Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with computation in excel thank you so much Problem: The partnership of Cruz, Vidal and Santos have capital account balances as follows: Cruz, P35,000.00; Vidal,

with computation in excel thank you so much

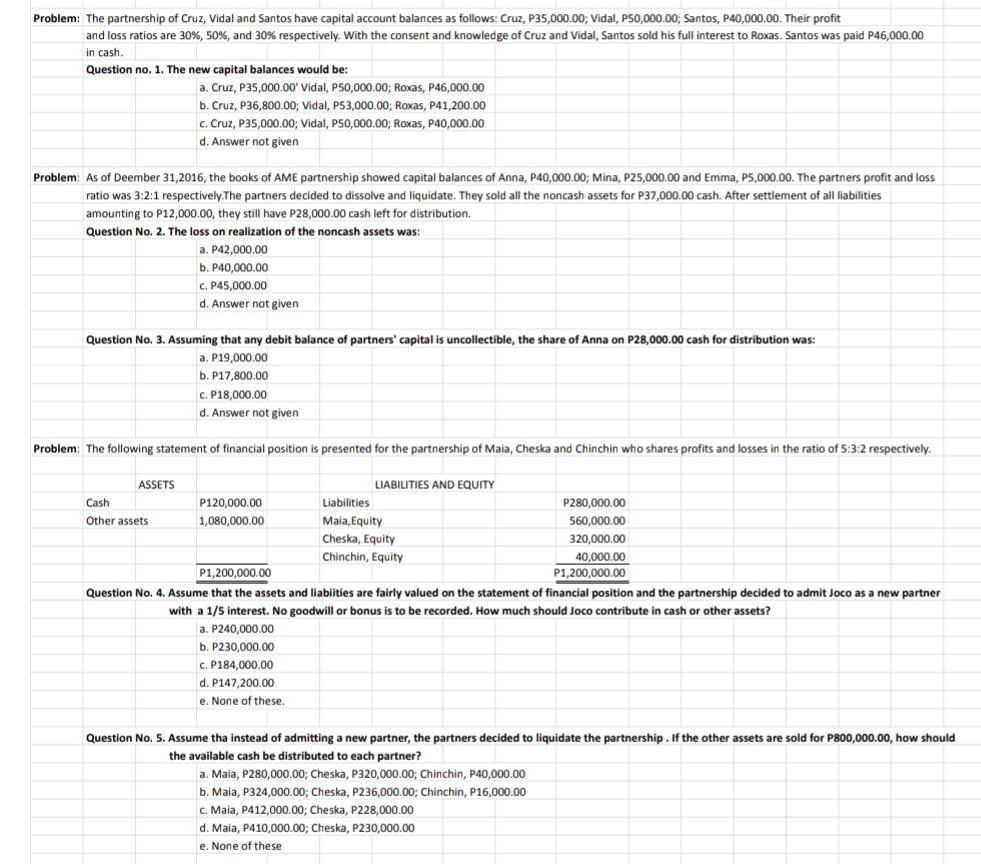

Problem: The partnership of Cruz, Vidal and Santos have capital account balances as follows: Cruz, P35,000.00; Vidal, P50,000.00; Santos, P40,000.00. Their profit and loss ratios are 30%, 50%, and 30% respectively. With the consent and knowledge of Cruz and Vidal, Santos sold his full interest to Roxas. Santos was paid P46,000.00 in cash. Question no. 1. The new capital balances would be: a. Cruz, P35,000.00 Vidal, P50,000.00; Roxas, P46,000.00 b. Cruz, P36,800.00; Vidal, P53,000.00; Roxas, P41,200.00 c. Cruz, P35,000.00; Vidal, P50,000.00; Roxas, P40,000.00 d. Answer not given Problem: As of Deember 31,2016, the books of AME partnership showed capital balances of Anna, P40,000.00; Mina, P25,000.00 and Emma, P5,000.00. The partners profit and loss ratio was 3:2:1 respectively. The partners decided to dissolve and liquidate. They sold all the noncash assets for P37,000.00 cash. After settlement of all liabilities amounting to P12,000.00, they still have P28,000.00 cash left for distribution. Question No. The loss on realization of the noncash assets was: a. P42,000.00 b. P40,000.00 c. P45,000.00 d. Answer not given Question No. 3. Assuming that any debit balance of partners' capital is uncollectible, the share of Anna on P28,000.00 cash for distribution was: a. P19,000.00 b. P17,800.00 c. P18,000.00 d. Answer not given Problem: The following statement of financial position is presented for the partnership of Maia, Cheska and Chinchin who shares profits and losses in the ratio of 5:3:2 respectively. ASSETS LIABILITIES AND EQUITY Cash P120,000.00 Liabilities P280,000.00 Other assets 1,080,000.00 Maia, Equity 560,000.00 Cheska, Equity 320,000.00 Chinchin, Equity 40,000.00 P1,200,000.00 P1,200,000.00 Question No. 4. Assume that the assets and liabiities are fairly valued on the statement of financial position and the partnership decided to admit Joco as a new partner with a 1/5 interest. No goodwill or bonus is to be recorded. How much should Joco contribute in cash or other assets? a. P240,000.00 b. P230,000.00 c. P184,000.00 d. P147,200.00 e. None of these. Question No. 5. Assume tha instead of admitting a new partner, the partners decided to liquidate the partnership. If the other assets are sold for P800,000.00, how should the available cash be distributed to each partner? a. Maia, P280,000.00, Cheska, P320,000.00; Chinchin, P40,000.00 b. Mala, P324,000.00; Cheska, P236,000.00; Chinchin, P16,000.00 c. Maia, P412,000.00; Cheska, P228,000.00 d. Maia, P410,000.00, Cheska, P230,000.00 e. None of theseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started