Answered step by step

Verified Expert Solution

Question

1 Approved Answer

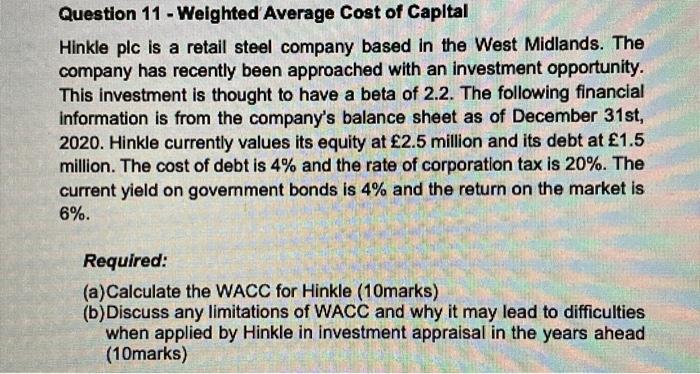

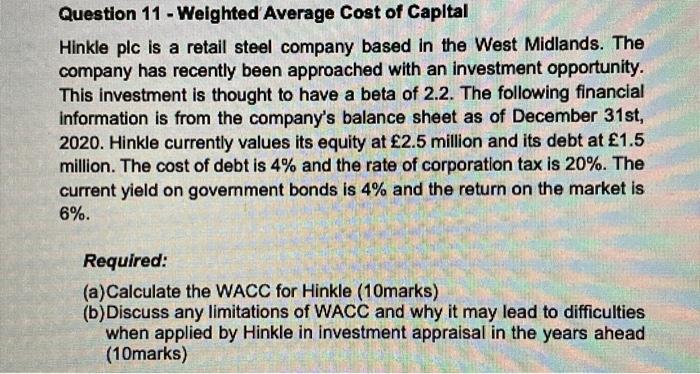

with formulas Question 11 - Weighted Average Cost of Capital Hinkle plc is a retail steel company based in the West Midlands. The company has

with formulas

Question 11 - Weighted Average Cost of Capital Hinkle plc is a retail steel company based in the West Midlands. The company has recently been approached with an investment opportunity. This investment is thought to have a beta of 2.2. The following financial information is from the company's balance sheet as of December 31 st, 2020. Hinkle currently values its equity at 2.5 million and its debt at 1.5 million. The cost of debt is 4% and the rate of corporation tax is 20%. The current yield on government bonds is 4% and the return on the market is 6%. Required: (a)Calculate the WACC for Hinkle (10marks) (b) Discuss any limitations of WACC and why it may lead to difficulties when applied by Hinkle in investment appraisal in the years ahead (10marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started