Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with calculations and reason please Question 5.4 (15pts) A firm has just received a special order from a client. The following financial data have been

with calculations and reason please

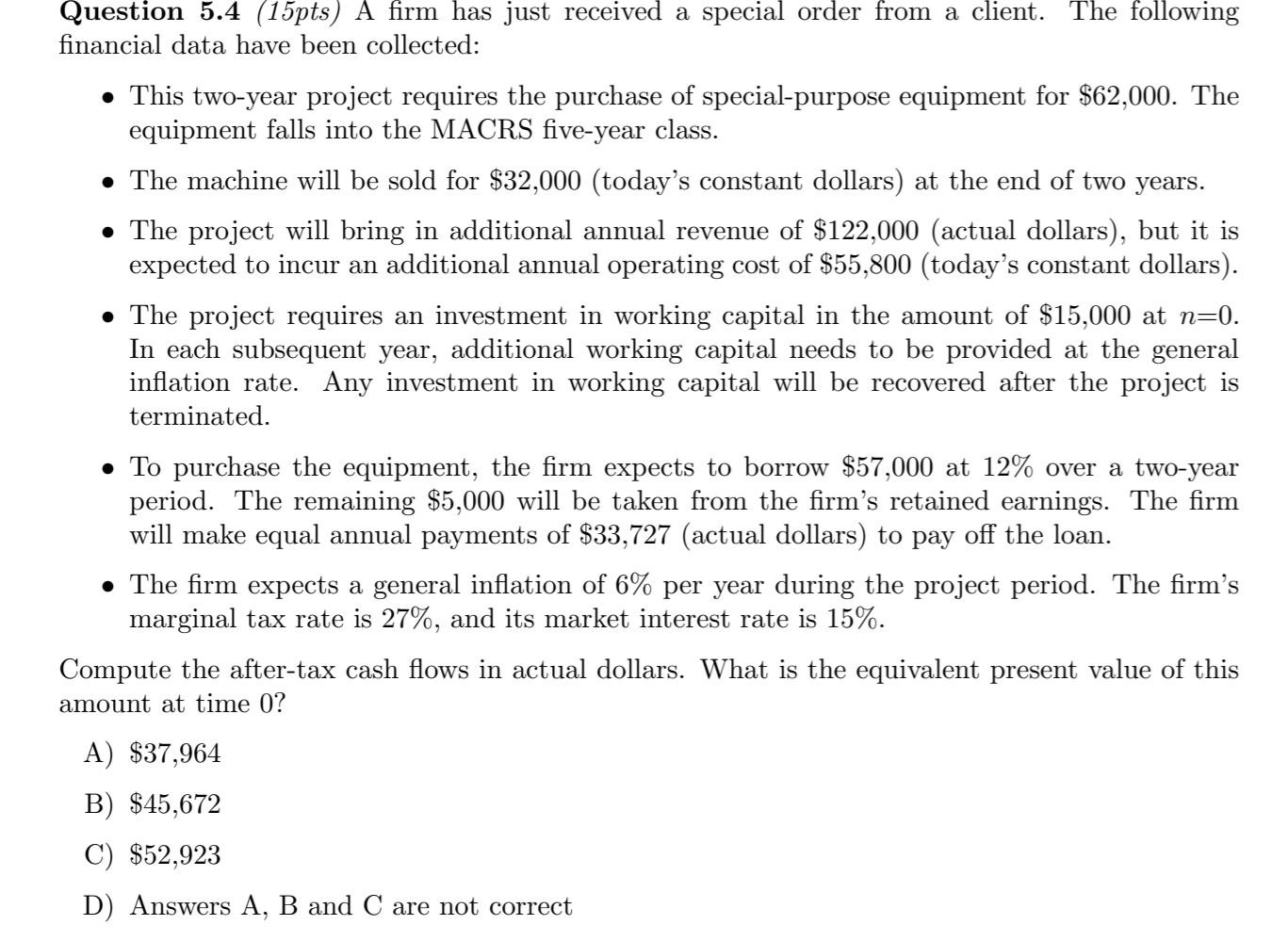

Question 5.4 (15pts) A firm has just received a special order from a client. The following financial data have been collected: This two-year project requires the purchase of special-purpose equipment for $62,000. The equipment falls into the MACRS five-year class. The machine will be sold for $32,000 (today's constant dollars) at the end of two years. The project will bring in additional annual revenue of $122,000 (actual dollars), but it is expected to incur an additional annual operating cost of $55,800 (today's constant dollars). The project requires an investment in working capital in the amount of $15,000 at n=0. In each subsequent year, additional working capital needs to be provided at the general inflation rate. Any investment in working capital will be recovered after the project is terminated. To purchase the equipment, the firm expects to borrow $57,000 at 12% over a two-year period. The remaining $5,000 will be taken from the firm's retained earnings. The firm will make equal annual payments of $33,727 (actual dollars) to pay off the loan. The firm expects a general inflation of 6% per year during the project period. The firm's marginal tax rate is 27%, and its market interest rate is 15%. Compute the after-tax cash flows in actual dollars. What is the equivalent present value of this amount at time 0? A) $37,964 B) $45,672 C) $52,923 D) Answers A, B and C are not correctStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started