Question

With complete solution pls thankyou PROBLEM 1 - 3 points On January 1, 2020 Multinational Company was organized with an authorized share capital of P10,000,000

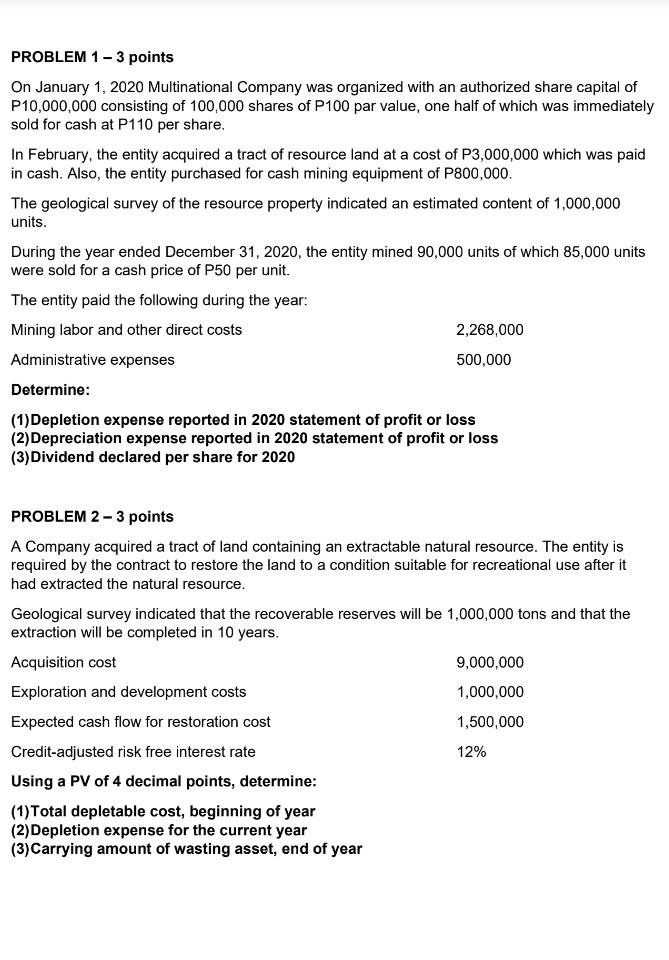

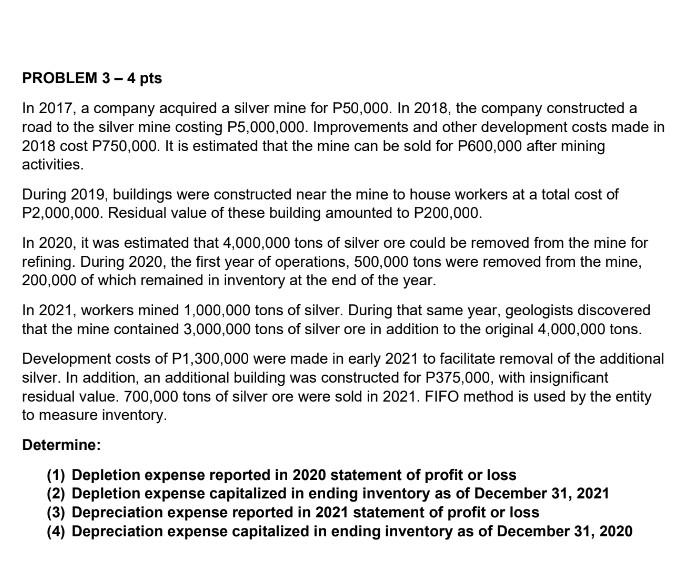

With complete solution pls thankyou PROBLEM 1 - 3 points On January 1, 2020 Multinational Company was organized with an authorized share capital of P10,000,000 consisting of 100,000 shares of P100 par value, one half of which was immediately sold for cash at P110 per share. In February, the entity acquired a tract of resource land at a cost of P3,000,000 which was paid in cash. Also, the entity purchased for cash mining equipment of P800,000. The geological survey of the resource property indicated an estimated content of 1,000,000 units. During the year ended December 31, 2020, the entity mined 90,000 units of which 85,000 units were sold for a cash price of P50 per unit. The entity paid the following during the year: Mining labor and other direct costs 2,268,000 Administrative expenses 500,000 Determine: (1) Depletion expense reported in 2020 statement of profit or loss (2)Depreciation expense reported in 2020 statement of profit or loss (3) Dividend declared per share for 2020 PROBLEM 2 - 3 points A Company acquired a tract of land containing an extractable natural resource. The entity is required by the contract to restore the land to a condition suitable for recreational use after it had extracted the natural resource. Geological Survey indicated that the recoverable reserves will be 1,000,000 tons and that the extraction will be completed in 10 years. Acquisition cost 9,000,000 Exploration and development costs 1,000,000 Expected cash flow for restoration cost 1,500,000 Credit-adjusted risk free interest rate 12% Using a PV of 4 decimal points, determine: (1) Total depletable cost, beginning of year (2) Depletion expense for the current year (3) Carrying amount of wasting asset, end of year PROBLEM 3 - 4 pts In 2017, a company acquired a silver mine for P50,000. In 2018, the company constructed a road to the silver mine costing P5,000,000. Improvements and other development costs made in 2018 cost P750,000. It is estimated that the mine can be sold for P600,000 after mining activities. During 2019, buildings were constructed near the mine to house workers at a total cost of P2,000,000. Residual value of these building amounted to P200,000. In 2020, it was estimated that 4,000,000 tons of silver ore could be removed from the mine for refining. During 2020, the first year of operations, 500,000 tons were removed from the mine, 200,000 of which remained in inventory at the end of the year. In 2021, workers mined 1,000,000 tons of silver. During that same year, geologists discovered that the mine contained 3,000,000 tons of silver ore in addition to the original 4,000,000 tons. Development costs of P1,300,000 were made in early 2021 to facilitate removal of the additional silver. In addition, an additional building was constructed for P375,000, with insignificant residual value. 700,000 tons of silver ore were sold in 2021. FIFO method is used by the entity to measure inventory Determine: (1) Depletion expense reported in 2020 statement of profit or loss (2) Depletion expense capitalized in ending inventory as of December 31, 2021 (3) Depreciation expense reported in 2021 statement of profit or loss (4) Depreciation expense capitalized in ending inventory as of December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started