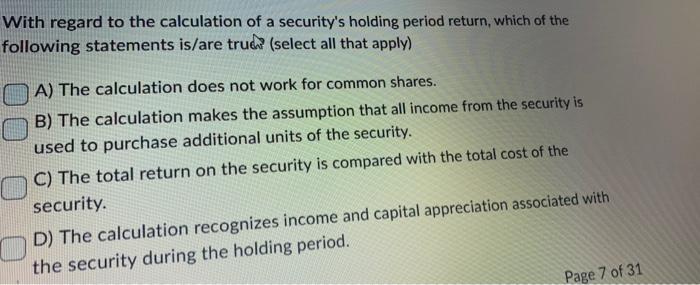

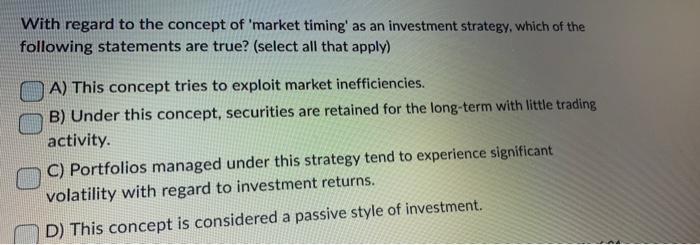

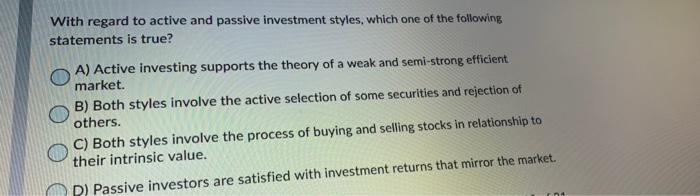

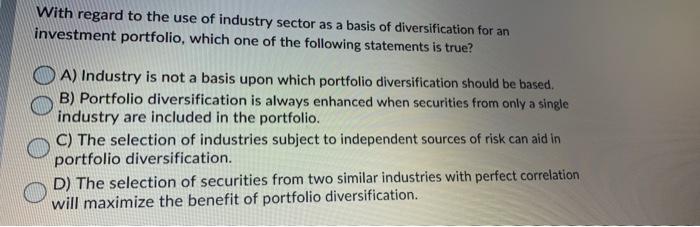

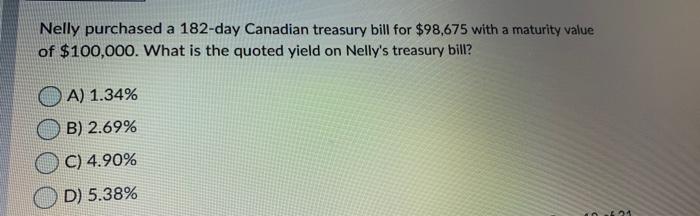

With regard to the calculation of a security's holding period return, which of the following statements is/are truc (select all that apply) A) The calculation does not work for common shares. B) The calculation makes the assumption that all income from the security is used to purchase additional units of the security. C) The total return on the security is compared with the total cost of the security. D) The calculation recognizes income and capital appreciation associated with the security during the holding period. Page 7 of 31 With regard to the concept of 'market timing' as an investment strategy, which of the following statements are true? (select all that apply) A) This concept tries to exploit market inefficiencies. B) Under this concept, securities are retained for the long-term with little trading activity. C) Portfolios managed under this strategy tend to experience significant volatility with regard to investment returns. D) This concept is considered a passive style of investment. With regard to active and passive investment styles, which one of the following statements is true? A) Active investing supports the theory of a weak and semi-strong efficient market. B) Both styles involve the active selection of some securities and rejection of others. C) Both styles involve the process of buying and selling stocks in relationship to their intrinsic value. D) Passive investors are satisfied with investment returns that mirror the market. With regard to the use of industry sector as a basis of diversification for an investment portfolio, which one of the following statements is true? A) Industry is not a basis upon which portfolio diversification should be based. B) Portfolio diversification is always enhanced when securities from only a single industry are included in the portfolio C) The selection of industries subject to independent sources of risk can aid in portfolio diversification. D) The selection of securities from two similar industries with perfect correlation will maximize the benefit of portfolio diversification. Nelly purchased a 182-day Canadian treasury bill for $98,675 with a maturity value of $100,000. What is the quoted yield on Nelly's treasury bill? A) 1.34% B) 2.69% C) 4.90% D) 5.38%