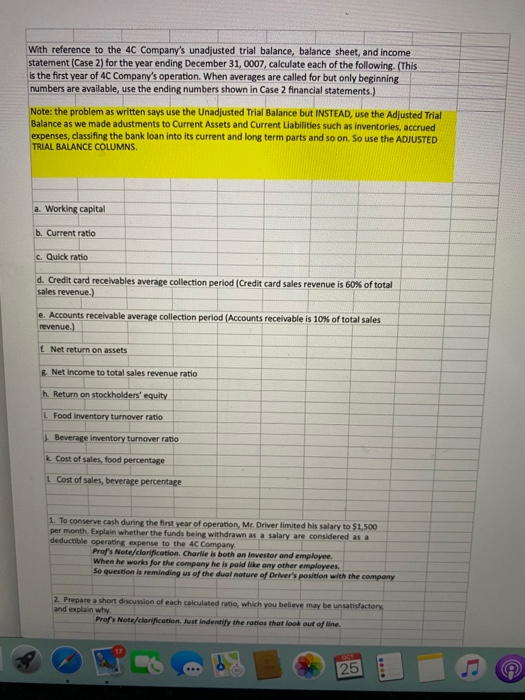

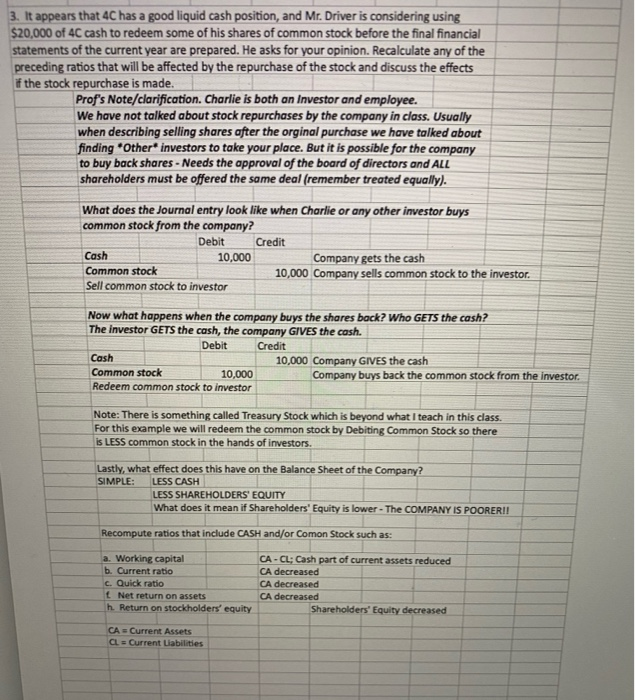

With reference to the 4C Company's unadjusted trial balance, balance sheet, and income statement (Case 2) for the year ending December 31, 0007, calculate each of the following. (This is the first year of 4C Company's operation. When averages are called for but only beginning numbers are available, use the ending numbers shown in Case 2 financial statements.) Note: the problem as written says use the Unadjusted Trial Balance but INSTEAD, use the Adjusted Trial Balance as we made adustments to Current Assets and Current Liabilities such as inventories, accrued expenses, classifing the bank loan into its current and long term parts and so on. So use the ADJUSTED TRIAL BALANCE COLUMNS a. Working capital b. Current ratio c. Quick ratio d. Credit card receivables average collection period (Credit card sales revenue is 60% of total sales revenue.) e. Accounts receivable average collection period (Accounts receivable is 10% of total sales revenue.) Net return on assets & Net income to total sales revenue ratio h. Return on stockholders' equity L Food Inventory turnover ratio Beverage inventory turnover ratio k Cost of sales, food percentage L Cost of sales, beverage percentage 1. To conserve cash during the first year of operation, Mr. Driver limited his salary to $1,500 per month. Explain whether the funds being withdrawn as a salary are considered as a deductible operating expense to the 4C Company Profs Note/clarification. Charlie is both an investor and employee. When he works for the company he is paid Nike any other employees. Se question is reminding us of the dual nature of Driver's position with the company 2. Prepare a short discussion of each calculated ratio, which you believe may be unsatisfactory and explain why Prof's Note/clarification. Just indentify the ratios that look out of line 25 a 3. It appears that 4C has a good liquid cash position, and Mr. Driver is considering using $20,000 of 40 cash to redeem some of his shares of common stock before the final financial statements of the current year are prepared. He asks for your opinion. Recalculate any of the preceding ratios that will be affected by the repurchase of the stock and discuss the effects if the stock repurchase is made. Prof's Note/clarification. Charlie is both an investor and employee. We have not talked about stock repurchases by the company in class. Usually when describing selling shares after the orginal purchase we have talked about finding Other investors to take your place. But it is possible for the company to buy back shares - Needs the approval of the board of directors and ALL shareholders must be offered the same deal (remember treated equally). What does the Journal entry look like when Charlie or any other investor buys common stock from the company? Debit Credit Cash 10,000 Company gets the cash Common stock 10,000 Company sells common stock to the investor. Sell common stock to investor Now what happens when the company buys the shares back? Who GETS the cash? The investor GETS the cash, the company GIVES the cash. Credit 10,000 Company GIVES the cash Common stock 10,000 Company buys back the common stock from the investor. Redeem common stock to investor Note: There is something called Treasury Stock which is beyond what I teach in this class. For this example we will redeem the common stock by Debiting Common Stock so there is LESS common stock in the hands of investors. Debit Cash Lastly, what effect does this have on the Balance Sheet of the Company? SIMPLE: LESS CASH LESS SHAREHOLDERS' EQUITY What does it mean if Shareholders' Equity is lower - The COMPANY IS POORERII Recompute ratios that include CASH and/or Comon Stock such as: a. Working capital b. Current ratio c. Quick ratio t Net return on assets h Return on stockholders' equity CA-CL: Cash part of current assets reduced CA decreased CA decreased CA decreased Shareholders' Equity decreased CA = Current Assets CL = Current Liabilities With reference to the 4C Company's unadjusted trial balance, balance sheet, and income statement (Case 2) for the year ending December 31, 0007, calculate each of the following. (This is the first year of 4C Company's operation. When averages are called for but only beginning numbers are available, use the ending numbers shown in Case 2 financial statements.) Note: the problem as written says use the Unadjusted Trial Balance but INSTEAD, use the Adjusted Trial Balance as we made adustments to Current Assets and Current Liabilities such as inventories, accrued expenses, classifing the bank loan into its current and long term parts and so on. So use the ADJUSTED TRIAL BALANCE COLUMNS a. Working capital b. Current ratio c. Quick ratio d. Credit card receivables average collection period (Credit card sales revenue is 60% of total sales revenue.) e. Accounts receivable average collection period (Accounts receivable is 10% of total sales revenue.) Net return on assets & Net income to total sales revenue ratio h. Return on stockholders' equity L Food Inventory turnover ratio Beverage inventory turnover ratio k Cost of sales, food percentage L Cost of sales, beverage percentage 1. To conserve cash during the first year of operation, Mr. Driver limited his salary to $1,500 per month. Explain whether the funds being withdrawn as a salary are considered as a deductible operating expense to the 4C Company Profs Note/clarification. Charlie is both an investor and employee. When he works for the company he is paid Nike any other employees. Se question is reminding us of the dual nature of Driver's position with the company 2. Prepare a short discussion of each calculated ratio, which you believe may be unsatisfactory and explain why Prof's Note/clarification. Just indentify the ratios that look out of line 25 a 3. It appears that 4C has a good liquid cash position, and Mr. Driver is considering using $20,000 of 40 cash to redeem some of his shares of common stock before the final financial statements of the current year are prepared. He asks for your opinion. Recalculate any of the preceding ratios that will be affected by the repurchase of the stock and discuss the effects if the stock repurchase is made. Prof's Note/clarification. Charlie is both an investor and employee. We have not talked about stock repurchases by the company in class. Usually when describing selling shares after the orginal purchase we have talked about finding Other investors to take your place. But it is possible for the company to buy back shares - Needs the approval of the board of directors and ALL shareholders must be offered the same deal (remember treated equally). What does the Journal entry look like when Charlie or any other investor buys common stock from the company? Debit Credit Cash 10,000 Company gets the cash Common stock 10,000 Company sells common stock to the investor. Sell common stock to investor Now what happens when the company buys the shares back? Who GETS the cash? The investor GETS the cash, the company GIVES the cash. Credit 10,000 Company GIVES the cash Common stock 10,000 Company buys back the common stock from the investor. Redeem common stock to investor Note: There is something called Treasury Stock which is beyond what I teach in this class. For this example we will redeem the common stock by Debiting Common Stock so there is LESS common stock in the hands of investors. Debit Cash Lastly, what effect does this have on the Balance Sheet of the Company? SIMPLE: LESS CASH LESS SHAREHOLDERS' EQUITY What does it mean if Shareholders' Equity is lower - The COMPANY IS POORERII Recompute ratios that include CASH and/or Comon Stock such as: a. Working capital b. Current ratio c. Quick ratio t Net return on assets h Return on stockholders' equity CA-CL: Cash part of current assets reduced CA decreased CA decreased CA decreased Shareholders' Equity decreased CA = Current Assets CL = Current Liabilities