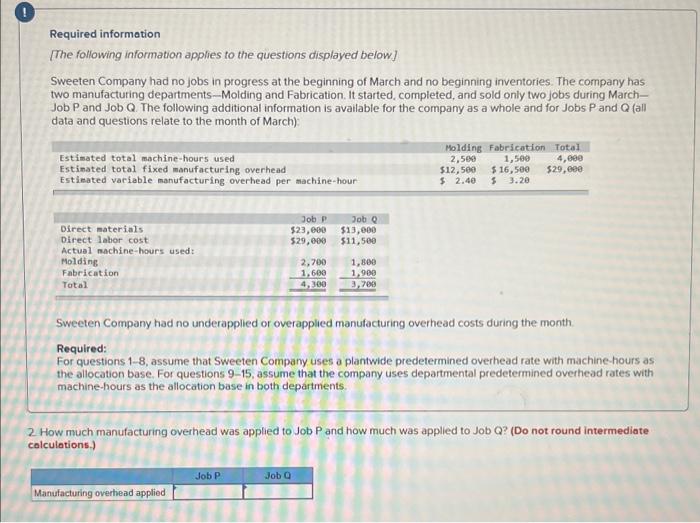

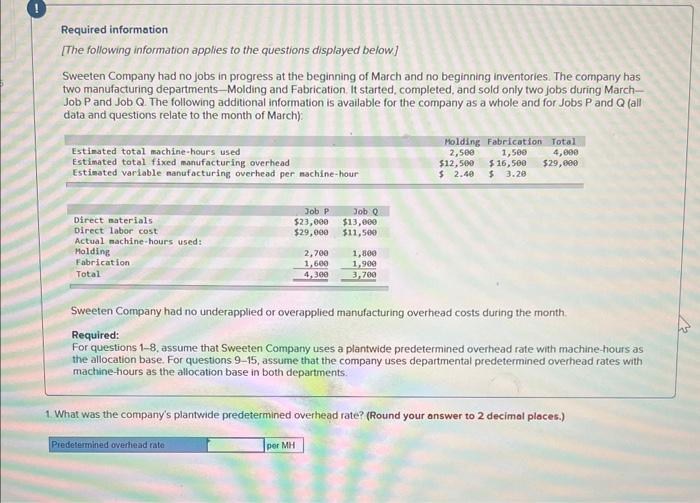

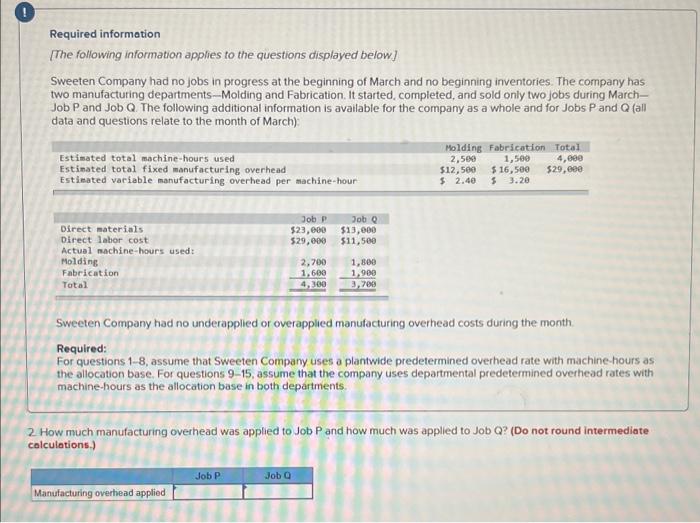

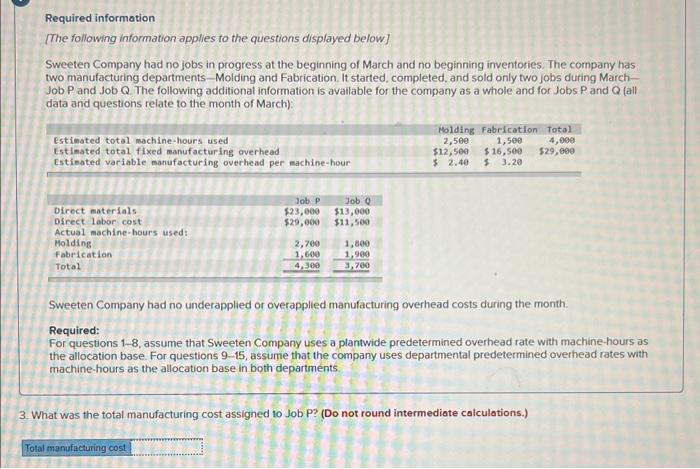

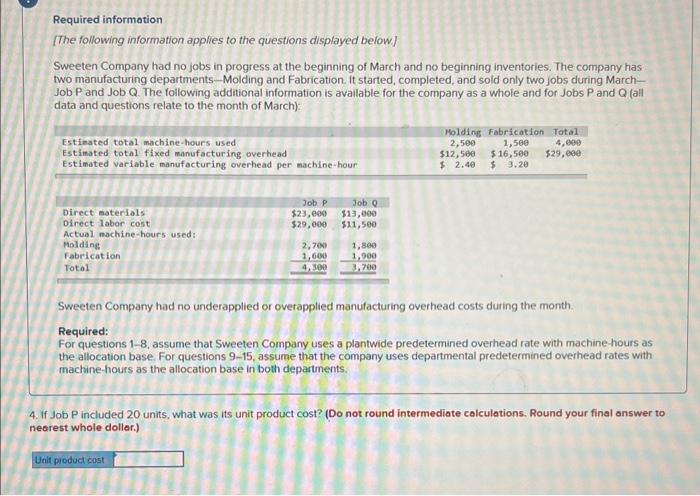

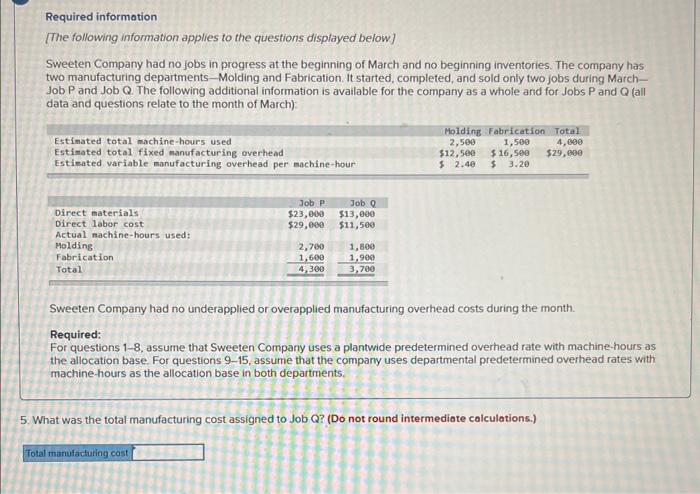

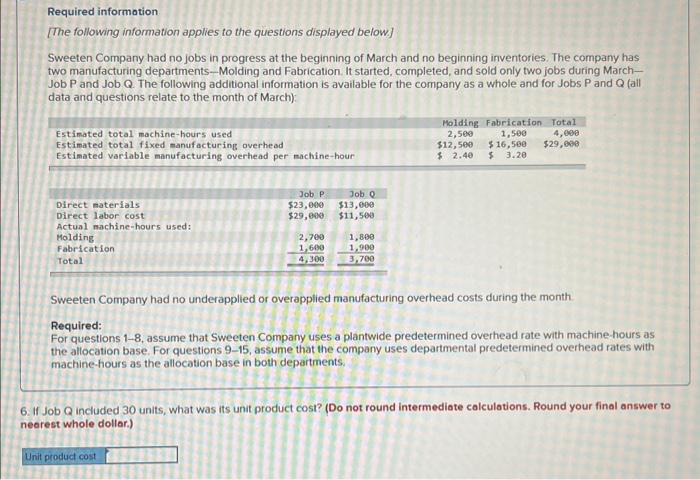

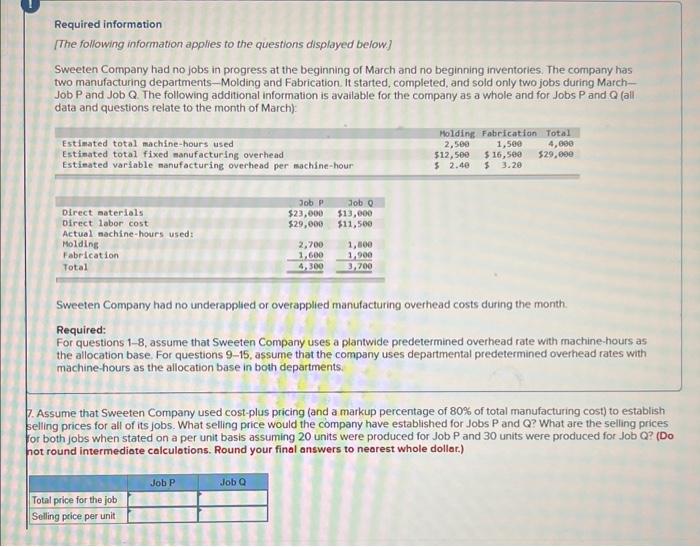

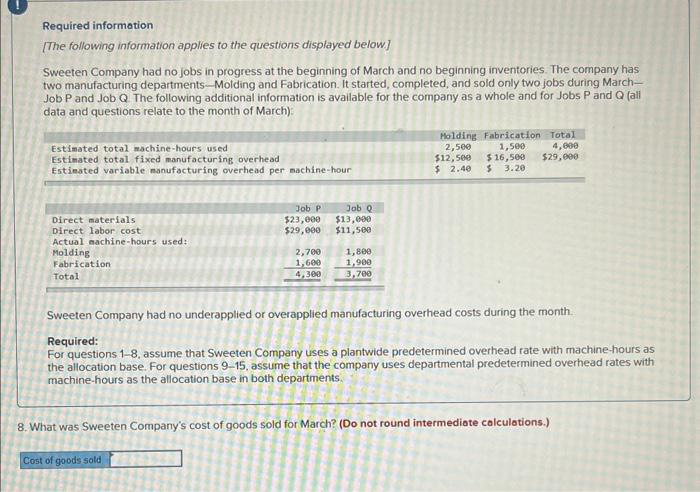

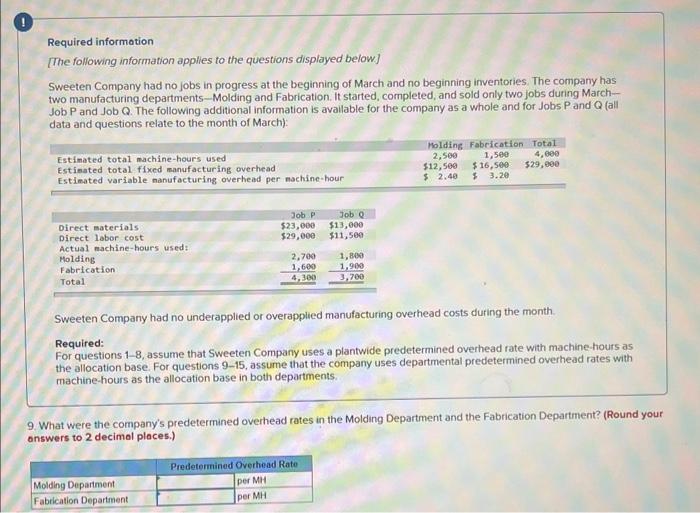

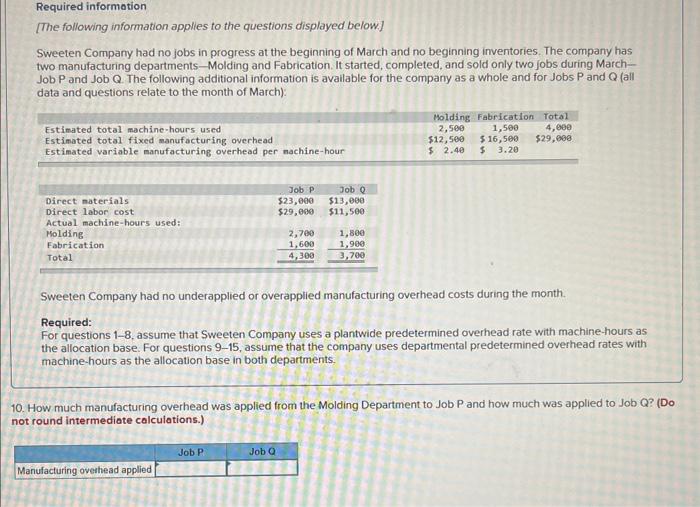

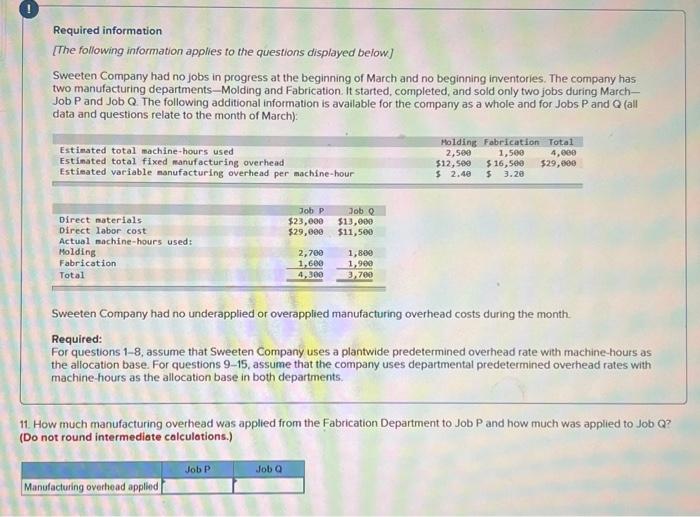

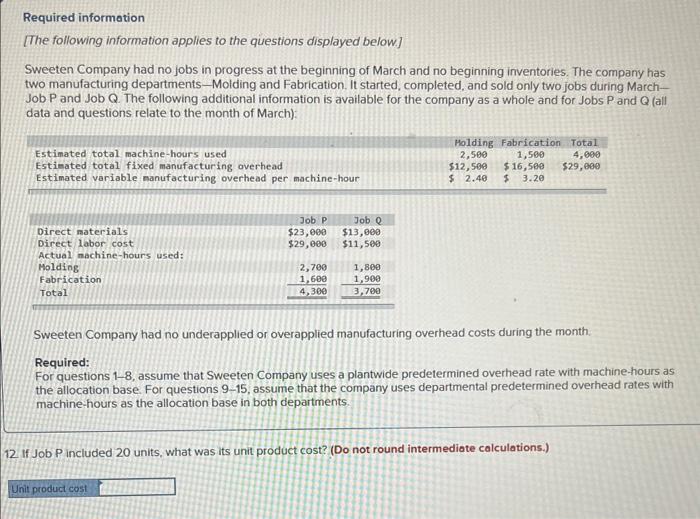

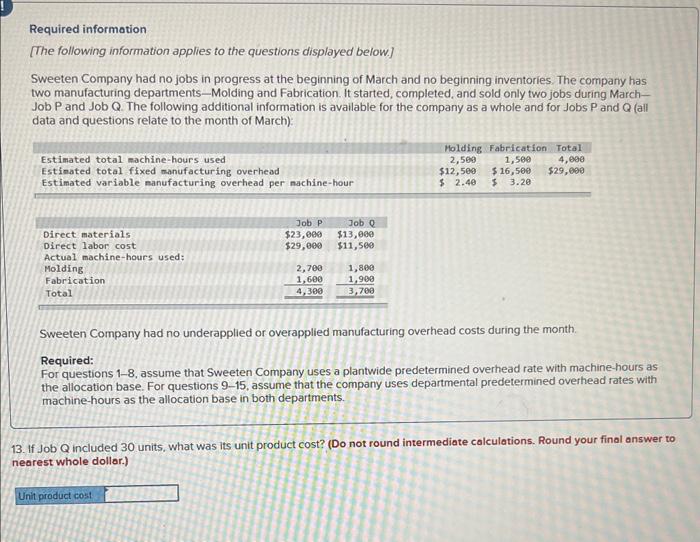

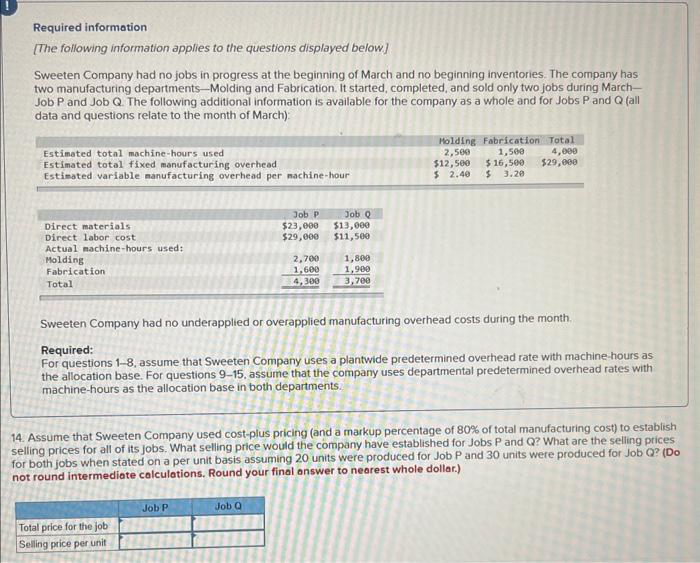

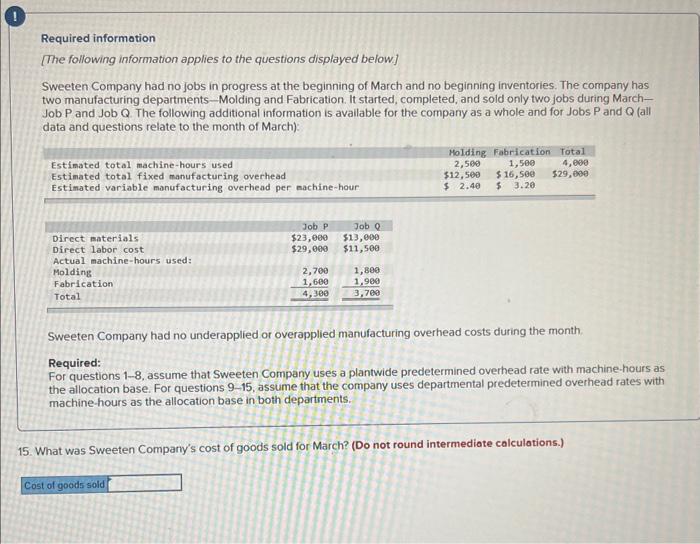

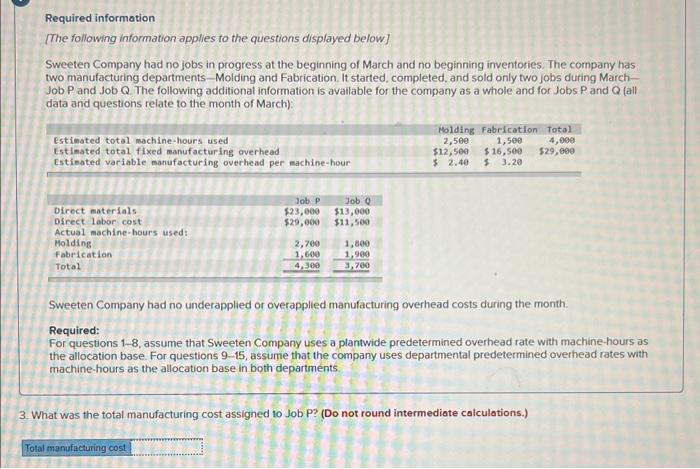

