Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with formula and step by step on how to count it search abcdefghij - The Boring portion of the competens och EN 61% 22:07 +

with formula and step by step on how to count it

search abcdefghij

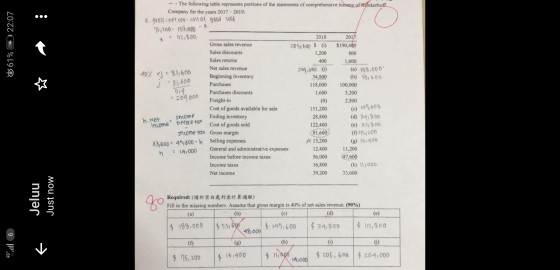

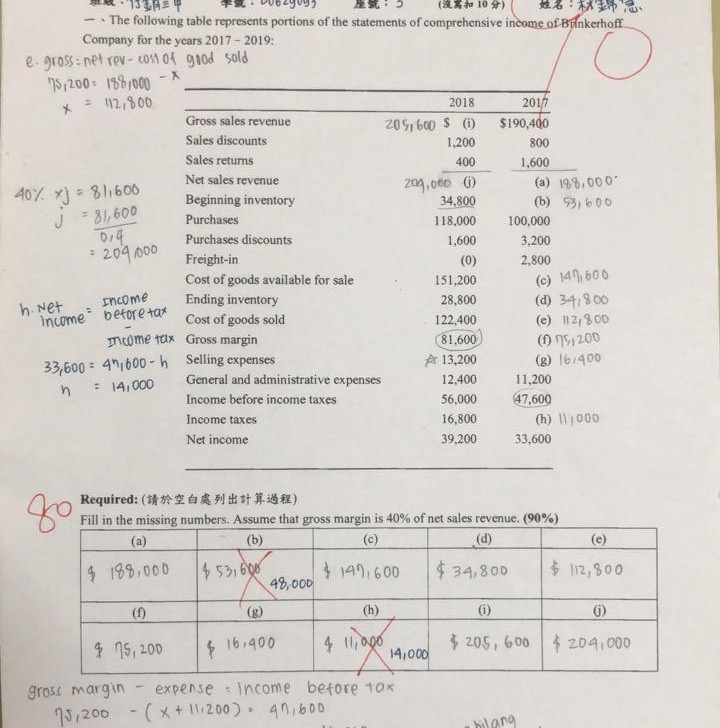

- The Boring portion of the competens och EN 61% 22:07 + 2011 S Go Sales 0) . Tag Pand 1.000 10 151.100 Color 12.400 19 304.600 lei 14.00 . . WO Jeluu Just now 80 REAR) ber 130 19.00 55 001 $94.00 OS che OL 104.000 $ 1.400 We'll $ 15,00 Ad (10) 2018 * 800 400 139A **as - The following table represents portions of the statements of comprehensive income of Brinkerhoff Company for the ycars 2017 - 2019: e. gross: net rev - 20510f good sold 75,200- 1881001 - = 112,800 2017 Gross sales revenue 209,600 $ (1) $190,400 Sales discounts 1.200 Sales returns 1,600 Net sales revenue 204,000 6 (a) 198.000 407 x) = 81,600 Beginning inventory 34.800 (b) 93,600 Purchases 118,000 100,000 Purchases discounts 1,600 3,200 204 000 Freight-in (0) 2,800 Cost of goods available for sale 151,200 Ending inventory 28,800 (d) 34,800 Thuome" betore tax Cost of goods sold 122,400 (e) 112,800 mtome tax Gross margin 81.600 (0 95,200 33,600 = 41600-h Selling expenses A 13,200 (8) 167400 = 14,000 General and administrative expenses 12,400 11,200 Income before income taxes 56,000 47.600 Income taxes 16,800 (h) 11,000 Net income 39,200 33,600 J=81,600 0.4 (c) 149,600 h.Net Income n 89 Required: () Fill in the missing numbers. Assume that gross margin is 40% of net sales revenue. (90%) (a) (b) () (d) $ 199,000 1$ 53,000 $19.600 $ 34,800 $ 112,800 49,000 (h) (1) 6 $ 25, 200 $ 16,900 4 11000 $ 205,600 $ 204,000 14,000 gross margin expense income before tak 73,200 -( x + 16200): 41,600 hilangStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started