Answered step by step

Verified Expert Solution

Question

1 Approved Answer

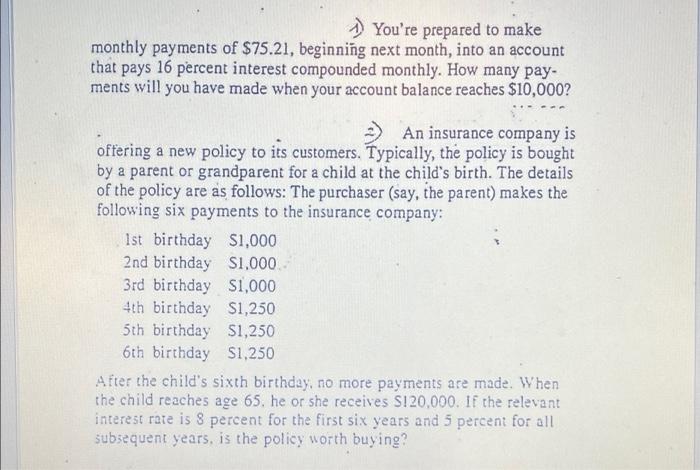

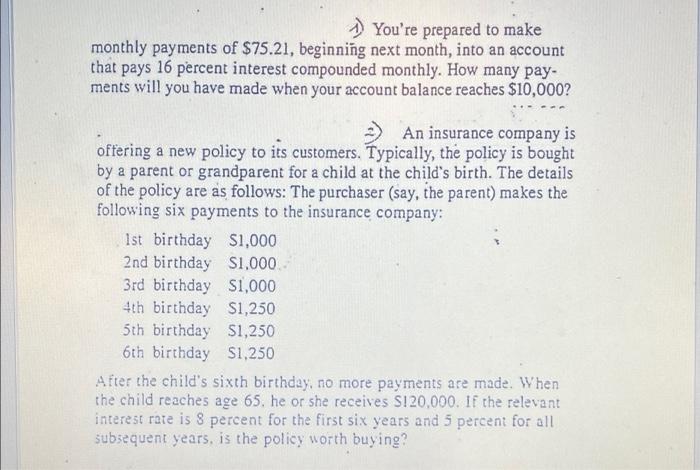

with explanations please You're prepared to make monthly payments of $75.21, beginning next month, into an account that pays 16 percent interest compounded monthly. How

with explanations please

You're prepared to make monthly payments of $75.21, beginning next month, into an account that pays 16 percent interest compounded monthly. How many pay- ments will you have made when your account balance reaches $10,000? An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the insurance company: 1st birthday $1,000 $1,000. 2nd birthday 3rd birthday $1,000 4th birthday S1,250 5th birthday S1,250 6th birthday S1,250 After the child's sixth birthday, no more payments are made. When the child reaches age 65. he or she receives S120,000. If the relevant interest rate is 8 percent for the first six years and 5 percent for all subsequent years, is the policy worth buying

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started