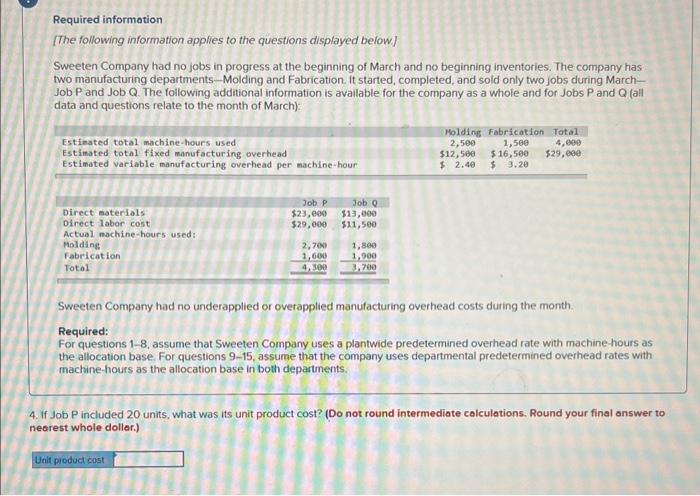

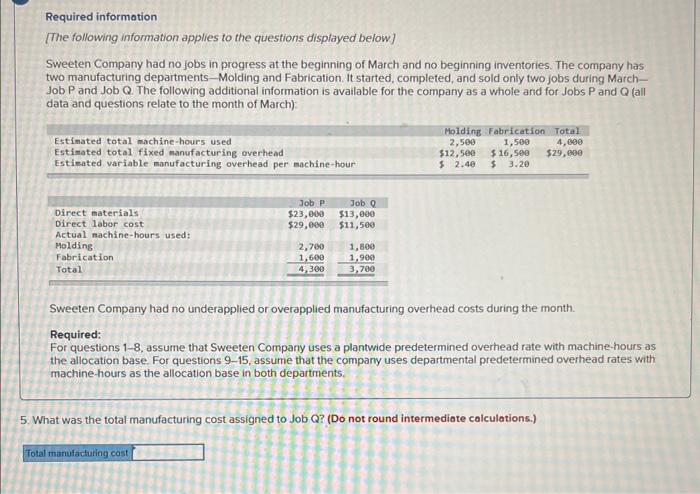

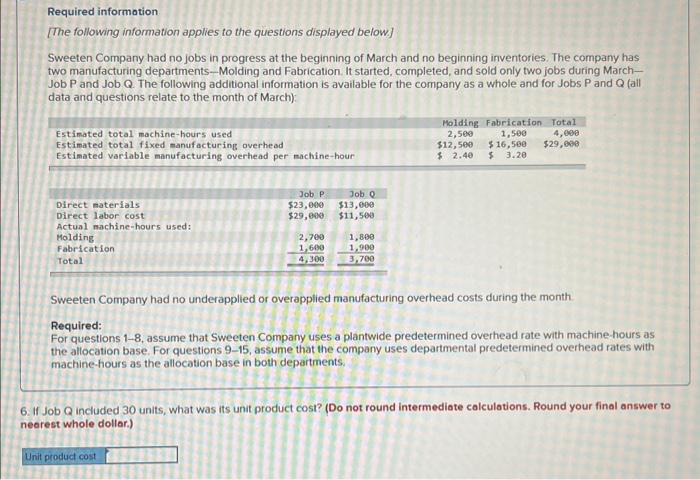

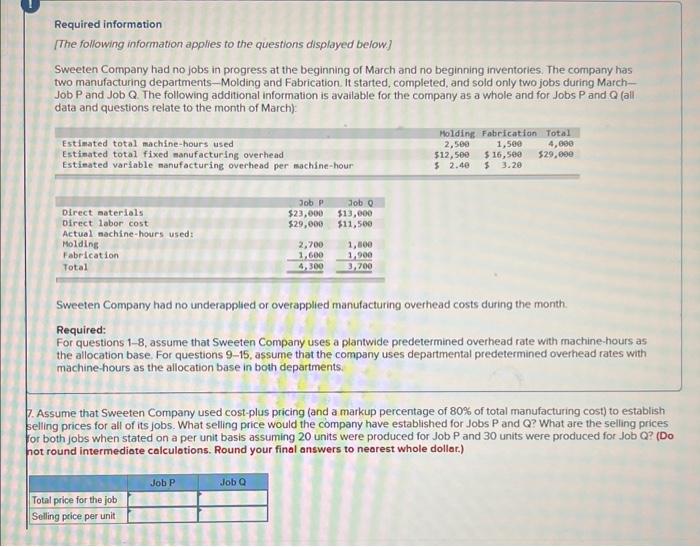

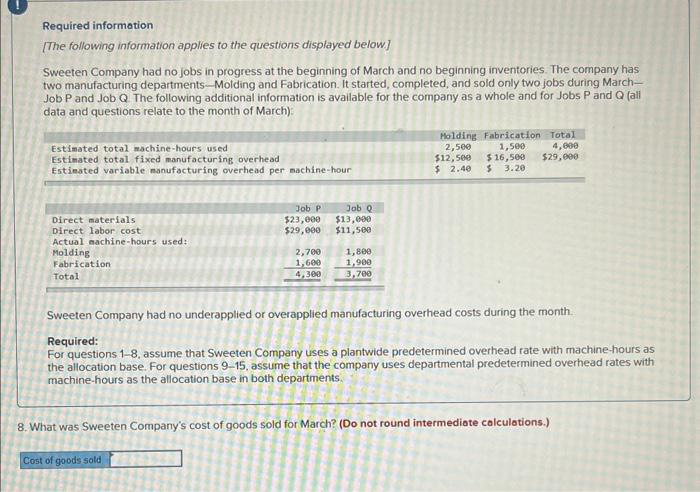

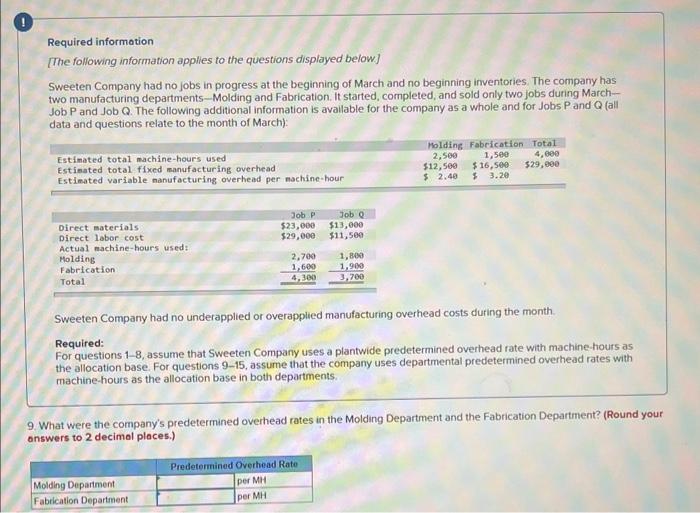

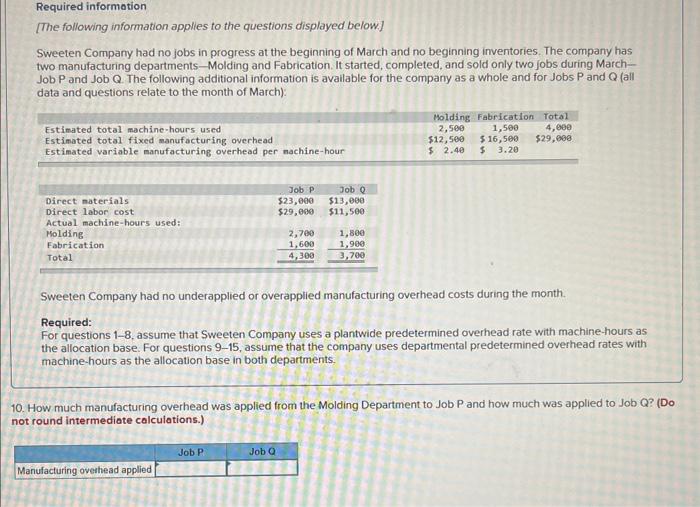

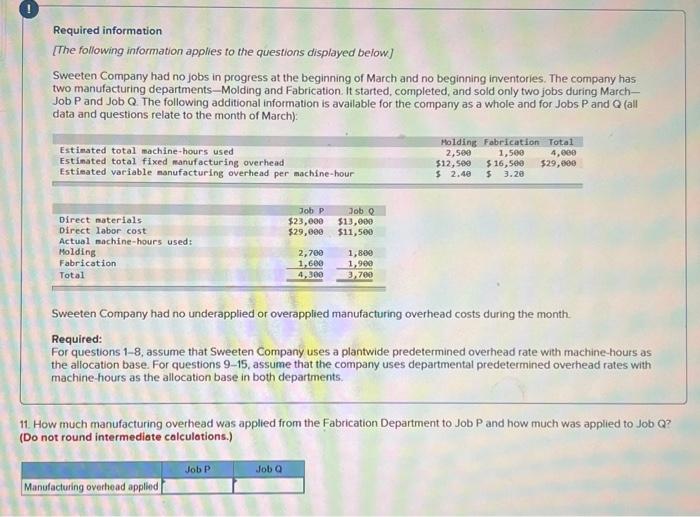

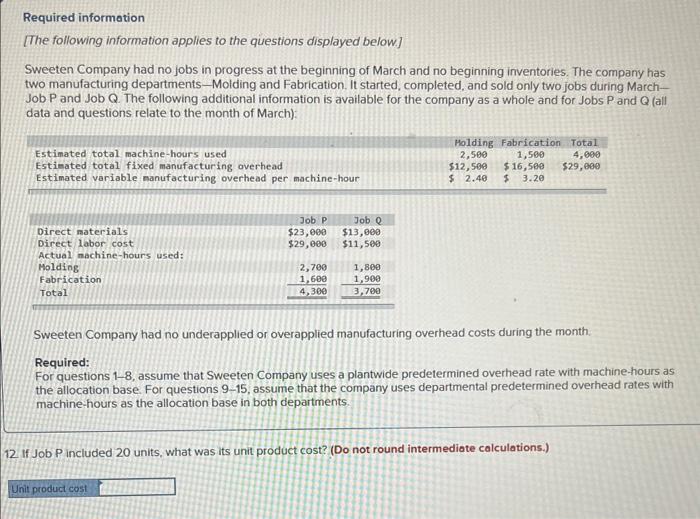

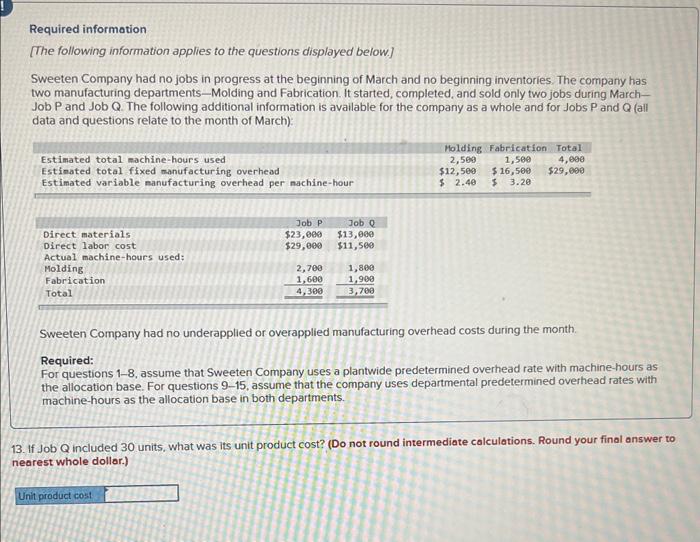

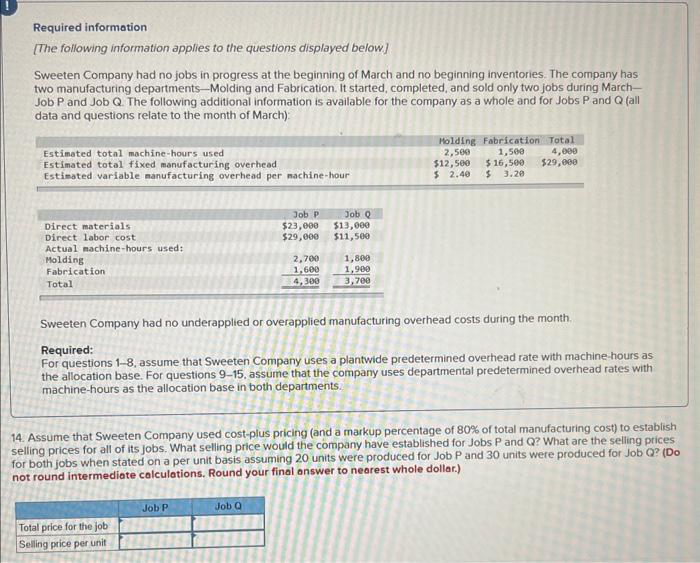

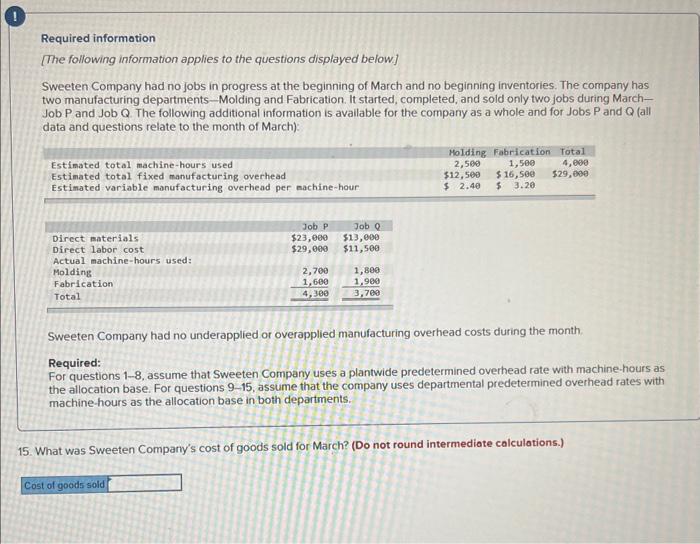

Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments - Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 915, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. 