Answered step by step

Verified Expert Solution

Question

1 Approved Answer

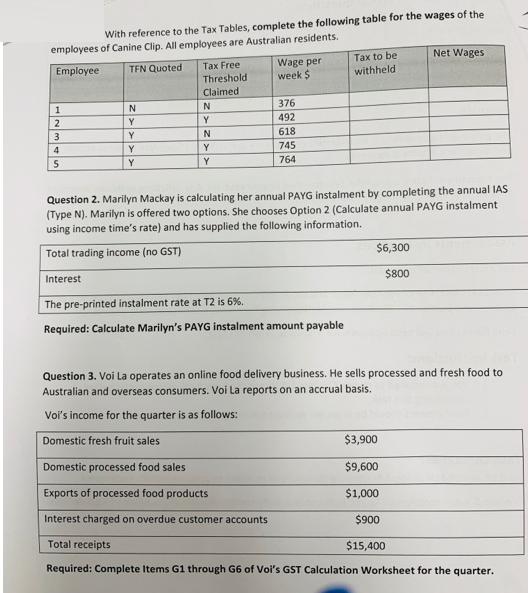

With reference to the Tax Tables, complete the following table for the wages of the employees of Canine Clip. All employees are Australian residents.

With reference to the Tax Tables, complete the following table for the wages of the employees of Canine Clip. All employees are Australian residents. Employee TFN Quoted 12345 N Y Interest Y Y Y Tax Free Threshold Claimed N Y N Y Y Wage per week $ 376 492 618 745 764 Tax to be withheld Question 2. Marilyn Mackay is calculating her annual PAYG instalment by completing the annual IAS (Type N). Marilyn is offered two options. She chooses Option 2 (Calculate annual PAYG instalment using income time's rate) and has supplied the following information. Total trading income (no GST) The pre-printed instalment rate at T2 is 6%. Required: Calculate Marilyn's PAYG instalment amount payable $6,300 $800 Net Wages Question 3. Voi La operates an online food delivery business. He sells processed and fresh food to Australian and overseas consumers. Voi La reports on an accrual basis. Voi's income for the quarter is as follows: Domestic fresh fruit sales Domestic processed food sales Exports of processed food products Interest charged on overdue customer accounts Total receipts Required: Complete Items G1 through G6 of Voi's GST Calculation Worksheet for the quarter. $3,900 $9,600 $1,000 $900 $15,400

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 EmployeeTFN QuotedTax Free Threshold ClaimedWage per week Tax to be withheldNet Wages 1NN37...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started