1. What was the company's plantwide predetermined overhead rate? (Round your onswer to 2 decimal places.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 915, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments How much manufacturing overhead was applied to Job P and how much was applied to Job Q? (Do not round intermediate colculations.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments - Molding and Fabrication, It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 915, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. 3. What was the total manufacturing cost assigned to Job P ? (Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments -Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. If Job P included 20 units, what was its unit product cost? (Do not round intermediate calculations. Round your final answer to learest whole dollar.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. 5. What was the total manufacturing cost assigned to Job Q? (Do not round intermediate caiculations.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: Required: For questions 18, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 915, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. If Job Q included 30 units, what was its unit product cost? (Do not round intermediate calculations. Round your final answer to ieerest whole doller.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments - Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 18, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 915, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish elling prices for all of its jobs. What selling price would the company have established for Jobs P and Q ? What are the selling prices both jobs when stated on a per unit basis assuming 20 units were produced for Job P and 30 units were produced for Job Q ? (Do ot round intermediate calculations. Round your final answers to nearest whole dollar.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 18, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 915, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. 3. What was Sweeten Company's cost of goods sold for March? (Do not round intermediate calculotions.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. it started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 18, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. What were the company's predetermined overhead rates in the Molding Department and the Fabrication Department? (Round your nswers to 2 decimal places.) [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments - Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. 10. How much manufacturing overhead was applied from the Molding Department to Job P and how much was applied to Job Q? (Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. How much manufacturing overhead was applied from the Fabrication Department to Job P and how much was applied to Job Q? o not round intermediate calculations.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 915, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. 2 If Job P included 20 units, what was its unit product cost? (Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. 13. If Job Q included 30 units, what was its unit product cost? (Do not round intermediate calculations. Round your final answer to nearest whole dollar.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments - Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 915, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. 14. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q ? What are the selling prices for both jobs when stated on a per unit basis assuming 20 units were produced for Job P and 30 units were produced for Job Q ? (Do not round intermediate calculations. Round your final answer to nearest whole dollar.) Required information [The following information applies to the questions displayed below] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 915, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. 5. What was Sweeten Company's cost of goods sold for March? (Do not round intermediate calculations.)